BEIJING, Nov. 5, 2020 — WiMi Hologram Cloud Inc. (Nasdaq: WIMI) ("WiMi" or the "Company"), a leading augmented reality ("AR") service provider in China, announces that its wholly-owned subsidiary, VIYI Technology Inc. ("VIYI Technology"), has entered into an agreement for the acquisition of 100% equity interests of Singapore-based Fe-da Electronics Company Pte Ltd….

Nium Names Frederick Crosby as New Chief Revenue Officer

Crosby will take on global responsibility and oversight for the company’s B2B sales, marketing and communication efforts. SINGAPORE, Nov. 5, 2020 — Nium, a financial technology infrastructure platform, today announced the appointment of Frederick Crosby as its new Chief Revenue Officer. This comes as the…

Fuji Xerox Strengthens Synergies Within Fujifilm Group to Create Growth Globally

Rebrands Asia Pacific Operations to Fujifilm from April 2021 TOKYO, Nov. 5, 2020 — Fuji Xerox announces that its Asia Pacific operations will change to the Fujifilm brand with the changing of Fuji Xerox Co., Ltd. corporate name to FUJIFILM Business Innovation Corp. on…

Former Global Head of Trade Finance, Farooq Siddiqi, joins fintech platform #dltledgers as CEO

SINGAPORE, Nov. 5, 2020 — Leading cross-border trade digitisation platform #dltledgers has hired veteran banker Farooq Siddiqi as its Co-CEO. Siddiqi, who has over 25 years of experience in transaction and corporate banking commenced his new role on 2nd November 2020. He will split responsibilities with the founder & CEO,…

Itiviti’s Linda Middleditch wins European Women in Finance Award for Excellence in FinTech

LONDON, Nov. 4, 2020 — Itiviti, a leading technology and service provider to financial institutions worldwide, today announced that Linda Middleditch, Chief of Product Strategy and Engineering, has won the Markets Choice Awards – European Women in Finance Awards in the category for Excellence in FinTech. Linda joined Itiviti in…

Wealth Dynamix Completes Eighth Year of Growth and Continues Expansion Despite Global Pandemic Challenges

LONDON, Nov. 4, 2020 — Wealth Dynamix, a global leader in Client Lifecycle Management (CLM) solutions, has announced year-end performance results that indicate strong growth during the twelve months to September 30, 2020. Wealth Dynamix has worked with new and existing wealth management clients to deliver the critical capabilities required to…

Nel ASA: Selected by Iberdrola as preferred supplier for a 20 MW green fertilizer project in Spain

OSLO, Norway, Nov. 4, 2020 — Nel Hydrogen Electrolyser, a division of Nel ASA (Nel, OSE:NEL), has been selected as preferred supplier by Iberdrola for a 20 MW PEM solution for a green fertilizer project in Spain. Contract award is subject to mutual agreement on the final commercial terms. The hydrogen…

The9 Limited Regains Compliance with Nasdaq Listing Requirement

SHANGHAI, Nov. 3, 2020 — The9 Limited ("The9") (Nasdaq: NCTY), an established Internet company, today announced that it received a notification letter from the Nasdaq Stock Market LLC ("Nasdaq") on November 2, 2020 stating that The9 has regained compliance with the minimum bid price requirement under Nasdaq Listing Rule 5550(a)(2)…

UP Fintech Asset Management Announces Closure of UP Fintech China-U.S. Internet Titans ETF

NEWTOWN SQUARE, Pa., Nov. 3, 2020 — The Board of Trustees of the TIGERSHARES Trust has decided to liquidate and close the UP Fintech China-U.S. Internet Titans ETF (TTTN) (the "Fund"), based on the recommendation of the Fund’s adviser, Wealthn LLC (d/b/a UP Fintech Asset Management ("Wealthn")), and Wealthn’s parent company,…

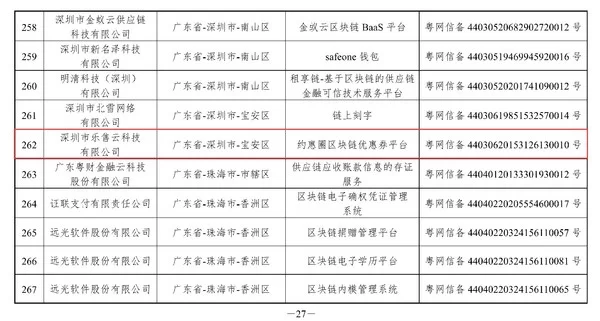

Yeahka’s Consumer Cloud Platform Listed as Registered Blockchain Information Service Provider by CAC to Explore Blockchain Application for Coupons

SHENZHEN, China, Oct. 31, 2020 — YEAHKA LIMITED ("Yeahka" or the "Company", stock code: 9923.HK), a leading technology platform in China, announced that its proprietary consumer cloud and blockchain-powered coupon platform (the "Consumer Cloud Platform") has been included in the fourth set of blockchain information service providers released on 30th by…