HANGZHOU, China, May 29, 2023 — BEST Inc. (NYSE: BEST) ("BEST" or the "Company"), a leading integrated smart supply chain solutions and…

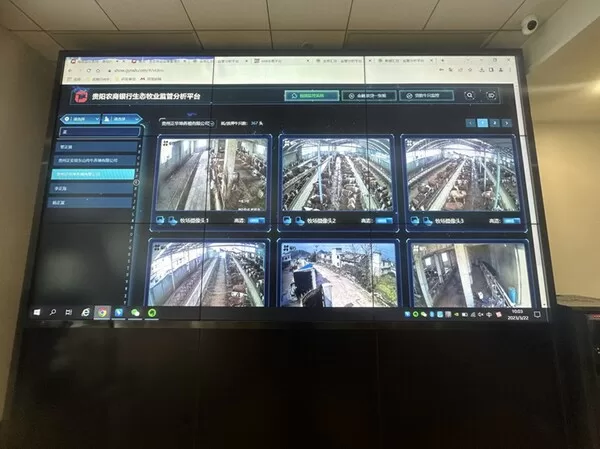

Guizhou writes a new chapter of rural revitalization with big data technology

GUIYANG, China, May 27, 2023 — A news report by Huanqiu.com: Guizhou is writing a new chapter of rural revitalization via the integration of big data and agriculture. Each…

CGTN: China-DRC ties enter comprehensive, deep-going growth with full vitality

BEIJING, May 27, 2023 — In 2015, China and the Democratic Republic of the Congo (DRC) established a strategic partnership of win-win cooperation, which provided a strategic direction for the…

Chinese city lures talent and firms with lavish perks

QUZHOU, China, May 26, 2023 — This is a report from China.org.cn Quzhou, a city in eastern China, is offering generous rewards to lure top enterprises and high-quality talent…

G-P Named Employer of Record Industry Leader in The IEC Group Global EOR Study 2023

G-P recognized for its innovative technology, exceptional customer experience and well-established expertise in the global research firm’s inaugural report REMOTE FIRST COMPANY,…

ATRenew Inc. Reports Unaudited First Quarter 2023 Financial Results

SHANGHAI, May 23, 2023 — ATRenew Inc. ("ATRenew" or the "Company") (NYSE: RERE), a leading technology-driven pre-owned consumer electronics transactions and services platform in China, today announced its unaudited financial…

AGM Group Receives Notification from Nasdaq Relating Delayed Filing of Form 20-F

BEIJING, May 20, 2023 — AGM Group Holdings Inc. ("AGM Group " or the "Company") (NASDAQ: AGMH), an integrated technology company focusing on providing fintech software services and producing…

Australia’s Most Influential CEO for 2023

MELBOURNE, Australia, May 19, 2023 — Sri Lankan born, Chamil Fernando, CEO of Alii, has been honoured with the prestigious Most Influential CEO 2023 – Australia award in the accounts…

Sercomm Philippines Holds Grand Opening of State-of-the-Art and Green Facility in Carmelray Industrial Park 1

Manufacturing center expansion aims to become regional hub to serve North America and Southeast Asia markets and create 5,000 job opportunities in the Philippines MANILA, Philippines, May 17, 2023…

OneConnect to Announce First Quarter 2023 Financial Results

SHENZHEN, China, May 15, 2023 — OneConnect Financial Technology Co., Ltd. (NYSE: OCFT and HKEX: 6638) ("OneConnect" or the "Company"), a leading technology-as-a-service provider for financial institutions in China, today…