The EKSA Air Joy Plus gaming headset is a versatile, lightweight, wired gaming headset designed to provide the best mobile and switch gaming experience out there. Now one can truly…

Ragnarok: The Lost Memories by Gravity Game Hub Now Officially Launches on IOS and Android

SINGAPORE, Dec. 13, 2021 — Gravity Game Hub, a subsidiary of Gravity Co., Ltd (NASDAQ: GRVY), announced that Ragnarok: The Lost Memories, a JRPG mobile game has been officially launched…

DearMonsters’ sustainable blockchain play-to-earn concept proves to be popular as 500000 BUSD public presale allocation sold

SINGAPORE, Nov. 30, 2021 — DearMonsters ($DMS) successfully completed their round of presale on 24th November 2021. Touted to be the next upcoming blockchain play-to-earn game, its concept of sustainability…

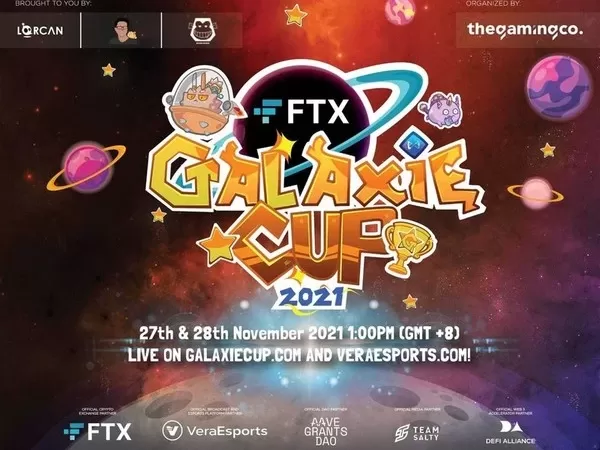

FTX Galaxie Cup Reinforces Sponsors Lineup with Industry Heavyweights

KUALA LUMPUR, Malaysia, Nov. 18, 2021 — The first of its kind professional Axie Infinity tournament, FTX GalAxie Cup, welcomes VeraEsports by Verasity, AAVE Grants DAO, Defi Alliance and Team Salty as…

HUYA Inc. Reports Third Quarter 2021 Unaudited Financial Results

GUANGZHOU, China, Nov. 9, 2021 — HUYA Inc. ("Huya" or the "Company") (NYSE: HUYA), a leading game live streaming platform in China, today announced its unaudited financial results for the…

AppGallery Commits to Providing Full-Spectrum Support, Expansion Opportunities, and Innovative Tools to Gaming Developers

SHENZHEN, China, Oct. 23, 2021 — Today at its annual Huawei Developer Conference 2021 (HDC 2021), Huawei reaffirmed its commitment to gaming developers in driving innovation and business expansion, offering…

Neopets Launches its First NFT Collection – The Neopets Metaverse Collection

EL SEGUNDO, Calif., Sept. 22, 2021 — Neopets is excited to announce a partnership with Raydium, an automated market maker (AMM) and launchpad powered by Solana, to bring a collection…

HUYA Inc. Announces Management Change

GUANGZHOU, China, Sept. 4, 2021 — HUYA Inc. (NYSE: HUYA) ("Huya" or the "Company"), a leading game live streaming platform in China, today announced that Ms. Catherine Xiaozheng Liu has tendered her resignation as the Company’s Chief Financial Officer due to personal reasons, effective on September 8, 2021. The Company…

Entrepreneurial Road of GERZZ INTERACTIVE

SHANGHAI, Aug. 21, 2021 — With fast development of online media and increasing demand for entertainment in China currently, LARP game, as a strategic board game of usually 4-8 players, is becoming accessible and popular among youth. The founder Kevin Ling and his team…

DeHorizon Foundation is to initiate DeVerse, Blockchain-based MMO/RPG Metaverse, making “Play for fun and to earn” into reality

SAN FRANCISCO, Aug. 14, 2021 — DeHorizon Foundation is to initiate DeVerse which is a blockchain-based MMO/RPG Metaverse game built on Binacne Smart Chain. The long-term vision of DeHorizon Foundation is to create a Metaverse world that is open, free, and dominated by players. DeVerse: a blockchain-based MMO/RPG Metaverse…