LAS VEGAS, Jan. 9, 2022 — At CES 2022, SK Telecom, SK Square and SK hynix announced the launch of the ‘SK ICT Alliance’ to jointly develop and invest in…

Luokung Announces Receipt of Nasdaq Notification Regarding Minimum Bid Price Deficiency

BEIJING, Jan. 7, 2022 /PRNewswire/ — Luokung Technology Corp. (NASDAQ: LKCO) ("Luokung" or the "Company"), a leading spatial-temporal intelligent big data services company and provider of interactive location-based services ("LBS") and…

Tuya Smart at CES 2022: IoT Security Products in Spotlight as COVID-19 Spurs Global Demand for IoT

LAS VEGAS, Jan. 7, 2022 — As a leader in the IoT sector, global IoT development platform service provider Tuya Smart (NYSE: TUYA) is also showcasing a number of brand-new…

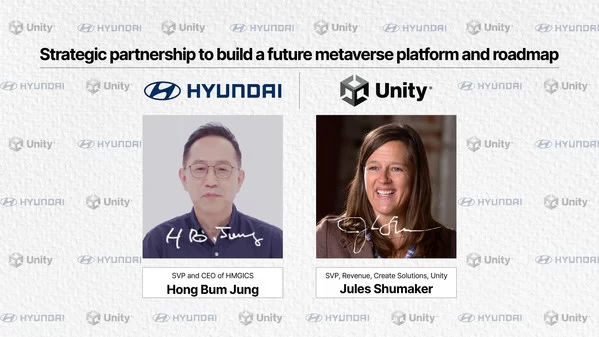

Hyundai Motor and Unity Partner to Build Meta-Factory Accelerating Intelligent Manufacturing Innovation

Partnership to support Hyundai’s vision of becoming a smart mobility solutions provider for an entirely new digital ecosystem Metaverse-based digital-twin factory to optimize plant operation and allow virtual…

Thundercomm Launches New Edge Products at CES 2022

LAS VEGAS, Jan. 6, 2022 — Thundercomm, the world-leading IoT product and solution provider, enriched its existing edge computing product and solution line-ups today, with three latest strategic products: Edge…

Edible fungus industry stimulates rural revitalization in Guiyang

BEIJING, Jan. 5, 2022 — A news report from China Daily on Guiyang. Success of agricultural sector sees output and profits of Guizhou province rise substantially. As a key edible…

CCTV+: China Media Group president delivers New Year message to global audience

BEIJING, Jan. 2, 2022 — China Media Group (CMG) President Shen Haixiong addressed the global audience on the first day of 2022, with the focus on the reflection of the CMG’s…

SoyNet to introduce AI accelerator at CES 2022

SEOUL, South Korea, Jan. 1, 2022 — SoyNet (CEO Yong-hoKim, Jung-wooPark) will introduce an AI execution accelerator at the "CES 2022" which will be held in Las Vegas on January…

AI Technology To Contribute Up To 70% Of Carbon Emissions Reductions By 2060: IDC And Baidu White Paper

BEIJING, Dec. 30, 2021 — Baidu, Inc. (NASDAQ: BIDU and HKEX: 9888) and IDC jointly launched China’s first White Paper on AI’s Contribution to Achieving the “Dual Carbon” Goals in…

Chunghwa Telecom announces new organizational structure effective in 2022

Business groups and technology groups will collaborate to elevate company to the next level TAIPEI, Dec. 30, 2021 — In response to market competition, rapid technological advancement and the ongoing…