ABU DHABI, UAE, Sept. 10, 2020 — Launched as an open invitation from Abu Dhabi to the world to unleash AI’s full potential, the Mohamed bin Zayed University of Artificial Intelligence (MBZUAI), the world’s first graduate-level, research-based artificial intelligence (AI) university, will welcome an international inaugural cohort of…

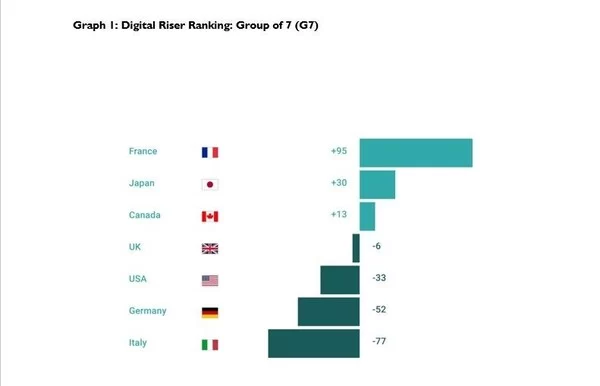

ESCP study reveals: New Digital Risers challenge incumbents

France top Digital Riser, China gains significantly, USA loses BERLIN, Sept. 7, 2020 — Digital incumbents increasingly face new and dynamic competitors from around the world. While countries such as USA, Sweden and Singapore are often perceived as digital champions, a new study indicates that they are not necessarily dynamic Digital…

ASTRI welcomes Graduate Programme 2020 participants, giving talented students a unique opportunity to launch career in an R&D environment

HONG KONG, Sept. 1, 2020 — The Hong Kong Applied Science and Technology Research Institute (ASTRI) welcomes our new recruits for the Graduate Programme 2020, a unique opportunity for university graduates to launch their careers in a research and development environment, in particular one with a mission to deliver impactful solution…

China Distance Education Holdings Limited Announces Results of Annual General Meeting of Shareholders

BEIJING, Aug. 28, 2020 — China Distance Education Holdings Limited (NYSE: DL) ("CDEL", or the "Company"), a leading provider of online education and value-added services for professionals and corporate clients in China, today announced that it held its 2020 Annual General Meeting of Shareholders ("2020 AGM") on August 28, 2020….

China Distance Education Holdings Limited Reports Financial Results for Third Quarter Fiscal Year 2020

– Third Quarter 2020 Net Revenue was $50.7 Million, within Guidance Range – – Third Quarter 2020 Gross Profit was $24.1 Million, with Gross Margin of 47.5% – – Third Quarter 2020 Operating Income was $2.5 Million, with Operating Margin of 4.9% – – Third Quarter 2020 Net Income Attributable…

Funding Societies and SMU collaborate to develop a case on P2P Lending for Small Businesses

SINGAPORE, Aug. 12, 2020 — Funding Societies, Southeast Asia’s largest digital financing platform, and Singapore Management University (SMU) have come together to develop and publish a case study explaining the role of FinTech and Peer-to-Peer (P2P) lending for small businesses. This is the first such case covering a P2P lender that…

KIIT Deemed to be University Announces Free Education for Children of COVID Deceased in Odisha

BHUBANESWAR, India, July 27, 2020 — The COVID-19 pandemic has infected millions and caused much panic across the globe, including India and Odisha. The number of new coronavirus infections is increasing by day in Odisha. Many have also lost their lives. KIIT has always reached out to the distressed people…

NetDragon Launched International Summer Intern Program

FUZHOU, China, July 22, 2020 — On July 21, 2020, NetDragon’s International Summer Intern Program opened, 17 college graduates from different countries and regions, such as the United States, Italy, and Serbia, began to formally take up their posts. It is reported that they have been screened out among more than…

ASTRI introduces Graduate Program 2020, one of our talent nurturing initiatives

HONG KONG, July 21, 2020 — The Hong Kong Applied Science and Technology Research Institute (ASTRI) has launched its first Graduate Program 2020 (the Program). It offers university graduates (2019-20) a unique opportunity to begin a career in technology research environment. The initiative serves as a timely response to the…

New Oriental to Report Fourth Quarter 2020 Financial Results on July 28, 2020

BEIJING, July 3, 2020 — New Oriental Education and Technology Group Inc. (the "Company" or "New Oriental") (NYSE: EDU), the largest provider of private educational services in China, today announced that it will report its financial results for the fourth quarter ended May 31, 2020, before the U.S. market opens on…