SYDNEY, Feb. 14, 2023 — A new product report by international share trading platform moomoo reveals its 10 most used features in…

ClimaFi is fighting greenwashing with the first platform for trading UK woodland and peatland carbon credits built on the Concordium blockchain

ZUG, Switzerland and LONDON, Feb. 10, 2023 — UK-based climate technology company ClimaFi announces the first trading platform to offer carbon credits from verified UK peatlands and woodlands. CLMT Exchange,…

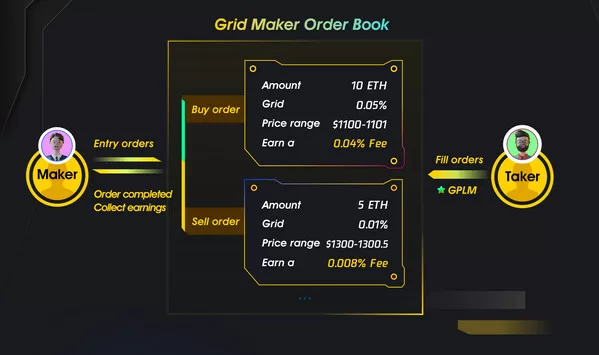

Gridex Protocol: Integrating First Fully On-chain Order Book For a New Generation of DEX

LONDON, Feb. 10, 2023 — Gridex Protocol, a cutting-edge decentralized protocol built on the Ethereum mainnet, is pushing the boundaries of what is possible in the DeFi space. Its advanced…

Lichen China Limited Announces Closing of US$16 Million Initial Public Offering

JINJIANG, China, Feb. 9, 2023 — Lichen China Limited (the "Company" or "Lichen China"), a dedicated financial and taxation service provider in China, today announced the pricing of its…

Lichen China Limited Announces Pricing of US$16 Million Initial Public Offering

JINJIANG, China, Feb. 6, 2023 — Lichen China Limited (the "Company" or "Lichen China"), a dedicated financial and taxation service provider in China, today announced the pricing of its…

PINTEC Announces Changes to Management and Board of Directors

BEIJING, Jan. 28, 2023 — Pintec Technology Holdings Limited (Nasdaq: PT) ("PINTEC" or the "Company"), a leading independent technology platform enabling financial services in China, today announced Mr. Zexiong…

Nippon Life India Chooses SS&C to Accelerate Expansion in Singapore

The firm will leverage the SS&C Eze asset management platform to scale Singapore strategy WINDSOR, Conn., Jan. 23, 2023 — SS&C Technologies Holdings,…

Jacobi Inc partnering with Principal Asset Management℠ to digitize and scale fintech-enabled model portfolio offering

SAN FRANCISCO, Jan. 20, 2023 — Principal Asset ManagementSM has partnered with Jacobi Inc., a global investment technology provider, to scale its…

Hedonova enters the renewable energy sector by investing $16M in a Chilean energy storage plant

Total investment of $16M The plant is located 800 kms north of Chile’s capital Santiago in the Atacama region The plant can store up to 2000 megawatts which…

The Leading Fintech Firm NEXGO — Will Attend IBEX India 2023

MUMBAI, India, Dec. 19, 2022 — NEXGO is thrilled to be a part of IBEX India 2023! For this conference, we prepared a product row. This lovely setup will…