BEIJING, Sept. 24, 2023 — The 2023 Global Business and Law Conference was held in Beijing on the evening of September 22. At the opening ceremony, former Canadian Prime…

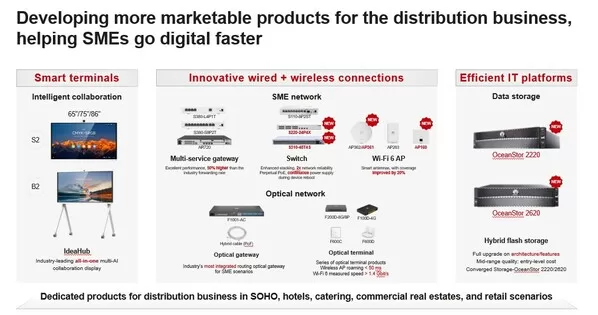

HUAWEI eKit Joins Hands with Distribution Partners to Explore Unlimited Opportunities in the SME Market

SHANGHAI, Sept. 21, 2023 — During HUAWEI CONNECT 2023, Huawei held a distribution business session titled "HUAWEI eKit, Digitalization for Success", outlined its approach to the distribution business: focus on…

STL starts to ‘Make in America’ with its next-gen Lugoff OFC facility

Inaugurated by Hon. Henry McMaster, Governor, South Carolina $56m USD investment Commitment to drive US rural broadband build and enable the…

Huawei Cloud in Token2049: Fueling Web3 Advances with Key Breakthroughs

SINGAPORE, Sept. 13, 2023 — From September 11 to 12, Huawei Cloud showcased staking node engine, confidential computing, and ZK rollup at Token2049 in Singapore. In this event, Huawei Cloud…

Easybom: Your Reliable Partner for Electronic Component Search and Procurement

SHENZHEN, China, Sept. 12, 2023 — Easybom, as a leading global electronic component search platform, has successfully connected millions of terminal factories worldwide through its extensive business coverage and…

VIRNECT and CelcomDigi sign MoU to develop experiential industrial Metaverse learning and education.

SEOUL, South Korea, Sept. 11, 2023 — CelcomDigi Berhad (CelcomDigi) and VIRNECT (438700: KOSDAQ), a Korea-based technology company that specializes in the development and commercialization of industrial extended reality…

China International Intelligent Communication Forum 2023 Builds up International Consensus and Facilitates Media Innovation

WUXI, China, Sept. 9, 2023 — The China International Intelligent Communication Forum 2023, hosted by China Media Group and the Jiangsu Provincial People’s Government, took place in Wuxi, Jiangsu…

Dow Jones and Cision Unveil Exclusive Global Content Partnership for the PR and Corporate Communications Market

New Agreement Empowers Reputation Management and Strategic Communication Agendas Worldwide CHICAGO and NEW YORK, Sept. 7, 2023 — Cision, the leading provider…

Trip.com Group Limited Reports Unaudited Second Quarter and First Half of 2023 Financial Results

SHANGHAI, Sept. 5, 2023 — Trip.com Group Limited (Nasdaq: TCOM; HKEX: 9961) ("Trip.com Group" or the "Company"), a leading one-stop travel service provider of accommodation reservation, transportation ticketing, packaged…

“With Saudi, Go Global” Huawei Cloud Launches Services in Saudi Arabia

RIYADH, Saudi Arabia, Sept. 4, 2023 — Huawei Cloud announced the launch of the Huawei Cloud Riyadh Region today at the Huawei Cloud Summit Saudi Arabia 2023. This Region…