SHANGHAI, Feb. 21, 2023 — On February 14, 2023, YouLianCloud announced to be the first batch of early experience officers of ERNIE Bot. Subsequently, YouLianCloud will fully experience ERNIE…

Tencent Music Entertainment Group to Report Fourth Quarter and Full Year 2022 Financial Results on March 21, 2023 Eastern Time

SHENZHEN, China, Feb. 20, 2023 — Tencent Music Entertainment Group ("TME", or the "Company") (NYSE: TME and HKEX: 1698), the leading online music and audio entertainment platform in China, today announced…

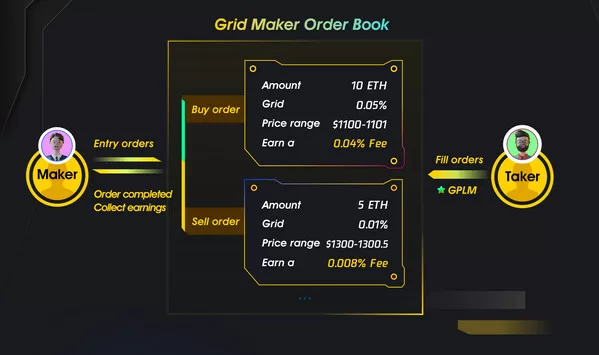

Gridex Protocol, the First Ever Fully On-Chain Order Book on Ethereum, Sponsors Europe’s Premier Blockchain Event

LONDON, Feb. 18, 2023 — Gridex Protocol, a cutting-edge trading protocol on Ethereum mainnet and layer 2s that features a fully on-chain order book, was a proud sponsor of the…

China Liberal Education Holdings Limited Receives Nasdaq Notification Regarding Minimum Bid Price Deficiency

BEIJING, Feb. 18, 2023 — China Liberal Education Holdings Limited (Nasdaq: CLEU) ("China Liberal," the "Company," or "we"), a China-based company that provides smart campus solutions and other educational services,…

International Share Trading Platform Moomoo Reveals Investors Were More Cautious in Approach to Investing in 2022

SYDNEY, Feb. 14, 2023 — A new product report by international share trading platform moomoo reveals its 10 most used features in…

Gridex Protocol: Integrating First Fully On-chain Order Book For a New Generation of DEX

LONDON, Feb. 10, 2023 — Gridex Protocol, a cutting-edge decentralized protocol built on the Ethereum mainnet, is pushing the boundaries of what is possible in the DeFi space. Its advanced…

Lichen China Limited Announces Closing of US$16 Million Initial Public Offering

JINJIANG, China, Feb. 9, 2023 — Lichen China Limited (the "Company" or "Lichen China"), a dedicated financial and taxation service provider in China, today announced the pricing of its…

Tencent Music Entertainment Group Introduces TME UNI Chart on Billboard to Promote Chinese Music in Global Markets

SHENZHEN, China, Feb. 8, 2023 — Tencent Music Entertainment Group ("TME," or the "Company") (NYSE: TME and HKEX: 1698), the leading online music and audio entertainment platform in China,…

Bramble Welcomes Jeff Immelt As Advisor

JACS Capital officially invests in future of Bramble ASHEVILLE, N.C., Feb. 7, 2023 — Bramble, the next-gen continuous improvement software company, is excited to announce Jeff Immelt has been…

Lichen China Limited Announces Pricing of US$16 Million Initial Public Offering

JINJIANG, China, Feb. 6, 2023 — Lichen China Limited (the "Company" or "Lichen China"), a dedicated financial and taxation service provider in China, today announced the pricing of its…