Along with industry experts from NITI Aayog and Aditya Birla Group, Frost & Sullivan will discuss India’s economic development and fastest-growing sectors SANTA CLARA, Calif., Feb. 19, 2021 — From a major economic crisis in 1991, India evolved to become the fastest-growing major economy in recent years. While Frost & Sullivan…

WiMi Wins Bid for Second Phase of China Mobile AND Media Cloud Platform’s Remote Interaction Holographic Project

BEIJING, Feb. 19, 2021 — WiMi Hologram Cloud Inc. (Nasdaq: WIMI) ("WiMi" or the "Company"), a leading Hologram Augmented Reality ("AR") Technology provider in China, today announced that it has won the bid for the second phase of China Mobile AND Media Cloud Platform’s remote interaction holographic project (the "Project")….

Crunchfish enrolled to VISA Technology Partner program

STOCKHOLM, Feb. 19, 2021 — Crunchfish AB ("Crunchfish") announces its enrolment into VISA Technology Partner program with its Digital Cash solutions. As a VISA technology partner, Crunchfish will get access to VISA specifications and toolkits enabling potential integration with the VISA digital payment rail. Crunchfish’s patent pending Digital Cash solutions…

Planful and Acumatica Partner to Bring Modern, Cloud-Based FP&A to Customers

Leader in Cloud Financial Planning and Analysis Becomes Top Planning Extension for Acumatica’s Cloud ERP Solution REDWOOD CITY, Calif., Feb. 18, 2021 — Planful Inc., the pioneer of financial planning and analysis (FP&A) cloud software, today announced it has partnered with Acumatica to give users…

Crunchfish enrolled to leading international payment network’s partner program

STOCKHOLM, Feb. 18, 2021 — Crunchfish AB ("Crunchfish") announces its enrolment into a leading international payment network’s partner program with its Digital Cash solutions. As a technology partner, Crunchfish will get access to specifications and toolkits enabling integration with their payment network. Crunchfish’s patent pending Digital Cash solutions are built…

Diginex launches Front-to-Back Digital Assets Trading, Portfolio Management and Risk Platform Powered by Itiviti

SINGAPORE, Feb. 17, 2021 — Diginex Limited (Nasdaq: EQOS), the digital assets financial services company, and Itiviti, a leading technology and service provider to financial institutions worldwide, today announced the launch of ‘Access’, a front-to-back trading, portfolio, and risk management solution that enables the trading of cryptocurrencies and crypto derivatives across…

Future FinTech and Xi’an Jiaotong University have worked together to establish Blockchain Finance Research Institute

NEW YORK, Feb. 17, 2021 — Future FinTech Group Inc.(NASDAQ: FTFT, "Future Fintech", "FTFT" or "Company"), a leading blockchain based e-commerce company and a financial technology service provider, announced today that its wholly-owned subsidiary, Future Commercial Group Co., Ltd., has cooperated with the School of Economics Finance of Xi’an Jiaotong University…

Marketing tech consultancy admiral.digital acquires Fresh Sports Group, strengthening its offering across the entire digital spectrum

From strategy, to technology, to creative KUALA LUMPUR, Malaysia, Feb. 17, 2021 — Marketing technology consultancy, admiral.digital, has acquired Fresh Sports Group (FSG), strengthening its consultancy offering across the entire digital spectrum. Following the acquisition, FSG will be renamed admiral.sports and serve under the admiral.digital umbrella, signalling a new chapter…

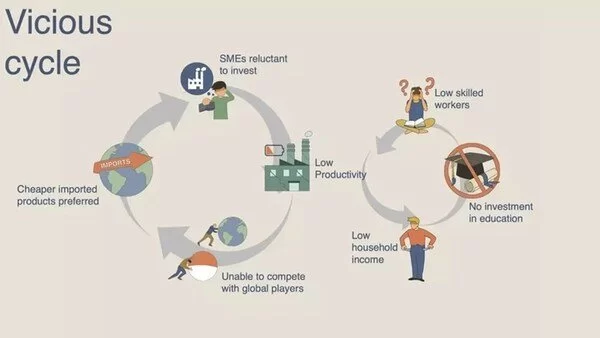

Evermos, an Indonesian Social-Commerce Platform, Seeks to Add Fairer Economy Discussions to The Davos Agenda 2021

BANDUNG, Indonesia, Feb. 17, 2021 — As part of the World Economic Forum’s Davos Agenda 2021, Evermos, a West Java’s social-commerce platform for Indonesian Muslim products, Evermos, unveiled an article on helping Indonesian MSMEs increase their competitiveness. Evermos presented the paper at the World Economic Forum’s Davos Agenda 2021 held…

Personetics secures a $75 million investment from Warburg Pincus to accelerate the global expansion of its AI-driven personalization and engagement solutions for financial institutions

– Over 95 million bank customers now ‘self-driving’ their finances with Personetics – Banks reaping the rewards with an up to 35% increase in mobile app engagement and 20% increase in customer account and balance growth – The global market for financial services personalization solutions is valued at $13 billion…