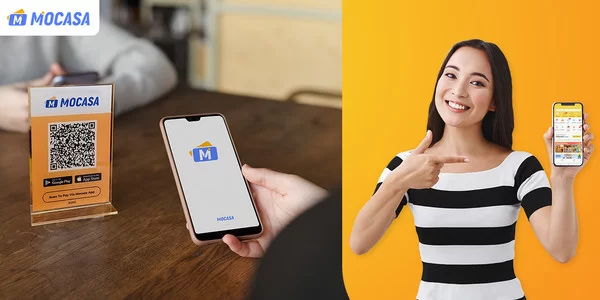

SINGAPORE, Sept. 16, 2022 — MOCASA has secured tens of millions of US dollars, which will propel this global mobile payment company to better product development, expand team cohort,…

Doo Group Affiliate, Doo Prime Showcases Extensive Investment Solutions At The iFX Expo Asia 2022 In Thailand

HONG KONG, Sept. 16, 2022 — Doo Group’s affiliate and world-leading fintech broker, Doo Prime, made a successful appearance in the largest B2B conference, the iFX Expo Asia 2022…

1 Level Up TLC is helping to accelerate FintechCashier brand exposure by attending Gumball rally across the Middle East from 12-20 November 2022

LONDON, Sept. 14, 2022 — FintechCashier CEO Shalom Dodoun is attending Gumball 3000 to rally across Middle East passing Dubai, Jebel Akhdar, Salalah, Muscat, Ras Al-Khaimah and finishing in…

MMTEC, Inc. Announces Half Year 2022 Unaudited Financial Results

BEIJING, Sept. 10, 2022 — MMTEC, Inc. (NASDAQ: MTC) ("MMTEC", "we", "our" or the "Company"), a China based technology company that provides access to the U.S. financial markets, today announced…

CardsPal named the official Ticketing Partner for Legacy Music Festival’s Glowhard, Singapore’s first Hard Dance festival

SINGAPORE, Sept. 3, 2022 — CardsPal has partnered Legacy Music Festival as their official ticketing partner, capitalising on its newly launched e-ticketing feature. With the introduction of the e-ticketing feature,…

MultiBank Group announces Record-Breaking Financial Figures for 2021

With a Daily Turnover of over US$ 12.1 Billion and annual revenue of US$ 189 million DUBAI, UAE, Aug. 25, 2022 — MultiBank Group, the largest and most regulated…

FinVolution Group to Report Second Quarter 2022 Financial Results on Monday, August 22,2022

-Earnings Call Scheduled for 8:30 p.m. ET on August 22, 2022- SHANGHAI, Aug. 9, 2022 — FinVolution Group ("FinVolution", or the "Company") (NYSE: FINV), a leading fintech platform, today…

KMS Officially Launches Kaypay – a Buy Now, Pay Later Commerce Platform

HO CHI MINH CITY, Vietnam, Aug. 5, 2022 — KMS officially introduced Kaypay to Vietnamese users from August 2022. Kaypay is an application that combines a social commerce platform…

XPro Markets Introduces Innovative Social Media Blog

GAUTENG, South Africa, Aug. 3, 2022 — Today’s market conditions and the competition over every client in the online trading industry have brought several outstanding brands to go the…

MMTEC, Inc. Regains Compliance with NASDAQ Minimum Bid Price Requirement

BEIJING, July 28, 2022 — MMTEC, Inc. (NASDAQ Capital Market: MTC) ("MMTEC" or the "Company"), a China-based technology company that provides access to the U.S. financial markets, today announced that that…