Crypto developer activity reached an all-time high in 2021 SAN FRANCISCO, Jan. 6, 2022 — Electric Capital today released their 2021 Developer Report, the industry standard for understanding the landscape across…

Huobi Singapore Launches First Huobi Academy Workshop on “The Future of Technology: Metaverse”

The webinar covered a wide spectrum of topics on the Metaverse including Non-Fungible Tokens (NFTs), GameFi, and crypto art SINGAPORE, Dec. 28, 2021 — Huobi Singapore, a leading global digital assets…

Anchorage Digital Raises $350 Million in Series D Funding Round, Led by KKR

New round values premier digital asset platform at over $3 billion SAN FRANCISCO, Dec. 15, 2021 — Anchorage Digital ("Anchorage" or the "Company"), the premier digital asset platform for institutions,…

aelf Hosts its Inaugural Metaverse Hackathon – Top of OASIS

SINGAPORE, Dec. 12, 2021 — aelf’s first metaverse-themed hackathon — Top of OASIS — has opened on December 12th, 2021. Participants are invited to submit their projects anytime before Feb. 9th, 2022. The distribution…

Artmarket.com: Pak allows thousands of collectors to buy part of a work whose total price reaches $91.8 million

PARIS, Dec. 11, 2021 — The idea of buying an artwork collectively goes back a long way and has been entertained in various…

Tonik secures USD 100 million in Consumer Deposits within 8 months of launch

MANILA, Philippines, Dec. 9, 2021 — Tonik, the Philippines’ first digital-only neobank, continues to blaze a trail in the local banking industry by surpassing P5B (US$100M) in consumer deposits. The…

X Financial Reports Third Quarter 2021 Unaudited Financial Results

SHENZHEN, China, Nov. 23, 2021 — X Financial (NYSE: XYF) (the "Company" or "we"), a leading online personal finance company in China, today announced its unaudited financial results for the third…

Digital Banking Start-up DNBC Launches Mobile Top-up Feature

Payment institutions and fintech companies acknowledged a significant change in the mobile transaction segment. Giving digital organizations the edge they need to combine the mobile airtime transactions to the payment…

Nisun International Announces Results of 2021 Shareholder Meeting

SHANGHAI, China, Nov. 20, 2021 — Nisun International Enterprise Development Group Co., Ltd ("Nisun International" or the "Company") (Nasdaq: NISN), a provider of innovative comprehensive solutions through the integration of technology,…

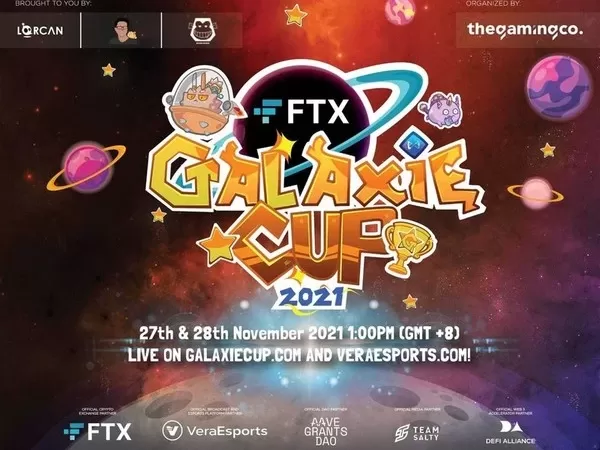

FTX Galaxie Cup Reinforces Sponsors Lineup with Industry Heavyweights

KUALA LUMPUR, Malaysia, Nov. 18, 2021 — The first of its kind professional Axie Infinity tournament, FTX GalAxie Cup, welcomes VeraEsports by Verasity, AAVE Grants DAO, Defi Alliance and Team Salty as…