JERSEY CITY, N.J., Feb. 24, 2022 — eBaoTech Corporation (eBaoTech), a global digital solution provider for the insurance industry, has enhanced its InsureMO®…

Pocket Network Becomes Primary Infra Provider To Decentralize Fuse’s Open-Source Financial Blockchain

TAMPA, Fla., Feb. 21, 2022 — Pocket Network, a Web3 RPC infrastructure middleware protocol which provides abundant blockchain bandwidth from a globally-distributed network of…

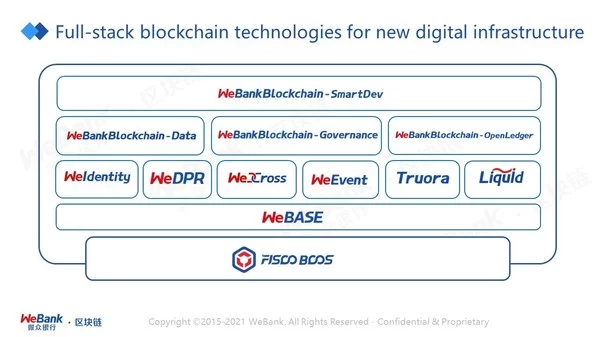

The Largest Digital Bank in China featured in the latest Forbes Blockchain 50

SHENZHEN, China, Feb. 11, 2022 — WeBank, the world’s leading digital bank, is featured in the Forbes Blockchain 50 2022. The bellwether list recognizes large corporations that lead in employing…

OneConnect Makes Forbes Blockchain 50 2022 List for Advanced Trade and Financing Solutions

SHANGHAI, Feb. 10, 2022 — OneConnect Financial Technology Co., Ltd. (NYSE: OCFT) ("OneConnect" or "the Company"), a leading technology-as-a-service platform for financial institutions, has made it on to the Forbes Blockchain 50…

1bill announces strategic investment in Accurassi

Multi-million-dollar investment to transform Australia’s energy landscape and unlock the future of global energy retail MELBOURNE, Australia, Feb. 7, 2022 — One of Australia’s leading financial technology innovators, 1bill Holdings, has…

“From customer service to complex banking tasks” DeepBrain AI implements AI human technology into KB Kookmin Bank

– Contactless counseling service tailored to the COVID-19 situation and significant reduction in waiting time – Provides information on financial products, branch information, weather and instructions on how to use…

Nano AA Ltd signs Partner agreement with LoginID®, for integration of FIDO certified Strong Authentication into their banking platforms

NanoB&K will utilize FIDO to lower both One-Time-Password (OTP) costs, and fraud around customer digital banking interactions. SAN MATEO, Calif. and Mauritius, Feb. 2, 2022 — NanoB&K, the FinTech arm of…

ARV partners with IBM to build a national digital corporate identity system for Thailand’s standardized corporate onboarding process

BANGKOK, Jan. 31, 2022 — AI & Robotics Ventures Company Limited (ARV), a subsidiary of PTT Exploration and Production Public Company Limited (PTTEP), announces that…

Too early to bottom-fish in China’s property bonds, Greifenberg Digital says

NEW YORK, Jan. 20, 2022 — Greifenberg Digital, a member of the IMTE Group, commented today on the risks to Chinese property bonds…

Stacks Ecosystem Becomes #1 Web3 Project on Bitcoin

One year after launch, the Stacks developer community has gone from 0 to 350+ million monthly API requests SAN FRANCISCO, Jan. 15, 2022…