BEIJING, Oct. 30, 2020 — A news report by China.org.cn on the 5th plenary session of the 19th central committee of the CPC and China’s "dual circulation":   The fifth plenary session of the 19th Central Committee of the Communist Party of China (CPC) concluded on Oct. 29….

Bursa Malaysia and CGS-CIMB Securities to Host InvestHack Virtual Hackathon to Improve Retail Investor Participation in the Marketplace

KUALA LUMPUR, Malaysia, Oct. 30, 2020 — Bursa Malaysia Berhad ("Bursa Malaysia" or the "Exchange") in partnership with CGS-CIMB Securities Sdn Bhd ("CGS-CIMB"), will host the inaugural "InvestHack" hackathon event from 20 – 22 November 2020. Themed "InvestHack: Reimagine Investing", the contest aims to develop innovative solutions and offerings that…

FinVolution Group Chairman Continues to Purchase Company Shares

SHANGHAI, Oct. 30, 2020 — FinVolution Group ("FinVolution", or the "Company") (NYSE: FINV), a leading fintech platform in China, today announced that Mr. Shaofeng Gu, Chairman and Chief Innovation Officer of the Company, has informed the Company that he purchased approximately in his personal capacity 0.4 million of the Company’s American Depositary Shares…

Chunghwa Telecom Reports Un-Audited Consolidated Operating Results for the Third Quarter of 2020

TAIPEI, Oct. 30, 2020 — Chunghwa Telecom Co., Ltd. (TAIEX: 2412, NYSE: CHT) ("Chunghwa" or "the Company") today reported its un-audited operating results for the third quarter of 2020. All figures were prepared in accordance with Taiwan-International Financial Reporting Standards ("T-IFRSs") on a consolidated basis. (Comparisons throughout the…

Fang to Report Third Quarter 2020 Financial Results on November 13, 2020

BEIJING, Oct. 30, 2020 — Fang Holdings Limited (NYSE: SFUN) ("Fang"), a leading real estate Internet portal in China, today announced that it will report its unaudited financial results for the third quarter ended September 30, 2020 before the U.S. market opens on Friday, November 13, 2020. Fang’s management…

Delving into DeFi’s Hidden Super Platform

SINGAPORE, Oct. 30, 2020 — Quietly up against strong competitors, DRK aims to fundamentally transform daily activities of crypto users (and DeFi users in particular) as it works towards its ambition to become an all-in-one super platform in the crypto space. Based on its native chain (DRK Chain), the underlying platform…

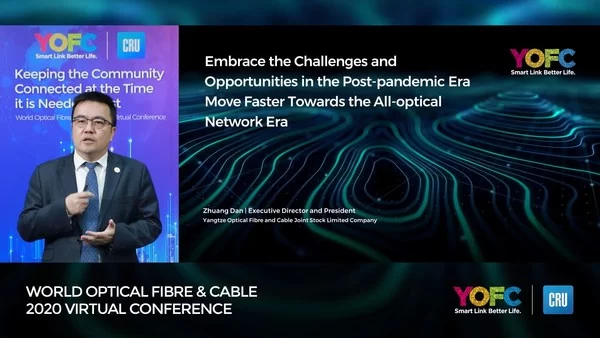

YOFC Shares Vision for Future Optical Industry at the 2020 World Optical Fibre and Cable Virtual Conference

WUHAN, China, Oct. 29, 2020 — Yangtze Optical Fibre and Cable ("the Company" and "YOFC", 601869.SH, 06869.HK), a global leader in the optical fibre and cable industry, shed light on trends of global fibre and cable markets at the CRU World Optical Fibre & Cable 2020 Virtual Conference which was…

PINTEC Announces RMB400 Million Financing under Equity Transfer Agreements

BEIJING, Oct. 27, 2020 — Pintec Technology Holdings Limited (Nasdaq: PT) ("PINTEC" or the "Company"), a leading independent technology provider enabling financial services in China, today announced that Pintec (Yinchuan) Technology Co., Ltd. (the "Transferee"), a wholly-owned subsidiary of the Company, entered into certain equity transfer agreements (the "Agreements"), pursuant…

VeChain, Renji Hospital and DNV GL Held Strategic Partnership Signing Ceremony To Launch World’s First Blockchain Intelligent Tumor Treatment Center

SHANGHAI, Oct. 27, 2020 — In partnership with VeChain and DNV GL, Renji Hospital, a top-ranked hospital in China affiliated with the Shanghai Jiaotong University School of Medicine, has announced the launch of the world’s first blockchain-enabled Intelligent Tumor Treatment Center on October 20,…

TerraPay strengthens its entry in North America with FINTRAC Canada MSB License

TORONTO and HAGUE, Netherlands, Oct. 26, 2020 — Canada’s growth lends itself to an increasing population of immigrants boosting the economy. Fuelling its aim to attract migrants to the nation in the next few years calls for a seamless and secure framework to…