SHENZHEN, China, June 25, 2021 — Meten EdtechX Education Group Ltd. (Nasdaq: METX) ("Meten EdtechX" or the "Company"), one of the leading omnichannel English language training ("ELT") service providers in China, today announced that its online ELT platform, "Likeshuo," maintained the No.2 language training sales[1] among all language training service providers…

“AIZEN,” Winner of MAS FinTech Awards, Offers Banking Services through AI-Based Data Integration

SEOUL, South Korea, June 25, 2021 — AIZEN, which ranked second in the Global Category of MAS FinTech Awards 2020 (Singapore FinTech Festival, MAS FinTech Awards) alongside Swiss Re (insurance) and BNY Mellon (banking), announced that it would provide banking-as-a-service to the Southeast Asian market. The company has been delivering artificial…

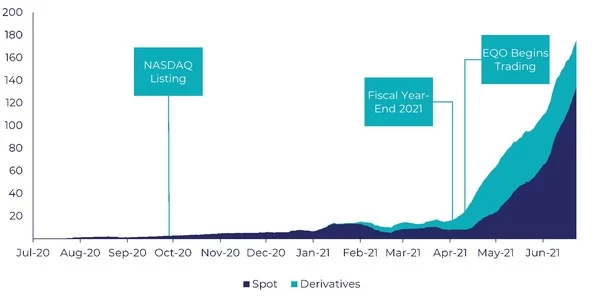

EQONEX Exchange Exceeds US$5 billion in 30 Day Volume

Fee Paying Volume Rapidly Accelerating Post-EQO Launch SINGAPORE, June 24, 2021 — Diginex Limited (Nasdaq: EQOS), recently rebranded as EQONEX Group (the "Company"), a digital assets financial services company, today announced that total spot and derivative trading volumes on EQONEX, its cryptocurrency exchange, exceeded US$5 billion over the past 30…

Cloud-based enterprise software provider Eka to transform corporate treasury operations with a new, purpose-built, state-of-the-art solution

– Eka acqui-hires banking and finance tech start-up Trxiea; – Devanshu Bhatt joins leadership team as SVP, Treasury Solutions NEW YORK, June 23, 2021 — Eka Software Solutions, a cloud-based enterprise solutions provider, announced today it has shored up a team of industry experts tasked with delivering a new solution to…

Doo Prime Secured The Renewal of VFSC License In Continuation Of Seizing The Global Market

PORT VILA, Vanuatu, June 22, 2021 — Doo Prime is pleased to announce that Doo Prime Vanuatu Limited has successfully renewed its financial dealer’s license from the Vanuatu Financial Services Commission (VFSC) to continue expanding international relations, and seize the global financial market. Doo…

China Industrial Bank and 4Paradigm start AI platform acceleration mode Millisecond credit card transaction anti-fraud system is online

BEIJING, June 21, 2021 — Recently, based on the low-threshold, automated AI platform created by 4Paradigm specialized for Industrial Bank, the Industrial Bank Credit Card Center launched a millisecond-level intelligent transaction anti-fraud system, has realized the automatic, intelligent and precise identification and control of credit card fraud risks, and provided…

GLG Names Ramakrishnan (Rama) Adaikalavan Head of APAC

NEW YORK, June 21, 2021 — GLG, the world’s insight network, today announced that Ramakrishnan (Rama) Adaikalavan will join the company as Head of APAC. He joins GLG’s global leadership team and will report directly to CEO Paul Todd. As Head of APAC,…

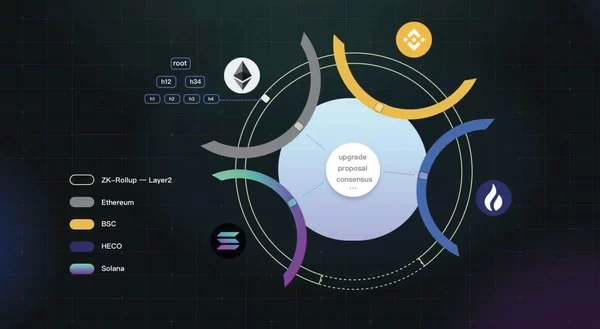

zkLink, the first Layer2 multi-chain integration DEX based on ZK-Rollup, will be launching

LONDON, June 19, 2021 — zkLink, the first Layer2 multi-chain integration DEX based on ZK-Rollup technology, will be launching its testnet later this June. Aiming to link multiple chains in a user-friendly way, zkLink aggregates different ecosystems’ liquidity and makes it possible for native assets on different chains to interact…

Senmiao Technology Announces Strategic Cooperation with the Top Online Ride-hailing Platform in China

Company Continues to Establish Partnerships for its Ride-hailing Expansion Initiatives CHENGDU, China, June 19, 2021 — Senmiao Technology Limited ("Senmiao") (Nasdaq: AIHS), a financing and servicing company focused on the online ride-hailing industry in China and an operator of its own online ride-sharing platform, today announced the signing of a…

Osome Raises a $16M Series A to Expand its AI-based Accounting Platform to Global Markets

SINGAPORE, June 18, 2021 — Osome, a super-app that digitizes accounting and compliance services for SMEs, has raised $16M in a Series A funding from a group of investors including Target Global, AltaIR Capital, Phystech Ventures, S16VC, and Peng T. Ong, an angel investor. The capital enables Osome to expand…