GUELPH, ON, May 18, 2023 — Canadian Solar Inc. ("Canadian Solar" or the "Company") (NASDAQ: CSIQ) today announced financial results for the first quarter ended March 31, 2023. Highlights 66%…

Celebrate Easter with BLUETTI Hidden Eggs

LAS VEGAS, April 7, 2023 — Easter 2023 is just a few weeks away, BLUETTI Easter campaign will be in full swing…

Emeren Issues Statement Regarding Silicon Valley Bank

STAMFORD, Conn., March 12, 2023 — Emeren Group Ltd ("Emeren" or the "Company") (www.emeren.com) (NYSE: SOL), a leading global solar project developer,…

BLUETTI’s Autumn Sale Adds More Fun to Autumn Outdoor Activities

SYDNEY, March 7, 2023 — Starting March 7, BLUETTI, the leading brand in clean energy storage industry, is offering a bundle of savings…

CNEY Entered the Drinkable Water Market with a Large Order

LISHUI, China, Jan. 27, 2023 — CN Energy Group. Inc. (NASDAQ: CNEY) today announced that its wholly owned subsidiary, Zhejiang CN Energy New Materials Co., Ltd., had recently obtained…

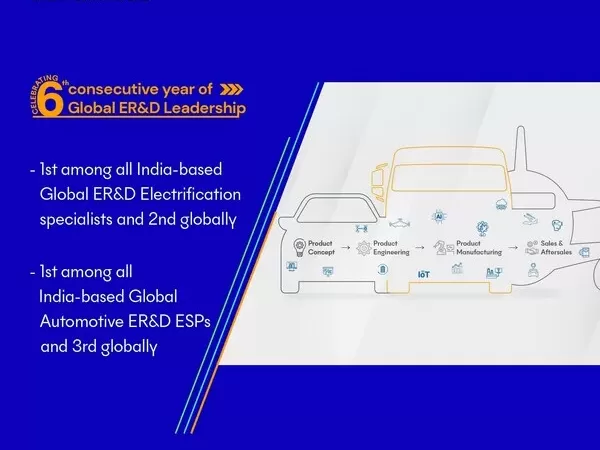

Tata Technologies celebrates 6th consecutive year of Global ER&D Leadership in Zinnov Zones 2022

Tata Technologies has been positioned 1st among all India-based Global ER&D Electrification specialists and 2nd globally as the ESP of choice for OEMs embarking on their electrification journey. PUNE, India…

Chinese Auto Parts Supplier Baolong Automotive Rolls Out New Lineup of Automotive Sensors for EVs

SHANGHAI, Dec. 31, 2022 — On December 30, 2022, Chinese auto parts manufacturer Shanghai Baolong Automotive Corporation hosted the "Super Sensing, Intelligent Core" product launch event at China’s largest automotive…

JinkoSolar Announces Results of 2022 Annual General Meeting

SHANGRAO, China, Dec. 27, 2022 — JinkoSolar Holding Co., Ltd. ("JinkoSolar" or the "Company") (NYSE: JKS), one of the largest and most innovative solar module manufacturers in the world,…

Daelim Successfully Obtained The Transformer UL/cUL Certification

BEIJING, Dec. 20, 2022 — Jiangsu Daelim Electric Co. LTD(here inafter Daelim) successfully obtained the transformer UL/cUL certification in this year. The UL/cUL certification is a mandatory requirement in…

70mai Launches the 2-Hour Full Recharged Power Station

Tera 1000, brings users with the endless power on the move SHANGHAI, Dec. 2, 2022 — 70mai, an industry leading consumer electronics brand, announced today its official launch of…