SINGAPORE, Dec. 23, 2020 — Huawei Pay, the mobile payment service by Huawei, today announced a new partnership with Aleta Planet and UnionPay International (UPI) to introduce the mobile payment solution combining Near Field Communication (NFC) and Quick Response Code (QR code) payments for Singapore Huawei users. Starting from now to 28…

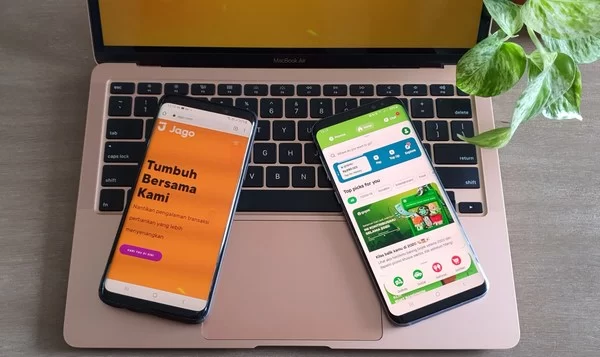

Gojek invests in Bank Jago to accelerate financial inclusion in Indonesia

Investment made through Gojek’s payments and financial services arm, with ambition to provide millions of users with greater access to digital banking services JAKARTA, Indonesia, Dec. 22, 2020 — Gojek, Southeast Asia’s leading mobile on-demand services and payments platform, has invested in Bank Jago, an Indonesia-listed technology-based bank, as part of…

ValueLabs wins IBSI Global Fintech Innovation Award

HYDERABAD, India, Dec. 18, 2020 — ValueLabs, a global technology services provider, won the IBSI Global Fintech Innovation Award for the Best Original & Adoptable Concept in Compliance & RegTech. It was for the Enterprise Customer Due Diligence solution which they built for…

Pintec enables China Mobile’s subsidiary Aspire Holdings with intelligent fintech solutions

BEIJING, Dec. 18, 2020 — Pintec Technology Holdings Ltd. ("Pintec"; NASDAQ: PT), a leading independent fintech solutions provider, announced today that it has cooperated with China Mobile Communications Corp. ("CMCC")’s subsidiary Aspire Holdings Ltd. to jointly develop advanced fintech solutions, leveraging Pintec’s big data analytics and AI technology capabilities. Aspire…

Crypto.com Chain Prepares for Mainnet Launch with Final Dry Run

Mainnet stress test event, Crossfire, includes USD 300,000 validator incentives HONG KONG, Dec. 18, 2020 — Crypto.com today announced Crossfire, the Crypto.com Mainnet dry run, aimed at stress testing the network in a practical, real-world setting before public release. Crossfire marks an important…

Coinstreet Partners and ECXX announce strategic partnership in asset tokenization, digitized securities and STO areas

SINGAPORE, Dec. 17, 2020 — Coinstreet Partners ("Coinstreet"), an award-winning AI-powered global decentralized investment banking group, and ECXX, a regulated blockchain-based digital securities exchange in Singapore, have entered into a strategic partnership to bring in end-to-end services to security token offering ("STO") and secondary trading of digitized securities to institutional…

Cantilan Bank Deploys First DN Series™ In The Philippines

The self-service solution provides the latest technology to support the bank’s modernization and financial inclusion strategy MANILA, Philippines and NORTH CANTON, Ohio, Dec. 15, 2020 — Diebold Nixdorf announced today that Cantilan Bank, Inc., one of the leading rural banks in the Philippines, has installed its DN Series™ ATMs at…

Synechron Acquires Attra

Expanding competencies with end-to-end banking and payments technology services. NEW YORK, Dec. 11, 2020 — Synechron Inc., a leading Digital Transformation consulting firm for the financial services industry, today announced the acquisition of Attra, an Australia-based technology services and solutions provider, headquartered in Melbourne,…

OneConnect Enables Fintech Innovation in Abu Dhabi Global Market’s Digital Lab

SHENZHEN, China, Dec. 11, 2020 — Leading technology-as-a-service platform provider OneConnect Financial Technology Co., Ltd. (NYSE: OCFT) ("OneConnect" or "the Company") was recognized at the recent FinTech Abu Dhabi Festival for its technological support of ADGM Digital Lab, a platform of Abu Dhabi Global Market (ADGM), the award-winning International Financial…

Global utility token OKB teams up with crypto payments service NOWPayments

VICTORIA, Seychelles, Dec. 10, 2020 — OKEx (www.okex.com), a world-leading cryptocurrency spot and derivatives exchange, has joined forces with noncustodial crypto payment services provider NOWPayments.The partnership allows holders of OKB — the global utility token issued by the OK Blockchain Foundation — to make fast and easy payments online using their OKB. Starting…