Boost Bank is teaming up with ZUS Coffee in an unusual team up to brew better savings for users and coffee drinkers.

Touch ‘n Go eWallet Unveils First-in-Malaysia In-App Visa Exchange Rate Calculator for Savvy Travelers

Touch N’ Go eWallet is bringing more features to make it a compelling travel companion including a brand new conversion tool that works with its VISA card.

Touch ‘n Go eWallet to Charge 1% Fee on International QR Transactions

Touch ‘n Go eWallet is one of Malaysia’s largest eWallets. Just recently, TNG Digital (TNGD), the company operating the eWallet, unveiled plans to become an integrated fintech company – one of the first in Malaysia. TNGD is well on the…

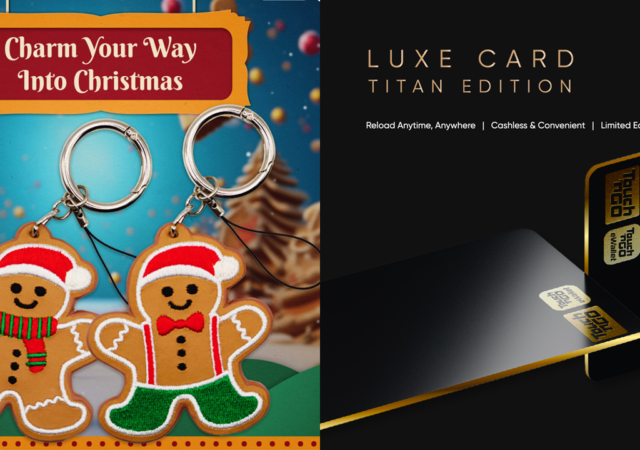

Touch ‘n Go Introduces a Charm for Christmas and a LUXE Card

Still on the hunt for that perfect festive gift? Look no further! Touch ‘n Go has just dropped two new items for your year-end holiday gifting: the Christmas Edition Charm and Touch ‘n Go LUXE Card – Titan Edition. Adding…

Touch ‘n Go eWallet Rewards Users with GOrewards

Touch ‘n Go eWallet unveils a new way for users to earn more with every ringgit spent with GOrewards.

Your Commute Can’t Get Any Cuter Than with Touch ‘n Go’s The Furry Series: Rabbit Charm

Introducing Touch ‘n Go’s Furry Series: Rabbit Charm, the accessory that seamlessly combines convenience, style, and a tribute to the cherished bond between humans and their pets.

Touch n’ Go Group Introduces ParkInsure

Touch n’ Go Group introduces ParkInsure – a simple insurance plan for users to park with peace of mind.

PayPal Cards Now Compatible with Apple Pay

PayPal Credit and Debit cards are now compatible with Apple Pay. You’ll be able to link your paypal cards and seamlessly pay for anything.

It’s Now Easier to Invest in ASNB with GOinvest on Touch ‘n Go E-wallet

Investing in ASNB unit trusts get even more accessible with Touch n’ Go eWallet with GOinvest.

Rev Up Your Drive with Touch ‘n Go’s DUKE of the Road Campaign

If you’re tired of fumbling with your Touch ‘n Go card at the toll or waiting in long queues, Touch ‘n Go is revving things up with their DUKE of the Road Campaign roadshow. This is an opportunity you won’t…