Payment orchestration leader will boost digital revenues in retail, online gaming, online education and entertainment & media. LONDON, June 9, 2021 — CellPoint Digital, a fintech leader in payment orchestration for travel, today announces it is now offering its market leading platform to new…

PingPong Payments launches new PLN and SEK currency exchange services

FinTech unicorn PingPong Payments now enables marketplace sellers, SMBs & larger enterprise traders to access Europe’s hottest markets through expanded currency capabilities NEW YORK, June 8, 2021 — Global payments and e-commerce services provider PingPong Payments, today announces expanded payments processing and currency exchange services for both the Polish (PLN)…

Mercurity Fintech Holding Inc. Reports First Quarter 2021 Financial Results

BEIJING, June 5, 2021 — Mercurity Fintech Holding Inc. (the "Company" or "MFH") (Nasdaq: MFH) today announced its unaudited financial results for the first quarter ended March 31, 2021. First Quarter 2021 Financial and Operating Highlights Q1 2021 GAAP revenues of $81 thousand, compared to $1,392 thousand in Q1…

LTI Syncordis Recognized as Temenos Service Partner of the Year

Award presented at Temenos Community Forum Online 2021 MUMBAI, India, June 2, 2021 — LTI Syncordis, a global Temenos implementation partner and a subsidiary of Larsen & Toubro Infotech Ltd. (BSE: 540005) (NSE: LTI) has been recognized as Service Partner of the Year…

Circle Completes $440 Million Financing to Drive Growth and Market Expansion

BOSTON, May 29, 2021 — Circle, a global financial technology firm that provides payments and treasury infrastructure for internet businesses, today announced it has raised $440 million in financing from leading institutional and strategic investors. The financing, among the top 10 in private…

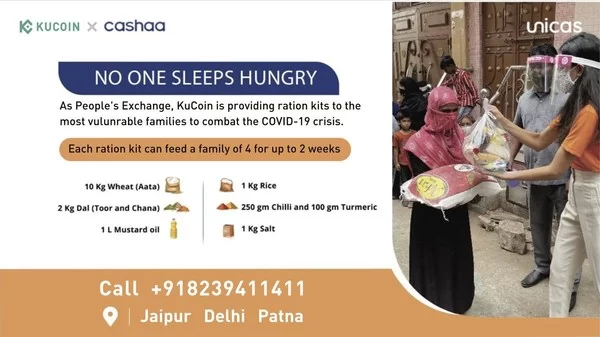

KuCoin Partners With Cashaa to Combat COVID-19 Crisis in India Through Distribution of Daily Supplies

VICTORIA, Seychelles, May 19, 2021 — KuCoin, an IDG-backed crypto exchange, announced today that it has partnered with Cashaa, a blockchain-based financial platform, to jointly initiate charity campaigns to help people cope with the increasingly severe challenges of COVID-19 in India. Latest statistics show that India’s COVID-19 cases have surpassed…

Kasisto Establishes Itself as the Intelligent Digital Assistant Leader for Banking on the African Continent

Kasisto makes key organizational hires within the African market as the firm experiences significant growth and selection of KAI by 3 of the top 5 financial institutions within this important region NEW YORK and JOHANNESBURG, May 18, 2021 — Kasisto, creators of KAI,…

FinVolution Group to Report First Quarter 2021 Financial Results on Tuesday, May 25, 2021

-Earnings Call Scheduled for 8:00 a.m. ET on May 25, 2021- SHANGHAI, May 17, 2021 — FinVolution Group ("FinVolution", or the "Company") (NYSE: FINV), a leading fintech platform in China, today announced that it will report its first quarter 2021 unaudited financial results, on Tuesday, May 25, 2021, before the open…

Circle and FTX Announce Global Partnership

World’s Fastest Growing Crypto Exchange Adopts Circle Platform for Payments and USDC Infrastructure, Including Seamless Card Payments Experiences on FTX.com and Blockfolio BOSTON, May 15, 2021 — Circle, a global financial technology firm that provides payments and treasury infrastructure for internet businesses, today announced…

Nayax Announces the Pricing of its Initial Public Offering

HERZLIYA, Israel, May 11, 2021 — Nayax Ltd. ("Nayax") announced today the pricing of its global initial public offering of 63,500,000 ordinary shares at a price per share of ILS 10.50 (approx. USD 3.25). The offering comprises 44,000,000 ordinary shares by Nayax and an aggregate of 19,500,000 ordinary shares by three…