WASHINGTON, Sept. 23, 2023 — Prepare to experience a laser engraving journey like never before as Monport Laser announces the expansion of its robust after-sales technical support services. With…

Tech innovator, Dalibor Ivkovic, announces new Salestrekker 2.0 as the mortgage industry’s first single lending, origination and CRM platform

SYDNEY, Sept. 22, 2023 — Salestrekker 2.0 has announced Australia’s first combined lending, origination and Customer Relationship Management (CRM) platform. The new features, flexibility, and functionality deliver unprecedented workflow and…

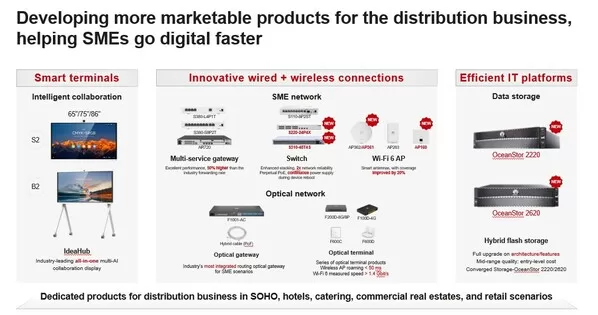

HUAWEI eKit Joins Hands with Distribution Partners to Explore Unlimited Opportunities in the SME Market

SHANGHAI, Sept. 21, 2023 — During HUAWEI CONNECT 2023, Huawei held a distribution business session titled "HUAWEI eKit, Digitalization for Success", outlined its approach to the distribution business: focus on…

ATRenew Joins the United Nations Global Compact

SHANGHAI, Sept. 20, 2023 — ATRenew Inc. ("ATRenew" or the "Company") (NYSE: RERE), a leading technology-driven pre-owned consumer electronics transactions and services platform in China, today announced that it…

NaaS Technology Inc. Joins NASDAQ Golden Dragon China Index

BEIJING, Sept. 18, 2023 — NaaS Technology Inc. (Nasdaq: NAAS) ("NaaS" or the "Company"), the first U.S. listed EV charging service company in China, today announced its inclusion in…

LightInTheBox Reports Second Quarter 2023 Financial Results

SINGAPORE, Sept. 15, 2023 — LightInTheBox Holding Co., Ltd. (NYSE: LITB) ("LightInTheBox" or the "Company"), an apparel e-commerce retailer that ships products to consumers worldwide, today announced its unaudited financial…

CGTN: Regional economic integration promotes China-ASEAN common prosperity

BEIJING, Sept. 8, 2023 — Themed "ASEAN Matters: Epicentrum of Growth," the 43rd Association of Southeast Asian Nations (ASEAN) Summit concluded on Friday in Jakarta, Indonesia, with a series…

Dow Jones and Cision Unveil Exclusive Global Content Partnership for the PR and Corporate Communications Market

New Agreement Empowers Reputation Management and Strategic Communication Agendas Worldwide CHICAGO and NEW YORK, Sept. 7, 2023 — Cision, the leading provider…

BRI’s Ultra-Micro Holding Continues Sustainable Financing for 36 Million Customers

JAKARTA, Indonesia, Sept. 7, 2023 — PT Bank Rakyat Indonesia (BRI) Persero Tbk. (IDX: BBRI), PT Pegadaian and PT Permodalan Nasional Madani (PNM) have been jointly advancing sustainable financing…

Trip.com Group Limited Reports Unaudited Second Quarter and First Half of 2023 Financial Results

SHANGHAI, Sept. 5, 2023 — Trip.com Group Limited (Nasdaq: TCOM; HKEX: 9961) ("Trip.com Group" or the "Company"), a leading one-stop travel service provider of accommodation reservation, transportation ticketing, packaged…