BEIJING, Sept. 9, 2020 — Chindata Group Holdings Limited ("Chindata Group"), a leading carrier-neutral hyperscale data center solution provider in Asia-Pacific emerging markets, today announced that it has publicly filed a registration statement on Form F-1 with the U.S. Securities and Exchange Commission relating to a proposed initial public offering…

China Online Education Group Announces Second Quarter 2020 Results

Second quarter net revenues increased by 40.0% year-over-yearSecond quarter GAAP/non-GAAP net margin were 6.6%/8.0% respectively BEIJING, Sept. 8, 2020 — China Online Education Group ("51Talk" or the "Company") (NYSE:COE), a leading online education platform in China, with core expertise in English education, announced its unaudited financial results for the…

OKEx Jumpstart to Support OKB Mining on Its Platform

VALLETTA, Malta, Sept. 8, 2020 — OKEx (www.okex.com), a world-leading cryptocurrency spot and derivatives exchange, has announced that its cryptocurrency project accelerator, OKEx Jumpstart, will now support mining on its platform. OKB holders can stake their OKB tokens 14 days before each new Jumpstart project is launched…

58.com Announces Shareholders’ Approval of Merger Agreement

BEIJING, Sept. 7, 2020 — 58.com Inc. (NYSE: WUBA) ("58.com" or the "Company"), China’s largest online market place for classifieds, today announced that at an extraordinary general meeting of shareholders held today, the Company’s shareholders voted in favor of, among other things, the proposal to authorize and approve the execution, delivery…

Daya Dimensi Global (DDG) officially rebrands to HR Path

JAKARTA, Indonesia, SINGAPORE and HO CHI MINH CITY, Vietnam, Sept. 7, 2020 — Daya Dimensi Global (DDG) is excited to officially announce their rebranding to HR Path, which will encompass the entire Asia Pacific region that includes HR Path offices in Indonesia,…

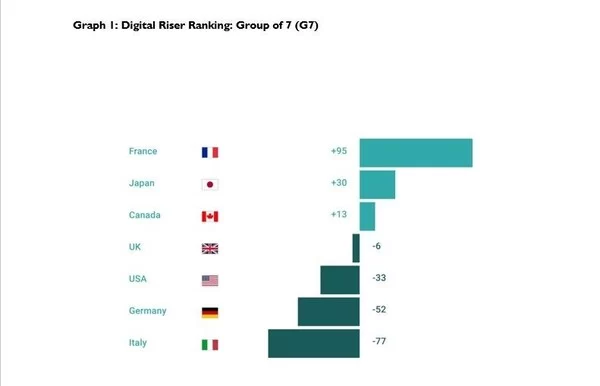

ESCP study reveals: New Digital Risers challenge incumbents

France top Digital Riser, China gains significantly, USA loses BERLIN, Sept. 7, 2020 — Digital incumbents increasingly face new and dynamic competitors from around the world. While countries such as USA, Sweden and Singapore are often perceived as digital champions, a new study indicates that they are not necessarily dynamic Digital…

Hexindai Regains Compliance with Nasdaq Minimum Bid Price Requirement

BEIJING, Sept. 5, 2020 — Hexindai Inc. (NASDAQ: HX) ("Hexindai" or the "Company"), a mobile e-commerce and consumer lending platform in China, today announced that it has received a notification letter from the Listing Qualifications Department of the Nasdaq Stock Market ("Nasdaq"), informing the Company that it has regained compliance with…

Hebron Announces Results of Annual General Meeting

SHANGHAI and WENZHOU, China, September 5, 2020 — Hebron Technology Co., Ltd. ("Hebron" or the "Company") (Nasdaq: HEBT), a provider of innovative comprehensive solutions through an integration of technology, industry, and finance, today announced the results of its 2020 Annual General Meeting of Shareholders ("AGM" or the "Meeting") held on…

Hebron Announces Appointment of Chief Executive Officer

SHANGHAI and WENZHOU, China, Sept. 4, 2020 — Hebron Technology Co., Ltd. ("Hebron" or the "Company") (Nasdaq: HEBT), a provider of innovative comprehensive solutions through an integration of technology, industry, and finance, today announced the appointment of Mr. Xiaoyun Huang as Chairman and Chief Executive Officer ("CEO"), effective immediately. Mr….

Coca-Cola Amatil Invests in Centrapay

Investment vehicle, Amatil X takes a stake in Centrapay. AUCKLAND, New Zealand, Sept. 3, 2020 — Coca-Cola Amatil’s corporate venturing platform, Amatil X, has completed a minority investment in Centrapay, as part of the payment platform’s seed funding round. Centrapay specialises in the adoption of digital assets and merchant…