M+Global opens its first stockbroking concept store targeted at educating and empowering Malaysians to grow their wealth through investments in stocks.

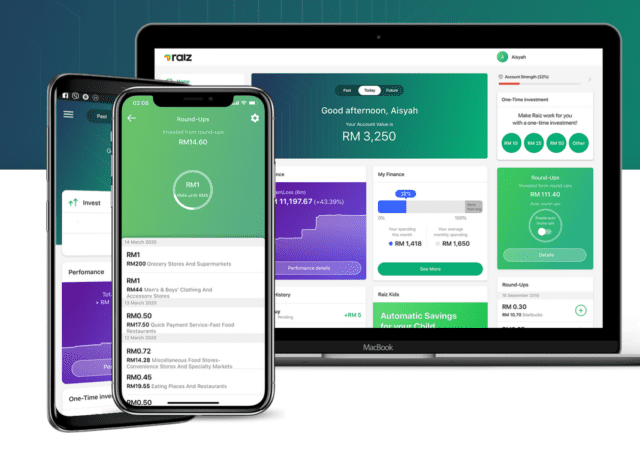

Raiz Departs Malaysia: Curtains Close on Micro-Investing Platform

Popular micro-investment platform, Raiz, has announced its exit from Malaysia. The Australian platform is ending its joint-venture with Permodalan Nasional Berhad (PNB).

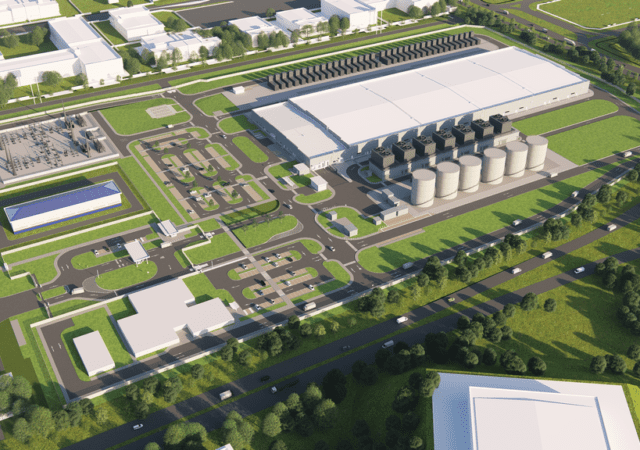

Google’s US$2 Billion Investment: A Catalyst for Malaysia’s Digital Transformation

Google invests USD$2 billion in Malaysia to setup the Malaysia Region for Google Cloud located in the Greater Region of Kuala Lumpur.

It’s Now Easier to Invest in ASNB with GOinvest on Touch ‘n Go E-wallet

Investing in ASNB unit trusts get even more accessible with Touch n’ Go eWallet with GOinvest.

Touch ‘n Go eWallet is Now More Than Just Payment with GO+

Touch ‘n Go launches a new financial management service, GO+. The new service embedded within the platform allows users to grow their assets.

Gold vs. Bitcoin: Which is Better to Protect Investors from Financial Crises?

*This article is contributed by By Victor Argonov, Analyst, EXANTE* There is still a great debate about which is the best asset to protect investors in difficult times: cryptocurrencies or gold. Cryptocurrencies are often compared to gold. They have a…