VICTORIA, Seychelles, Aug. 9, 2021 — OKEx (www.okex.com), a world-leading cryptocurrency spot and derivatives exchange, is pleased to announce the listing of Efinity’sEFI, the first paratoken on the Efinity network. EFI is specially designed to be the next-generation blockchain solution for NFTs. EFI deposits, withdrawals and spot trading for EFI/USDT…

The hi Dollar (HI) Lists on UNISWAP

Withdrawals Enabled Along with Listing on the World’s Largest Decentralized Exchange SINGAPORE, Aug. 9, 2021 — hi, a not-for-profit fintech bridging the divide between traditional fintech and crypto, has enabled withdrawals of hi Dollars (HI), the hi Platfrom’s membership token, and announced the listing of HI on Uniswap, the…

HotPlay announces the completion of a merger with Monaker Group as it begins trading on NASDAQ under the name “NextPlay” (NXTP)

BANGKOK, Aug. 6, 2021 — HotPlay has finalized it’s listing on the NASDAQ stock market, one of the largest stock exchanges in the United States based on market capitalization, under the new name "NextPlay Technologies Inc." This change was effective June 30th 2021. HotPlay announces the completion of a…

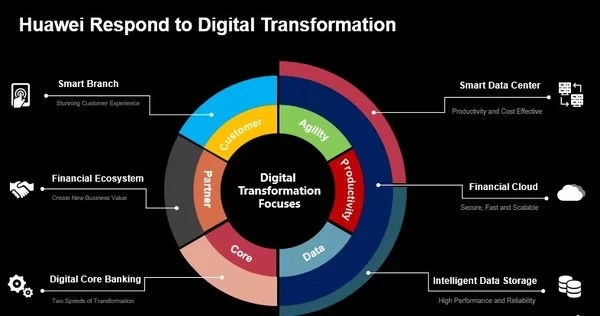

Huawei vows to enable digital ecosystem-based finance in APAC

SINGAPORE, Aug. 3, 2021 — Huawei on July 29, 2021 held its first virtual Asia-Pacific Intelligent Finance Summit 2021, with the theme "Accelerate Digital Transformation in Banking, New Value Together". As economies across the Asia-Pacific region continue to recover and rebound, leading banks and financial institutions are accelerating digital transformation, seizing…

JD CENTRAL’s Parent Company JD.com Ranks 59th on Fortune Global 500 List

BEIJING, Aug. 3, 2021 — JD.com, China’s largest retailer and the parent company of JD CENTRAL, ranked 59th on the Fortune Global 500 list released on August 2. Up by 43 places comparing with last year, JD.com has made the list for the 6th consecutive year, as the largest "retail…

New Oriental Education & Technology Group Inc. Cancels Scheduled Earnings Release and Earnings Call

BEIJING, July 31, 2021 — New Oriental Education & Technology Group Inc. ("New Oriental" or the "Company") (NYSE: EDU and SEHK: 9901), the largest provider of private educational services in China, today announced that in light of the recent regulatory developments, it will cancel the earnings release for the fourth quarter…

iWeb Inc, OTC Markets QB, IWBB, announced it will acquire Tingo Mobile Plc. from Tingo International Holdings, Inc, in a deal valuing the Tingo Mobile Plc at $3.7 Billion USD

LOS ANGELES, July 30, 2021 — Transaction was negotiated for IWEB by their Business Development Partners Global Fintech Trading Limited Led by Craig Marshak an experienced Fintech Specialist investment banker who formerly ran a Nomura bank Venture Technology fund in London with considerable success in online gaming, Software and Cybersecurity investments….

Zhihu Inc. to Report Second Quarter 2021 Unaudited Financial Results on August 16, 2021

BEIJING, July 30, 2021 — Zhihu Inc. ("Zhihu" or the "Company") (NYSE: ZH), the operator of Zhihu, a leading online content community in China, today announced that it will report its unaudited financial results for the second quarter ended June 30, 2021, before the open of the U.S. market on…

Doo Financial’s First Display On Times Square Nasdaq Tower, Establishing A Fully Disclosed Brokerage Relationship With Interactive Brokers

HONG KONG, July 30, 2021 — Doo Financial, an online broker affiliated with Doo Group, has recently established a fully disclosed brokerage relationship with Interactive Brokers, and celebrated with a debut on the Nasdaq in Times Square, New York. Doo Financial has recently established…

Kasisto Announces Series C Funding to Fuel Rapid Growth, Powering the Financial Services Industry with Cutting Edge Conversational AI Technology

$15.5 Million Round Co-Led by Naples Technology Ventures and NCR Corporation NEW YORK, July 28, 2021 — Kasisto, creators of KAI, the leading digital experience platform for the financial services industry, today announced the close of its $15.5 million Series C funding round. The…