Company Has Established a Comprehensive, Ethically-responsible Management System For Its AI-enabled Home Appliances SEOUL, South Korea, Feb. 15, 2024 — LG Electronics (LG) has recently achieved a significant milestone…

PETLIBRO Introduces the One RFID Pet Feeder for Personalized Pet Meals

Harnessing innovative RFID pet recognition technology, PETLIBRO’s latest smart feeder relieves mealtime stress in multi-pet households. SAN JOSE, Calif., Jan. 25, 2024 — PETLIBRO, a leading US smart pet supply…

DJI Mic 2: Elevating Professional Audio Recording Excellence

with Unparalleled Quality, User-Centric Design, and Exceptional Stability SHENZHEN, China, Jan. 17, 2024 — DJI, the global leader in civilian drones and innovative camera technology, today announced the launch…

EMEET’s Latest AirFlow Open-Ear Earbuds Offer Exceptional Audio Experience for Both Music and Calls.

LAS VEGAS, Jan. 13, 2024 — As one of the tremendous tech events on earth, CES 2024 is no doubt the place where innovation meets enthusiasm, offering a glimpse of…

Dreame Launches Revolutionized Robotic Lawn Mower A1 that Brings Real Hands-free Experience at CES 2024

LAS VEGAS, Jan. 11, 2024 — Dreame Technology,a pioneer of innovative home appliances, introduced its Roboticmower A1 at CES 2024 in Las Vegas. Dreame is well-known for its indoor home…

HISENSE EXHIBITS NEW ULED X TV, SMART REFRIGERATOR AND DISHWASHER AT CES 2024

LAS VEGAS, Jan. 10, 2024 — Global electronics and home appliance corporation Hisense demonstrates at CES 2024 how its range of home appliances, paired with the ConnectLife smart platform and…

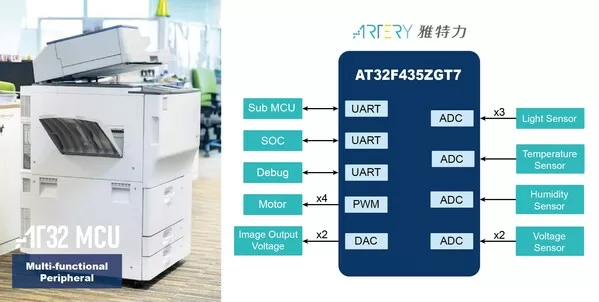

ARTERY AT32 MCU-based Solutions for High-speed Multi-Functional Peripheral

HSINCHU, Jan. 5, 2024 — Office facilities are always fundamental to business. To save manpower and promote efficiency, more and more user-friendly office equipment have been introduced, and one…

Does Monport Laser Really Offer The Lowest Price Of The Year During The Last Days of 2023?

LOS ANGELES, Dec. 29, 2023 — As the year comes to a close, Monport Laser claims to offer the lowest prices of the year during the last days of 2023….

Pocket PangPang, Korea’s new concept shopping platform, has launched in Thailand

Officially launched a 200 Baht single-price mobile shopping mall service in Thailand SEOUL, South Korea, Dec. 29, 2023 — Pocket PangPang, Korea’s single-price mobile shopping platform, officially began its…

Century in the Spotlight: Paris Rhône Rings in the Holidays with Innovative Home Appliances

PARIS, Dec. 26, 2023 — Paris Rhône, the esteemed household appliance brand established in 1915, is set to add joy and cheer to the holiday season with its legacy…