SEOUL, South Korea, June 29, 2020 — On June 29th, South Korea’s Blockchain Project Carry Protocol announced that it started data collection from the offline market targeting roughly half of the South Korean population (23M users) with South Korea’s largest SMB loyalty platform, Dodo Point. The data collection feature…

KPMG and Planon Extend Cooperation to Support Organisations in the Digitalisation of Lease-, Real Estate- and Portfolio Management Processes

NIJMEGEN and AMSTELVEEN, Netherlands, June 26, 2020 — KPMG and Planon today announced moving their collaboration to the next level, by signing a partnership agreement. Over the past two years the parties have been successfully working together on helping companies to comply with IFRS 16 standards by implementing Planon’s Lease…

Planful Raises Equity Round to Meet Increasing Demand for Its Cloud-Based FP&A Solution

Additional Funds from Majority Shareholder Vector Capital and Other Leading Investment Firms Position Planful to Seize Market Opportunities, Invest in Product, and Drive Go-to-Market Initiatives REDWOOD CITY, California, June 25, 2020 — Planful Inc. (formerly Host Analytics), a leading financial planning and analysis…

Yiren Digital Reports First Quarter 2020 Financial Results

BEIJING, June 24, 2020 — Yiren Digital Ltd. (NYSE: YRD) ("Yiren Digital" or the "Company"), a leading fintech company in China, today announced its unaudited financial results for the first quarter ended March 31, 2020. First Quarter 2020 Operational Highlights Wealth Management—Yiren Wealth Cumulative number of investors served…

Crypto.com Completes Key Exchange Infrastructure Upgrades

Delivers 10x performance with the new Matching Engine, paving the way for margin and derivative features rollout HONG KONG, June 18, 2020 — Crypto.com today announced it has rolled out significant infrastructure upgrades to its Exchange, including a revamped Matching Engine, OMS (Order…

OMC Group Ready to Roll with Blockchain Solutions

|

PETALING JAYA, Malaysia, June 18, 2020 /PRNewswire/ — OMC Group Sdn Bhd ("OMC Group" or "Company"), the blockchain arm of AIO Synergy Holdings Berhad ("AIO Synergy"), is set to offer more blockchain solutions to businesses, government and the community to help them operate in a world that is increasingly going digital.

OMC Group offers solutions through the Company’s own patented decentralised ledger technology ("DLT") known as Authorised Proof of Capacity ("APoC"), which is the consensus mechanism used to run the OMChain for trust and verification purposes.

Jack Lee, CEO of the company said: "We are in the midst of witnessing how technology has evolved and how businesses are conducted differently from the way it was. The move to doing business digitally paves the way for the business we are in as blockchain strongly encourages transparency and immutability."

"We are offering our blockchain solutions to serve merchants, which includes a decentralised ledger that is secure, trustworthy and transparent together with a community and ecosystem that we support through our hybrid Point of Sales ("POS") devices that includes a mining feature rewarding users with points that can be used for transactions".

The second version of OMC Group’s hybrid POS device together with hot wallet was launched in Malaysia in the second quarter of 2020 ("Q2 2020") following sales of the devices in China in Q3 2019. The devices are now available in 11 countries in East and Southeast Asia. In total, over 29,000 POS devices have been sold together with the hot wallet.

In the pipeline is the launch of the Asia Blockchain Centre in Q3 2020, a hub supporting blockchain startups through education, providing solutions for businesses, government and the community as well as offering solutions on the applications of blockchain technology. A debit card will be launched in Q4 2020 while a series of awareness campaigns on blockchain will be held.

The OMC ecosystem comprises OmniChat, a text/video/picture messaging platform that has 20 million users worldwide; Omnipay, a peer-to-peer payment network with third-party payment license in China as well as more than 10,000 merchants on-boarded and; Omnity, a smart community management application that can securely store customer information and collect management fees with more than 48,000 daily active users.

The Company’s long-term plans include obtaining a license in Malaysia to operate financial services in 2021 including cross-border payment services and offering its own patented DLT technology, APoC.

Media Contact:

Stefani Wan

[email protected]

Photo – https://photos.prnasia.com/prnh/20200618/2834771-1?lang=0

Logo – https://photos.prnasia.com/prnh/20200618/2834771-1LOGO?lang=0

Related Links :

https://omc-group.co/

MACROKIOSK and Silverlake Collaborate to Advance the Future of Banking

The synergistic collaboration will yield future-ready solutions to accelerate the banking industry of tomorrow

KUALA LUMPUR, Malaysia, June 18, 2020 /PRNewswire/ — MACROKIOSK and Silverlake join forces to empower the emerging digital banking industry in the Asia Pacific region. This collaboration brings together the proven robust digital solutions and respective capabilities of MACROKIOSK and Silverlake to support virtual banks in the evolving banking industry landscape.

With increasing digital transformation across the banking sector, the arrival of digital banking in the region is certain. As digital banking is set to disrupt traditional banking practices and cater to underserved markets, advanced technology becomes more crucial than ever in driving the success of digital banking in emerging economies. The partnership between MACROKIOSK and Silverlake will play a vital role in pioneering connectivity and facilitating virtual banks with their digital offerings.

As Asia’s leading digital technology company, MACROKIOSK’s key focus is in the areas of Communication, Authentication, Engagement and Payment delivered through its in-house developed BOLD. suite of digital solutions which are scalable, secure and highly adaptable.

"MACROKIOSK powers over 40 financial institutions in 14 countries across Asia Pacific. Our BOLD. solutions are future-ready to meet the demands of virtual banks and together with Silverlake, we are confident we will provide meaningful access, efficiency and convenience for digital banking consumers," says Dato’ Henry Goh, Co-Founder and Chief Operating Officer, MACROKIOSK Group.

With award-winning financial institutions as its clients and a vision of ‘mobility beyond imagination’, Silverlake has left a rather large footprint for digital banking and enterprise mobility in the Asia Pacific region. Moving forward, Silverlake intends to continue developing digital solutions and improve its customer experience models to simplify banking for individuals and organisations alike. Alongside with MACROKIOSK, it recognises the significance of digital banking. "Our focus is to drive innovation in financial institutions in Asia Pacific countries through various digital financial services," says Mr. Joseph Yeong, Co-Founder and Executive Director, Silverlake Mobility Ecosystem.

The collaboration between MACROKIOSK and Silverlake is poised to create a strong partner ecosystem across technologies in their respective areas of expertise, which enable virtual banks to leverage advanced solutions to stay ahead of competition and expand their foothold in the digital banking landscape.

ABOUT MACROKIOSK

MACROKIOSK is Asia’s leading digital technology company with a strong global presence. Since 2000, MACROKIOSK has been at the forefront of helping individuals and businesses embrace the digital economy through the delivery of Digitalisation Platform-as-a-Service (DPaaS) solutions.

To date, more than 3000 businesses in 37 countries spanning 24 industries and millions of users experience MACROKIOSK’s scalable, secure and highly-adaptable digital solutions developed in-house. MACROKIOSK is certified to international standards including the Microsoft.NET, PMP certification and ISO27001 ISMS.

For more information, please visit www.macrokiosk.com.

ABOUT SILVERLAKE

Silverlake is a leading Technology Innovations, Banking, Financial and Cyber Security solutions provider in the Asia Pacific region with a global presence. Executing parallel efforts in pursuing technology innovations as well as keeping its more than 30 years of deploying core banking to customer sites at 100% success rate is paramount to the company’s strategy.

For more information, please visit www.silverlakemobility.com.

MEDIA CONTACT

MACROKIOSK Press Office

[email protected]

Silverlake

[email protected]

[email protected]

Photo – https://photos.prnasia.com/prnh/20200615/2830846-1?lang=0

Related Links :

http://www.macrokiosk.com

Yiren Digital to Report First Quarter 2020 Financial Results on June 23, 2020

BEIJING, June 17, 2020 /PRNewswire/ — Yiren Digital Ltd. (NYSE: YRD) ("Yiren Digital" or the "Company"), a leading fintech company in China, announced that it plans to release its unaudited financial results for the quarter ended March 31, 2020 after U.S. market closes on Tuesday, June 23, 2020.

Yiren Digital’s management will host an earnings conference call at 8:00 p.m. U.S. Eastern Time on June 23, 2020 (or 8:00 a.m. Beijing/Hong Kong Time on June 24, 2020).

Participants who wish to join the call should register online in advance of the conference at:

http://apac.directeventreg.com/registration/event/2773237

Please note the Conference ID number of 2773237.

Once registration is completed, participants will receive the dial-in information for the conference call, an event passcode, and a unique registrant ID number.

Participants joining the conference call should dial-in at least 10 minutes before the scheduled start time.

A replay of the conference call may be accessed by phone at the following numbers until July 1, 2020:

|

International |

+61 2-8199-0299 |

|

U.S. |

+1 646-254-3697 |

|

Replay Access Code: |

2773237 |

Additionally, a live and archived webcast of the conference call will be available at ir.yirendai.com.

About Yiren Digital

Yiren Digital Ltd. (NYSE: YRD) is a leading fintech company in China, providing both credit and wealth management services. For its credit business, the Company provides an effective solution to address largely underserved investor and individual borrower demand in China through online and offline channels to efficiently match borrowers with investors and execute loan transactions. Yiren Digital deploys a proprietary risk management system, which enables the Company to effectively assess the creditworthiness of borrowers, appropriately price the risks associated with borrowers, and offer quality loan investment opportunities to investors. Yiren Digital’s marketplace provides borrowers with quick and convenient access to consumer credit at competitive prices and investors with easy and quick access to an alternative asset class with attractive returns. For its wealth management business, the Company targets China’s mass affluent population and strives to provide customized wealth management services, with a combination of long-term and short-term targets as well as different types of investments, ranging from cash and fixed-income assets, to funds and insurance. For more information, please visit ir.Yirendai.com.

Related Links :

http://ir.yirendai.com/

FinVolution Group Receives APP Security and Information Security Certifications from China’s CVERC

SHANGHAI, June 12, 2020 /PRNewswire/ — FinVolution Group ("FinVolution", or the "Company") (NYSE: FINV), a leading fintech platform in China, today announced that its fintech application, PPDAI App, has received both the APP Security Certification and the APP Information Security Certification with level 3 rating, the highest rating level in security evaluation standard, from China National Computer Virus Emergency Response Center ("CVERC").

Safeguarding user information and protecting user privacy is paramount in FinVolution Group’s operation since its inception. The Company has established a comprehensive administrative mechanism and standardized employee training system for stringent information security management. FinVolution has also been deploying innovative technologies to promote user data protection. For example, the Company launched a Smart Finance Institute in 2018 for research and development in the field of artificial intelligence that can be applied in various aspects of financial services. In addition, FinVolution is also a member of the National Information Security Standardization Technical Committee and Mobile Application (APP) Security Committee, maintaining up to date knowledge and compliant regarding the latest cyber-security regulatory requirements.

Mr. Feng Zhang, Chief Executive Officer of FinVolution Group, commented, "The receipt of the certifications from CVERC is a clear testament to our efforts and competency in safeguarding user information and protecting their privacy, and further solidify our competitive advantage in terms of regulatory compliance. We remain committed to the highest operational standard and continue to advance our technological capabilities in enhancing cyber security. Meanwhile, we will leverage our cooperation with institutional funding partners to provide secure and convenient services for our users."

CVERC is the official agency for anti-virus internet security and the designated testing body for the "Special Crackdown on the Illegal Collection and Misuse of Personal Information by Apps" initiative by China’s Ministry of Public Security.

Safe Harbor Statement

This press release contains forward-looking statements. These statements constitute "forward-looking" statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and as defined in the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as "will," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates," "target," "confident" and similar statements. Such statements are based upon management’s current expectations and current market and operating conditions and relate to events that involve known or unknown risks, uncertainties and other factors, all of which are difficult to predict and many of which are beyond the Company’s control. Forward-looking statements involve risks, uncertainties and other factors that could cause actual results to differ materially from those contained in any such statements. Potential risks and uncertainties include, but are not limited to, uncertainties as to the Company’s ability to attract and retain borrowers and investors on its marketplace, its ability to increase volume of loans facilitated through the Company’s marketplace, its ability to introduce new loan products and platform enhancements, its ability to compete effectively, laws, regulations and governmental policies relating to the online consumer finance industry in China, general economic conditions in China, and the Company’s ability to meet the standards necessary to maintain listing of its ADSs on the NYSE, including its ability to cure any non-compliance with the NYSE’s continued listing criteria. Further information regarding these and other risks, uncertainties or factors is included in the Company’s filings with the U.S. Securities and Exchange Commission. All information provided in this press release is as of the date of this press release, and FinVolution does not undertake any obligation to update any forward-looking statement as a result of new information, future events or otherwise, except as required under applicable law.

About FinVolution Group

FinVolution Group is a leading fintech platform in China connecting underserved individual borrowers with financial institutions. Established in 2007, the Company is a pioneer in China’s online consumer finance industry and has developed innovative technologies and has accumulated in-depth experience in the core areas of credit risk assessment, fraud detection, big data and artificial intelligence. The Company’s platform, empowered by proprietary cutting-edge technologies, features a highly automated loan transaction process, which enables a superior user experience. As of March 31, 2020, the Company had over 108.3 million cumulative registered users.

For more information, please visit: http://ir.finvgroup.com.

For investor and media inquiries, please contact:

In China:

FinVolution Group

Head of Investor Relations

Jimmy Tan

Tel: +86 (21) 8030 3200- Ext 8601

E-mail: [email protected]

The Piacente Group, Inc.

Jenny Cai

Tel: +86 (10) 6508-0677

E-mail: [email protected]

In the United States:

The Piacente Group, Inc.

Brandi Piacente

Tel: +1-212-481-2050

E-mail: [email protected]

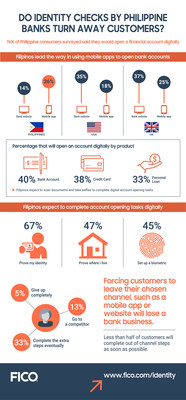

FICO Survey: Philippine Consumers more Comfortable Opening Bank Accounts with Smartphones than Americans and British

|

26 percent of Filipinos prefer to open a bank account on their phone compared to 18 percent in the US and 25 percent in the UK

MANILA, Philippines, June 12, 2020 /PRNewswire/ —

Highlights:

- The FICO Consumer Digital Banking Survey examines the preferences Filipino consumers have with digital bank account opening

- The study found 26 percent of Filipinos prefer to open a bank account on their phone compared to 18 percent in the US and 25 percent in the UK

- 76 percent of Filipino consumers said they would open a financial account online

- Identity verification with too much friction could cost organizations over 40 percent of new account openings

More information: https://www.fico.com/identity

FICO, a global analytics software firm, has released its Consumer Digital Banking Survey which found Philippine consumers are more comfortable opening bank accounts on their smartphones than consumers in the US and the UK.

The study showed that 26 percent of Filipinos prefer to open a bank account on their phone, compared to 18 percent in the US and 25 percent in the UK.

"Filipino consumers are digital natives," said Subhashish Bose, FICO’s lead for fraud, security and compliance in Asia Pacific. "Around 40 percent of Filipinos have a smartphone and according to a recent study they rank in the top 10 mobile internet users globally, spending an average of 4.58 hours a day on their phones."

The study showed that digital account opening is rapidly becoming the norm in the Philippines, with 76 percent of consumers saying they would open some kind of financial account online.

Of those that would open a financial account online, 40 percent would consider doing so for an everyday transaction account, 38 percent for a credit card and 33 percent for a personal loan.

Bucking expectations, it was older consumers in the Philippines who were more likely to be leading the digital push with the youngest Filipinos being the laggards.

- 46 percent of those over 55 years of age said they would open a bank account online

- 40 to 45 percent of 25-34, 35-44 and 45-54 year-olds said they would do the same

- While just 28 percent of 18-24-year-olds would open a bank account online

"The truth in the numbers here is far more nuanced," explained Bose. "Younger Filipinos are adept at using smartphones and computers, however, many do not have the required identification forms to open bank accounts at a young age, don’t have regular income or are presented with bank account options that are not appealing. For example, many bank accounts in the Philippines require a minimum balance to avoid monthly account-keeping fees.

"As consumers’ reliance on online services grows in response to COVID-19, we expect further shifts in adoption and indeed an acceleration and acceptance in opening bank accounts digitally. It is important that banks closely examine any points of friction in their application process to ensure consumers are not abandoning a process or switching to a competitor," said Bose.

Filipinos expect account opening to be fully digital

The survey found that a large percentage of Filipinos had an expectation that they should be able to complete all aspects of account opening online or on their phone.

Out of the regular identity checks needed to open an account, 67 percent of Filipinos thought they should be able to prove their identity by scanning documents or providing a selfie, 47 percent expected to prove where they live without going offline and 45 percent said they should be able to set up a biometric such as a fingerprint scan at account opening.

If all actions required to complete an account opening cannot be accomplished in-session, only 41 percent of respondents said they would carry out the necessary offline actions as soon as possible.

Around 33 percent thought they would eventually complete offline actions such as taking a phone call, posting documents, or visiting a branch. A further 13 percent said they would try a competitor while 5 percent said they would give up completely. Overall findings demonstrated that financial institutions in the Philippines that don’t facilitate a completely digital account opening experience could lose over 40 percent of their new business.

"There is research to show that only 6 to 9 percent of applicants move through the funnel and complete the process," said Bose. "Banking executives should review the application completion for authenticated versus non-authenticated applications, as well as how many applicants with saved or abandoned applications return to complete the process."

FICO’s Consumer Digital Banking Survey was produced using an online, quantitative poll of 5,000 adults (over 18) across 10 countries carried out on behalf of FICO by an independent research company. The countries surveyed were: Brazil, Canada, Germany, Malaysia, Mexico, Philippines, Sweden, UK and the USA.

About FICO

FICO (NYSE: FICO) powers decisions that help people and businesses around the world prosper. Founded in 1956 and based in Silicon Valley, the company is a pioneer in the use of predictive analytics and data science to improve operational decisions. FICO holds more than 195 US and foreign patents on technologies that increase profitability, customer satisfaction and growth for businesses in financial services, manufacturing, telecommunications, health care, retail and many other industries. Using FICO solutions, businesses in more than 100 countries do everything from protecting 2.6 billion payment cards from fraud, to helping people get credit, to ensuring that millions of airplanes and rental cars are in the right place at the right time.

Join the conversation on Twitter at @FICOnews_APAC.

FICO is a registered trademark of Fair Isaac Corporation in the US and other countries

Photo – https://techent.tv/wp-content/uploads/2020/06/fico-survey-philippine-consumers-more-comfortable-opening-bank-accounts-with-smartphones-than-americans-and-british-1.jpg

Logo – https://techent.tv/wp-content/uploads/2020/06/fico-survey-philippine-consumers-more-comfortable-opening-bank-accounts-with-smartphones-than-americans-and-british.jpg

Related Links :

https://www.fico.com