SHANGHAI, Nov. 19, 2021 — Boqii Holding Limited ("Boqii" or the "Company") (NYSE: BQ), a leading pet-focused platform in China, today announced that it would reschedule its earnings announcement for…

Afiniti Chairman and CEO Steps Down

HAMILTON, Bermuda, Nov. 19, 2021 — The Board of Directors of Afiniti, Ltd. ("Afiniti") announces that Mr. Zia Chishti has stepped down from his role as Chairman, Chief Executive Officer,…

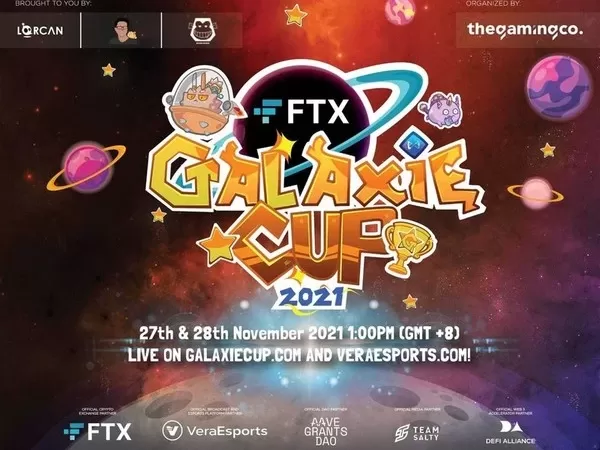

FTX Galaxie Cup Reinforces Sponsors Lineup with Industry Heavyweights

KUALA LUMPUR, Malaysia, Nov. 18, 2021 — The first of its kind professional Axie Infinity tournament, FTX GalAxie Cup, welcomes VeraEsports by Verasity, AAVE Grants DAO, Defi Alliance and Team Salty as…

Behavioural research by Xero uncovers barriers to small business technology adoption

Anxiety over short-term risks of change, overconfidence in the safety of the status quo, and choice paralysis are the most common behavioural barriers…

Crypto ELONGATE Officially Reveals Its Tech Roadmap, Wins Award For Best Social Impact Project 2021

ZUG, Switzerland, Nov. 13, 2021 — Social impact frontrunner in the blockchain space Elongate recently participated in the 2021 Crypto Expo Dubai held this October 14-15 at the Festival Arena,…

Meten Holding Group Ltd. Closes $20 Million Registered Direct Offering of Ordinary Shares Priced At-the-Market Under Nasdaq Rules

SHENZHEN, China, Nov. 12, 2021 — Meten Holding Group Ltd. ("Meten Holding" or the "Company") (NASDAQ: METX), one of the leading omnichannel English language training ("ELT") service providers in China, today…

Arabesque Asset Management Singapore Pte. Ltd. to establish an engineering and research unit to embark on AI project

– Commencing in January 2022, Arabesque Asset Management Singapore Pte. Ltd. (Arabesque) will be embarking on an AI project that focuses on financial knowledge graphs, understanding data bias with application…

PrimeCredit Takes Operational Efficiency to Next Level with SAP Concur Automated Spend Management Solution

Enhanced data visibility, scalability and transparency empowers PrimeCredit to fulfill its fast-growing business needs while maintaining stringent governance HONG KONG, Nov….

Nisun International Reports Unaudited Operational Results for the Nine Months Ended September 30, 2021

SHANGHAI, Nov. 10, 2021 — Nisun International Enterprise Development Group Co., Ltd ("Nisun International" or the "Company") (Nasdaq: NISN), a provider of innovative comprehensive solutions through the integration of technology,…

Webull Financial Donates Brooklyn Nets Tickets to DozenS of New York-Based Community Organizations

Donation of 8,000 Tickets Follows Announcement of Multi-Year Partnership Between Webull and the Nets NEW YORK, Nov. 10, 2021 — Webull Financial LLC, an independent, self-directed broker-dealer focused on zero-commission trading…