SINGAPORE, Sept. 3, 2022 — CardsPal has partnered Legacy Music Festival as their official ticketing partner, capitalising on its newly launched e-ticketing feature. With the introduction of the e-ticketing feature,…

Moomoo Launches New Earnings Feature, Opens Final Voting for Tutorial Video Challenge

Trading app furthers commitments to financial literacy and stock education with new features PALO ALTO, Calif., Sept. 2, 2022 — Moomoo, the next-generation…

EQT sets target fund size for EQT Infrastructure VI at EUR 20 billion

STOCKHOLM, Sept. 1, 2022 — EQT has today set the target size for the EQT Infrastructure VI fund at EUR 20 billion. The actual fund size is dependent on…

Biomedical industry bears fruit again in National Nanning Economic & Technological Development Area

NANNING, China, Aug. 31, 2022 — Recently, the lung CT image-aided diagnosis software developed by Guangxi Yizhun Intelligent Technology Co., Ltd. ("Yizhun") in National Nanning Economic & Technological Development Area ("Area")…

LightInTheBox to Report Second Quarter 2022 Financial Results on Tuesday, September 6, 2022

SHANGHAI, Aug. 30, 2022 — LightInTheBox Holding Co., Ltd. (NYSE: LITB) ("LightInTheBox" or the "Company"), a cross-border e-commerce company that delivers products directly to consumers around the world, today…

Waterdrop Releases User Family Insurance Report

BEIJING, Aug. 26, 2022 — Waterdrop Inc. ("Waterdrop", the "Company" or "we") (NYSE: WDH), a leading technology platform dedicated to insurance and healthcare service with a positive social impact, recently…

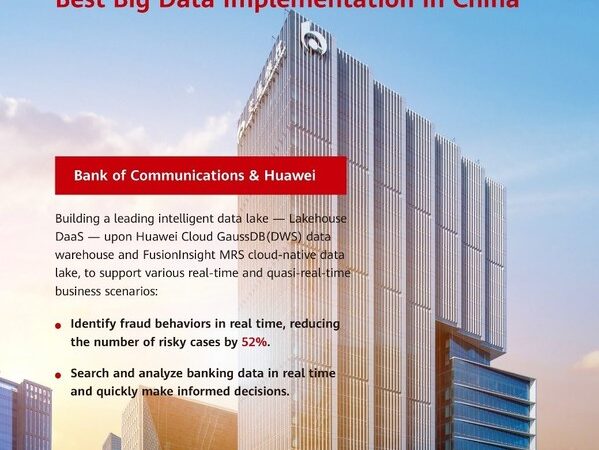

Equipped with Huawei’s Tech, Bank of Communications Wins The Asian Banker’s Award of Best Big Data Implementation in China

BEIJING, Aug. 26, 2022 — The Asian Banker, an authoritative global platform for insights about the finance industry, has unveiled the winner list for its 2022 Financial Technology Awards at…

Huawei and Bank of China Jointly Win The Asian Banker’s Award of Best Bank Infrastructure Technology Implementation in China

BEIJING, Aug. 26, 2022 — The "Finance China 2022" event organized by the prestigious international finance magazine The Asian Banker successfully commenced in Beijing on the 25th of August….

MultiBank Group announces Record-Breaking Financial Figures for 2021

With a Daily Turnover of over US$ 12.1 Billion and annual revenue of US$ 189 million DUBAI, UAE, Aug. 25, 2022 — MultiBank Group, the largest and most regulated…

Building a Magnetic Field Attracting Global Resources, Jing’an Leads the Race for Accelerated Open Economy

SHANGHAI, Aug. 24, 2022 — Recently, Jing’an District has initiated the "Aiding Foreign Investment, Forging Partnership" plan and signed cooperation contracts with Shanghai-based chambers of commerce from the US,…