JAKARTA, Indonesia, June 27, 2024 — During the inaugural OceanBase INFINITY tech conference in Jakarta, Indonesia, OceanBase unveiled that its comprehensive suite of cloud database products and services is now…

Flash News: OKX Wallet Integrates with Side Protocol

SINGAPORE, April 27, 2024 — OKX, a leading Web3 technology company, today announced the integration of Side Protocol with the OKX Wallet. Side Protocol is a cross-chain middleware protocol designed…

Aurionpro Solutions acquires Arya.ai, to power next generation Enterprise AI platforms for Financial Institutions

SINGAPORE, April 22, 2024 — Aurionpro Solutions Limited (BSE: 532668) (NSE: AURIONPRO) announces the acquisition of Banking and Insurance focused PaaS startup, Arya.ai….

LexisNexis Risk Solutions Wins Best KYC Data Solution at RegTech Insight APAC Awards 2024

HONG KONG, March 28, 2024 — LexisNexis® Risk Solutions has won the award for Best KYC Data Solution at the RegTech Insight APAC…

Fueled by Growth, Global Fintech Adyen Doubles Down on North American Presence With New 150,000-Square-Foot Office in Downtown San Francisco

SAN FRANCISCO, March 14, 2024 — Adyen, the global financial technology platform of choice for leading businesses, has signed a new sublease…

Privy Appoints New Country Lead and Charts Course for Better Digital Trust Solutions in Australia

Privy extends its reach to Australia, introducing solutions that authenticate agreements, people and businesses to build digital trust. Launch to coincide with Australia’s increase in government spending and…

AsiaPay and Solaire Resort Entertainment City forge a partnership to enhance their digital payment.

MANILA, Philippines, March 6, 2024 — AsiaPay, a leading digital payment service and technology provider in Asia, has partnered with Solaire Resort…

Qrios Inc. Unveils Revolutionary cPaaS and Digital Payments Portal: deep.qrios.com

PLANO, Texas, Feb. 9, 2024 — Qrios Inc., headquartered in Plano, Texas, and a leading multinational provider of cloud communication platform as a…

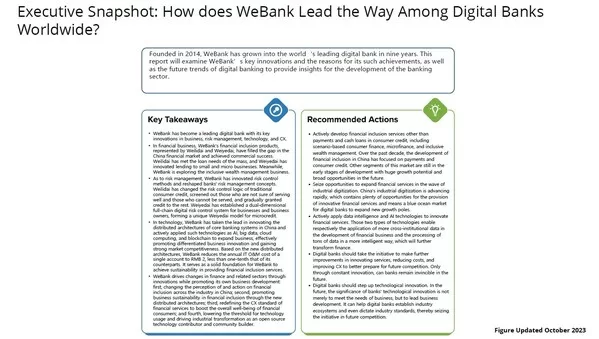

WeBank Recognized as a World Leading Digital Bank driven by Innovation

SHENZHEN, China, Jan. 31, 2024 — Leading IT market research and advisory firm International Data Corporation (IDC) published its latest case study report, How Does WeBank Lead the Way…

ForexVox Rebrands to MarketsVox: A Landmark Evolution Reflecting Growth and Innovation

LONDON, Jan. 9, 2024 — ForexVox, a prominent name in the online trading sphere, proudly announces a significant transformation with its rebranding to MarketsVox. This momentous shift goes beyond…