BEIJING, June 30, 2023 — NaaS Technology Inc. (Nasdaq: NAAS) ("NaaS" or the "Company"), the first U.S. listed EV charging service company in China, today announced that it entered…

LightInTheBox Announces Share Repurchase Program

SINGAPORE, June 29, 2023 — LightInTheBox Holding Co., Ltd. (NYSE: LITB) ("LightInTheBox" or the "Company"), an apparel e-commerce retailer that ships products to consumers worldwide, today announced that its board…

ACAMS Launches Korea Chapter, Announces CAMS Korean Scholarship Winners

The new chapter for AFC professionals comes as part of ACAMS’ ongoing commitment to support the fight against illicit finance throughout Korea…

PalmPay celebrates 25 million user milestone in Nigeria, network of 800,000 mobile money agents and merchants

LAGOS, Nigeria, June 28, 2023 — PalmPay, a pioneering Africa-focused fintech platform, celebrates a significant landmark in its journey, marking 25 million users on its app and an extensive…

Artmarket.com: according to our long-term data, art made in 1964 has generated more auction turnover than art made in any other year of the 20th century

PARIS, June 27, 2023 — May’s auction results in New York showed that after all the records set by the Paul G….

Visa champions women’s success with new campaign for FIFA Women’s World Cup Australia & New Zealand 2023™

SINGAPORE, June 27, 2023 — To support women’s empowerment in the region, Visa is launching a "Behind Every Number, There’s A Story" campaign timed…

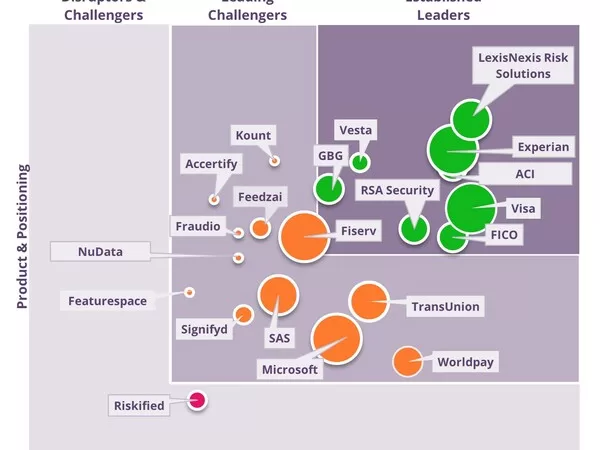

Juniper Research: Losses from Online Payment Fraud to Exceed $362 Billion Globally Over Next 5 Years, as eCommerce Growth in Emerging Markets Accelerates Fraud

HAMPSHIRE, England, June 26, 2023 — A new study from Juniper Research, the foremost experts in payment markets, forecasts that merchant losses from online payment fraud will exceed $362 billion…

CGTN: China pledges practical support for developing countries at global financing summit

BEIJING, June 25, 2023 — China would continue to take practical steps to support its fellow developing countries, Chinese Premier Li Qiang said on Friday at the closing ceremony of…

Baijiayun Announces Lock-Up Commitment by Certain Shareholders

BEIJING, June 22, 2023 — Baijiayun Group Ltd ("Baijiayun" or the "Company") (Nasdaq: RTC), a one-stop video-centric technology solution provider, today announced that Mr. Gangjiang Li, Chairman of the Board and…

TDK Ventures expands into Europe; will use new $150-million Fund EX1 to invest in clean-tech startups

TDK Ventures selected London for its first European office New $150-million (USD) multi limited-partner Fund EX1 (EX = energy transformation) will focus on both European and North American-based…