BEIJING, Dec. 2, 2023 — A report from People’s Daily: Chinese President Xi Jinping inspected a government-subsidized rental housing community and learned about the city’s efforts in constructing government-subsidized…

Fosun Group Implements CCH® Tagetik Expert Solution from Wolters Kluwer for integrated budget management and reporting

SHANGHAI, Nov. 29, 2023 — Wolters Kluwer, a global leader in professional information, software solutions, and services, today announced that Fosun Group has selected CCH Tagetik Corporate Performance Management (CPM) software…

“Industrial Finance Empowerment, Cohesion and Win-win” – The Fourth China-Korea-Japan Asset Management Summit Forum Draws to a Successful Close

CHANGZHOU, China, Nov. 28, 2023 — To cope with the new economic changes in the world and create a new economic development pattern in the Asia Pacific region, the…

Abu Dhabi Finance Week Charts the Rise of the Falcon Economy with the Launch of Abu Dhabi Economic Forum

The Chairman & CEO of JP Morgan Chase & Co praised the economic transformation agendas of Abu Dhabi, whilst announcing plans…

Jowell Global Ltd. Announces First Half 2023 Unaudited Financial Results

— First Half Revenue of $84.4 million, down 15.9% year-over-year —- First Half GMV of $115.5 million, down 20.6% year-over-year — SHANGHAI, Nov. 25, 2023 — Jowell Global Ltd. ("Jowell"…

Global Times: BRI offers common development: officials from partner countries

WENZHOU, China, Nov. 23, 2023 — The China proposed Belt and Road Initiative (BRI) has brought the vision of "heart connectivity" to reality, and it is a path to…

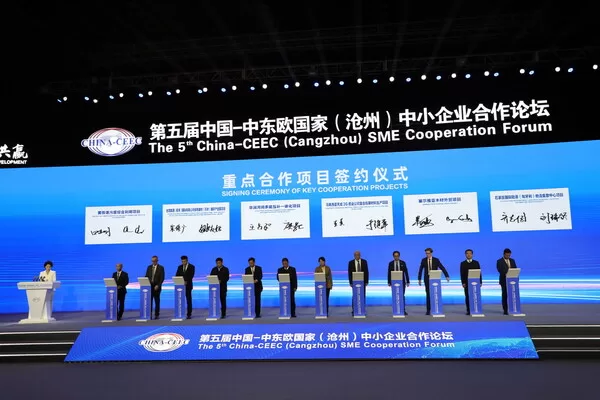

5th China-Central and Eastern European Countries (Cangzhou) Small and Medium-Sized Enterprise Cooperation Forum Launched in N.China Province

CANGZHOU, China, Nov. 18, 2023 — The 5th China-Central and Eastern European Countries (CEEC) (Cangzhou) Small and Medium-Sized (SME) Cooperation Forum initiated on November 13th in Cangzhou, north China’s…

AKA Bank Showcases DeepBrain AI’s Conversational AI Human Service at Euro Finance Tech Day 2023

PALO ALTO, Calif., Nov. 18, 2023 — DeepBrain AI, in collaboration with AKA Ausfuhrkredit-Gesellschaft mbH (AKA), introduced AI avatar technology to the European financial services sector at the Euro…

Appian Enhances “One Appian” Global Partner Program Strategy for 2024

Enablement, alignment, and investment support accelerated partner success MCLEAN, Va., Nov. 16, 2023 — Appian (Nasdaq: APPN) today announced significant updates to…

SymphonyAI Introduces Breakthrough Predictive and Generative AI-Powered Case Management for Financial Crime Investigation in Asia Pacific

Unified Sensa Investigation Hub is the industry’s first for high-impact AI transformation of critical financial crime investigation and detection SINGAPORE, Nov. 15,…