NEW YORK, May 28, 2021 — GlocalMe®, a product and service brand of UCLOUDLINK GROUP INC. (NASDAQ: UCL, "uCloudlink" or "the Company"), the world’s first and leading mobile data traffic sharing marketplace, has announced its new rental service for customers in the U.S. as the world’s largest economy has seen…

Dada Group Announces Inclusion in MSCI ACWI Index

SHANGHAI, May 26, 2021 — Dada Group (Nasdaq: DADA) ("Dada"), China’s leading local on-demand delivery and retail platform, is pleased to announce that it will be included in the MSCI ACWI Index, effective after the U.S. market close on May 27, 2021. MSCI Inc., a leading provider of research-based indexes…

US politicization of tech supply chains is both risky and costly

BEIJING, May 25, 2021 — A news report by China.org.cn on US politicization of tech supply chains is both risky and costly. In 2019, the Trump administration unleashed its "tech war" on China, with the goal of blocking China’s development in high tech sectors by preventing targeted companies from procuring…

Cohen Milstein Provides Notice of Data Event

WASHINGTON, May 22, 2021 — Cohen Milstein Sellers & Toll PLLC ("Cohen Milstein") provides notice of a data event. On January 23, 2021, Cohen Milstein discovered unusual activity on certain computer systems. Cohen Milstein quickly disconnected the affected systems from the network and commenced an investigation that included working with…

TD Holdings, Inc. Receives NASDAQ Notice on Late Filing of its Form 10-Q

SHENZHEN, China, May 22, 2021 — TD Holdings, Inc. (Nasdaq: GLG) (the "Company"), a commodities trading service provider in China, today announced that it has received a notice from the NASDAQ Stock Market on May 18, 2021 notifying the Company that, because its Form 10-Q for the period ended March 31, 2021 (the "2021…

Yalla Group Limited Responds to Short Attack Reports

DUBAI, UAE, May 20, 2021 — Yalla Group Limited ("Yalla" or the "Company") (NYSE: YALA), the leading voice-centric social networking and entertainment platform in the Middle East and North Africa (MENA), today announced that it became aware of certain short attack reports that contain numerous errors and distorted, misleading and…

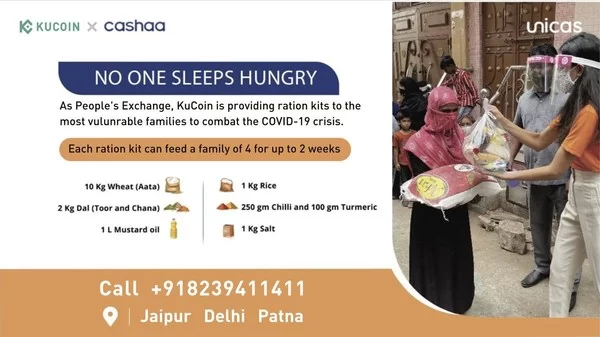

KuCoin Partners With Cashaa to Combat COVID-19 Crisis in India Through Distribution of Daily Supplies

VICTORIA, Seychelles, May 19, 2021 — KuCoin, an IDG-backed crypto exchange, announced today that it has partnered with Cashaa, a blockchain-based financial platform, to jointly initiate charity campaigns to help people cope with the increasingly severe challenges of COVID-19 in India. Latest statistics show that India’s COVID-19 cases have surpassed…

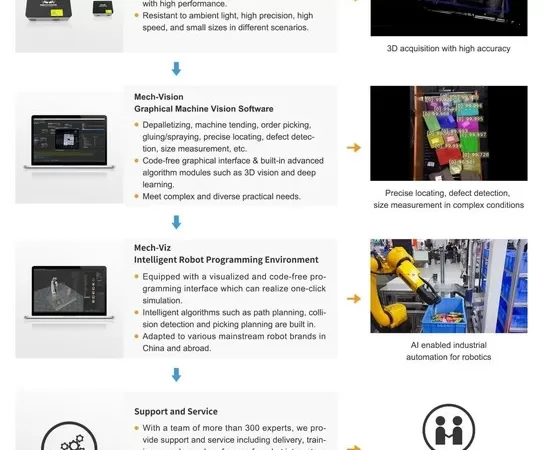

AI Robotics Startup Mech-Mind Completes Series C Funding Led by Tech Giant Meituan

With total funding of over USD100 million, Mech-Mind is pioneering the next frontier of manufacturing through a combination of artificial intelligence and industrial robotics BEIJING, May 19, 2021 — Fast-growing Chinese AI industrial robotics startup, Mech-Mind Robotics ("Mech-Mind") has recently completed Series C funding led by tech giant Meituan. This latest…

Kasisto Establishes Itself as the Intelligent Digital Assistant Leader for Banking on the African Continent

Kasisto makes key organizational hires within the African market as the firm experiences significant growth and selection of KAI by 3 of the top 5 financial institutions within this important region NEW YORK and JOHANNESBURG, May 18, 2021 — Kasisto, creators of KAI,…

FinVolution Group to Report First Quarter 2021 Financial Results on Tuesday, May 25, 2021

-Earnings Call Scheduled for 8:00 a.m. ET on May 25, 2021- SHANGHAI, May 17, 2021 — FinVolution Group ("FinVolution", or the "Company") (NYSE: FINV), a leading fintech platform in China, today announced that it will report its first quarter 2021 unaudited financial results, on Tuesday, May 25, 2021, before the open…