SINGAPORE, Nov. 27, 2020 — Singapore-based fintech company, Lightnet Pte. Ltd. (Lightnet Group), has announced a partnership with Siam Commercial Bank (SCB). The partnership makes remittance services accessible to all Thai bank accounts and anyone who has signed up for PromptPay, a government-sponsored service that enables instant bank-to-bank fund transfers….

OKEx resumes withdrawals of digital assets

Restoring its full range of services for all users VALLETTA, Malta, Nov. 27, 2020 — OKEx (www.okex.com), a world-leading cryptocurrency spot and derivatives exchange, has restored its full range of services for its users by reopening withdrawals of all digital assets as of…

OneConnect Financial Technology cements presence in Malaysia with new entity; Launch graced by MDEC

SHENZHEN, China, Nov. 26, 2020 — OneConnect Financial Technology Co., Ltd. (NYSE: OCFT), the leading technology-as-a-service platform provider and an associate of Ping An Insurance Group, reaffirms its commitment as the trusted tech partner for financial institutions in Malaysia with the launch of its new entity, OneConnect Smart Technology (Malaysia) Sdn…

5 Ways to Combat Fraud During the Holidays

Black Friday and the holiday season will bring more fraud attempts – here’s how to protect yourself SAN JOSE, Calif., Nov. 25, 2020 — Highlights: 5 Tips to Combat Fraud Online During the Holidays The pandemic is driving holiday…

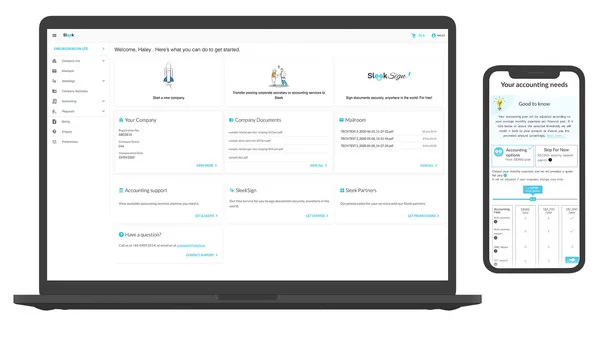

Singapore Fintech startup Sleek secures US $4M from Enterprise Singapore’s SEEDS Capital and business angels

SINGAPORE, Nov. 23, 2020 — Sleek, a fintech startup that is disrupting the traditional corporate services industry, has raised US $4M in a new funding round. Led by SEEDS Capital, the investment arm of Enterprise Singapore, the funding was also joined by MI8 Limited, a Hong-Kong multi-family office, and investor Pierre…

Brilliance Financial Technology Launches DPX

Next Generation Real Time Digital Pricing and Profitability Management for Banks NEW YORK, Nov. 23, 2020 — Brilliance Financial Technology (bxfin.com), the world’s leading digital pricing and profitability system provider for banks, has announced the release of DPX, an integrated solution that uniquely combines Pricing, Rates & Product, and Profitability Management….

Official G20 2020 Family Photo Released

RIYADH, Saudi Arabia, Nov. 21, 2020 — The Saudi G20 Presidency is pleased to share a family photo of the G20 leaders projected this evening on the walls of the UNESCO World Heritage Site At-Turaif District in Ad-Diriyah outside Riyadh. Official G20 2020 Family Photo Released …

G20 Riyadh Summit: Post-Presidency Press Conference

RIYADH, Saudi Arabia, Nov. 21, 2020 — The G20 Riyadh Summit will be held virtually from November 21 – 22, 2020. The G20 Presidency Press Conference will be conducted after the conclusion of the second and last day of the Leaders’ Summit by Saudi Finance Minister His Excellency Mr. Mohammed…

Multiple Investments of Hong Kong-Listed Yeahka in Advertising Business May Become Next Growth Driver

HONG KONG, Nov. 18, 2020 — Payment-based technology platform Yeahka (09923.HK) ("the Group") announced on 9 November that it agreed to acquire a 42.5% equity interest in Beijing Chunagxinzhong Technology Co., Ltd. ("Chuangxinzhong"). This transaction is Yeahka’s second external investment after the Group became a cornerstone investor in the listing…

IBM to Acquire SAP Consulting Partner TruQua

Acquisition will bolster IBM Services’ expertise in financial workflows with SAP and further strengthen the company’s hybrid cloud growth agenda ARMONK, New York, Nov. 16, 2020 — As part of IBM’s hybrid cloud growth strategy to drive digital transformation for clients, IBM…