Latest version of desktop platform offers traders the option to completely customize widgets based on preference and importance NEW YORK, Aug. 20, 2020 — Webull Financial LLC, an independent, self-directed broker dealer focused on zero-commission trading and in-depth market data, today announced the launch of Webull Desktop 4.0. The enhanced…

EQT Infrastructure to acquire leading global data center provider EdgeConneX

– EQT Infrastructure has agreed to acquire EdgeConneX, a leading global data center provider serving the fast growing Hyperscale and Edge ecosystems – EdgeConneX has a global footprint, operating and developing over 40 facilities in 33 markets across North America, Europe and South America – EQT Infrastructure is committed to…

FinVolution Group to Report Second Quarter 2020 Financial Results on Tuesday, August 25, 2020

-Earnings Call Scheduled for 8:00 a.m. ET on August 25, 2020- SHANGHAI, Aug. 18, 2020 — FinVolution Group ("FinVolution", or the "Company") (NYSE: FINV), a leading fintech platform in China, today announced that it will report its second quarter 2020 unaudited financial results, on Tuesday, August 25, 2020, before the open…

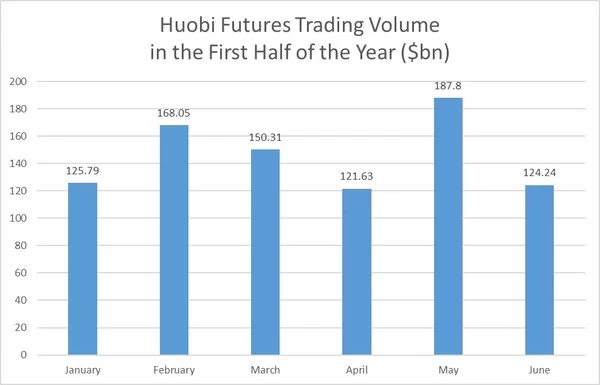

Huobi Records $877.8 Billion in Trading Volume for First Half of 2020

LONDON, Aug. 14, 2020 — Despite 2020 being a difficult year across the planet due to the coronavirus pandemic, the cryptocurrency trading space on Huobi has remained strong and resilient. New information from Huobi global has seen that $877.8 billion has been traded on the platform in the last six…

Spotware Celebrates 10 Years of Fintech Innovation

LIMASSOL, Cyprus, Aug. 13, 2020 — It has now been 10 years since Spotware, and soon after its flagship product – cTrader, have entered the market and became the epitome of Fintech innovation. 10 years of continuous growth, development and updates, a journey…

HotForex Launches CFDs on ETFs and DMA Stocks on its MT5 Platform

Traders with the award-winning broker HotForex can now diversify their portfolio by trading Contracts for Differences ("CFDs") on hundreds of DMA Stocks & ETFs on the company’s powerful multi-asset platform MT5 PORT LOUIS, Mauritius, Aug. 13, 2020 — HotForex, the internationally acclaimed multi-asset broker…

Funding Societies and SMU collaborate to develop a case on P2P Lending for Small Businesses

SINGAPORE, Aug. 12, 2020 — Funding Societies, Southeast Asia’s largest digital financing platform, and Singapore Management University (SMU) have come together to develop and publish a case study explaining the role of FinTech and Peer-to-Peer (P2P) lending for small businesses. This is the first such case covering a P2P lender that…

TPIsoftware and Taishin’s API Management Platform awarded with Global Finance’s “The Innovators 2020 Cash Management” award

TPIsoftware’s APIM platform, digiRunner, provides integrated cash management services for convenient and diversified collection and payment services. TAIPEI, Aug. 10, 2020 — Leading Taiwanese digital banking software provider TPIsoftware collaborated with Taishin International Bank to create an API management platform using TPIsoftware’s own APIM module. The system integrates related cash…

AGM Group Holdings Inc. Signs LOI to Acquire Hong Kong-Based Financial Services Company with Type 1, 2, 4, 5, and 9 Licenses

BEIJING, Aug. 7, 2020 — AGM Group Holdings Inc. ("AGMH" or the "Company") (NASDAQ: AGMH), an application software company providing accounting and ERP software, fintech software, and trading education software and website service, is pleased to announced that through its wholly-owned subsidiary, AGM Technology Limited ("AGM Technology"), the Company has…

FinVolution Group Releases 2019 Environmental, Social, and Governance Report

SHANGHAI, Aug. 6, 2020 — FinVolution Group ("FinVolution", or the "Company") (NYSE: FINV), a leading fintech platform in China, today announced the release of its Environmental, Social, and Governance (ESG) report highlighting FinVolution’s efforts and accomplishments in environmental sustainability, social responsibility and corporate governance for 2019. "Corporate social responsibility is an essential element…