QINGDAO, China, Oct. 1, 2020 — Hisense, the global consumer electronics and home appliances market leader, today announced a multi-year partnership with esports organization, Fnatic. Through this partnership, the two companies will produce a variety of content, including product reviews, video collaborations and social engagement, each featuring Hisense appliances…

AB Electrolux to propose reinstated dividend based on recovery in earnings and cash flow

STOCKHOLM, Sept. 25, 2020 — After assessing the company’s financial position and the impact of the coronavirus pandemic, the Board of Directors of AB Electrolux has decided to propose a dividend of SEK 7 per share for the fiscal year 2019. Electrolux has seen a substantial recovery in earnings and…

Keeping Data Safe from Prying Eyes: HP Monitor Receives First TUV Rheinland Dynamic Privacy Filter Certification

TAIPEI, Sept. 18, 2020 — Due to the increasing importance of privacy protection to people today, TUV Rheinland has followed up on the success of its exclusive Eye Comfort certification by bringing the first Dynamic Privacy Filter (DPF) certification to the market this…

Informa Markets in Japan Proves Exhibitions are Returning and Relevant

TOKYO, Sept. 18, 2020 — This week Informa Markets successfully held four exhibitions in Japan, including Call Center/CRM Demo & Conference Osaka, eCommerce Fair Osaka, Diet & Beauty Fair (Tokyo) and PROJECT Tokyo. These events altogether hosted over 500 exhibiting companies and over 20,000 attendees. Eager…

SIGN CHINA 2020 Opens Today, Both Virtual & Physical

SHANGHAI, Sept. 17, 2020 — SIGN CHINA 2020 Shanghai Show, organised by Informa Markets Trust, kicks off its first ever SIGN CHINA | Live online webcast today with its physical show at Shanghai New International Expo Centre, 17 -19 September 2020 to allow domestic and overseas buyers conduct their sourcing with reliable suppliers…

First 2,000 coocaa x Clip TV Smart TVs Sold in Under One Day at the Start of Lazada’s 9.9 Mega Sale

HO CHI MINH, Vietnam, Sept. 12, 2020 — As part of their new strategic cooperation, Clip TV and coocaa have released a co-branded smart television. Each coocaa x Clip TV includes a complimentary lifetime ad-free Clip TV membership, marking the start of a new generation of free content viewing in…

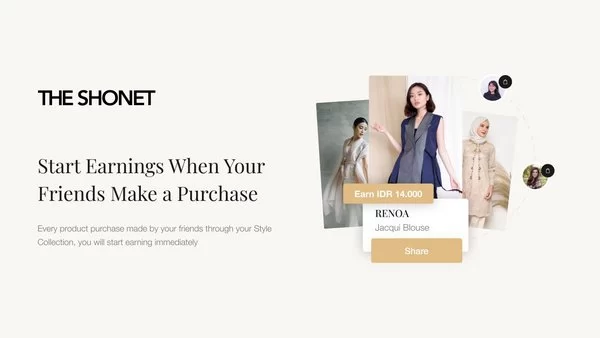

Indonesian Start Up the Shonet, Launches Social Commerce Providing New Stimulus for Fashion and Beauty Players to Survive the Pandemic Period

JAKARTA, Indonesia, Sept. 9, 2020 — The COVID-19 pandemic has an impact on the continuity of the entire industry, including in the realm of fashion and beauty. In the midst of a challenging situation for industry players, the Shonet as a digital company based for social commerce focuses on supporting the…

MaxCare Home cooperates with the musician Nguyen Hai Phong to launch a MV “Con Ke Ba Nghe” with a meaningful message in Vu Lan Ceremony 2020

HO CHI MINH CITY, Vietnam, Sept. 4, 2020 — On the occasion of Vu Lan Ceremony 2020, MaxCare Home – the top brand which distributes high quality and prestigious equipment for family health care from Japan and America, collaborates with the musician Nguyen Hai Phong to launch the MV "Con Ke…

As More Seniors Look to Age Independently, TCL Unveils the MOVETIME Family Watch to Help Keep Seniors Connected

BERLIN, Sept. 3, 2020 — TCL, one of the world’s best-selling consumer electronics brands and leading technology companies, is introducing the MOVETIME Family Watch MT43A today. This 4G connected watch provides hands-free two way calling, automatic fall detection, heart rate monitoring and medication reminders designed to help seniors maintain their independence….

UL Advances Ability for Electronic Product and Equipment Manufacturers to Quickly Enter Mexico Market

Mexico Ministry of Economy grants UL first mutual recognition agreement to allow electronics product testing outside of Mexico NORTHBROOK, Illinois, Aug. 29, 2020 — UL, a leading global safety science company, today announced that Mexico’s Ministry of Economy, General Directorate of Standards (DGN),…