SINGAPORE, June 25, 2021 — FTAG Group announced today that it has acquired a significant stake in Singapore-based live streaming startup BeLive Technology. The strategic move, made via the company’s investment arm FTAG Ventures, will enhance FTAG’s own media capabilities while expanding its technology portfolio. It also makes them one…

“AIZEN,” Winner of MAS FinTech Awards, Offers Banking Services through AI-Based Data Integration

SEOUL, South Korea, June 25, 2021 — AIZEN, which ranked second in the Global Category of MAS FinTech Awards 2020 (Singapore FinTech Festival, MAS FinTech Awards) alongside Swiss Re (insurance) and BNY Mellon (banking), announced that it would provide banking-as-a-service to the Southeast Asian market. The company has been delivering artificial…

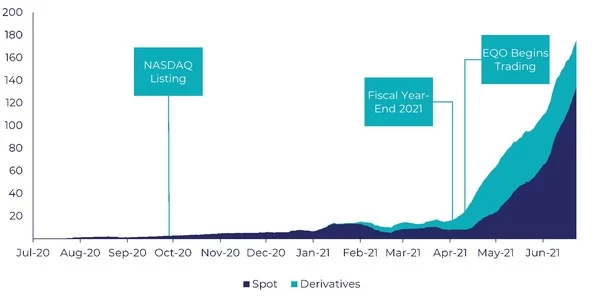

EQONEX Exchange Exceeds US$5 billion in 30 Day Volume

Fee Paying Volume Rapidly Accelerating Post-EQO Launch SINGAPORE, June 24, 2021 — Diginex Limited (Nasdaq: EQOS), recently rebranded as EQONEX Group (the "Company"), a digital assets financial services company, today announced that total spot and derivative trading volumes on EQONEX, its cryptocurrency exchange, exceeded US$5 billion over the past 30…

Doo Prime Secured The Renewal of VFSC License In Continuation Of Seizing The Global Market

PORT VILA, Vanuatu, June 22, 2021 — Doo Prime is pleased to announce that Doo Prime Vanuatu Limited has successfully renewed its financial dealer’s license from the Vanuatu Financial Services Commission (VFSC) to continue expanding international relations, and seize the global financial market. Doo…

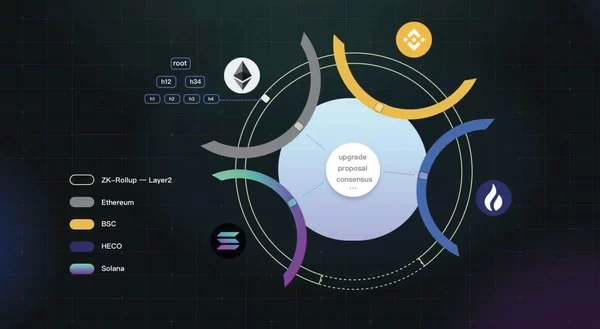

zkLink, the first Layer2 multi-chain integration DEX based on ZK-Rollup, will be launching

LONDON, June 19, 2021 — zkLink, the first Layer2 multi-chain integration DEX based on ZK-Rollup technology, will be launching its testnet later this June. Aiming to link multiple chains in a user-friendly way, zkLink aggregates different ecosystems’ liquidity and makes it possible for native assets on different chains to interact…

BCcard secures a strong foothold in Vietnam’s card payments market

– BCcard acquired 100% stake in the Vietnamese No.1 bank POS terminal supplier – Possessing software development capabilities on top of its distribution business… attaining high client satisfaction – BCcard to provide convenient and stable services applying its advanced technology SEOUL, South Korea, June 17, 2021 — BCcard (CEO Choi Won-Seok),…

Nium and Travelex launch new digital remittance offering in Hong Kong

Travelex International Money Transfer aims to offer Hong Kong residents a faster and convenient method to transfer money overseas HONG KONG, June 15, 2021 — Travelex, one of the market leading foreign exchange brands, alongside advanced global payments platform Nium, has today announced…

Adyen granted US branch license

AMSTERDAM, June 15, 2021 — The US Office of the Comptroller of the Currency (OCC) has approved Adyen’s application to establish a Federal Foreign Branch in San Francisco, California. The OCC’s approval and its granting of the branch charter in combination with the…

Lion Announces Response to SEC Guidance Issued on April 12, 2021 Applicable to Warrants Issued by Special Purpose Acquisition Companies (“SPACs”)

HONG KONG, June 12, 2021 — Lion Group Holding Ltd. ("Lion" or "the Company") (NASDAQ: LGHL), operator of an all-in-one trading platform that offers a wide spectrum of products and services with a focus on Chinese investors, announced today in a Current Report on Form 6-K, that as a result…

Planful Debuts “Predict: Signals,” a Native AI and ML Anomaly Detection Technology for FP&A

Predict Signals Gives FP&A Teams Unmatched Confidence and Strategic Insight to Drive Greater Business Impact REDWOOD CITY, Calif., June 10, 2021 — Planful Inc., the pioneer of financial planning, analysis (FP&A), and consolidations cloud software, today announced the launch of “Predict: Signals,” the first…