– U.S. growth accelerates as BetMGM plans to double its footprint in three months – Entain to seek licence in Canada and becomes the first global sports betting and gaming operator to gain a licence in Latin America LONDON, Dec. 10, 2020 — The global sports betting and gaming…

Indosat Ooredoo partners with Comviva, the leader in mobility solutions to accelerate growth

Comviva to deliver its next-gen real-time analytics platform JAKARTA, Indonesia, Dec. 7, 2020 — Comviva, the global leader in mobility solutions and Indosat Ooredoo, Indonesia’s leading mobile operator announced a strategic partnership today. The partnership will help rapidly enhance Indosat’s customer first…

OtterBox Hong Kong acquires Roxfit, with aim to reach new audiences

HONG KONG, Dec. 7, 2020 — OtterBox Hong Kong, a subsidiary of Otter Products LLC, the No. 1 most-trusted case in smartphone protection*, has acquired Roxfit, a UK based mobile accessories brand primarily tailored for Sony’s smartphone devices founded in 2010 by Mr. Malcolm Stapleton, a veteran in designing and manufacturing…

CooTek to Announce Third Quarter 2020 Unaudited Financial Results on December 15, 2020

SHANGHAI, Dec. 5, 2020 — CooTek (Cayman) Inc. (NYSE: CTK) ("CooTek" or the "Company"), a fast-growing global mobile internet company, today announced that it will report its unaudited financial results for the third quarter 2020 ended September 30, 2020, before the open of U.S. markets on December 15, 2020. CooTek’s…

Website Builds Calculator Showing How Long It Will Take You to Afford Mahomes’ KC Mansion – My Home vs Mahomes

ISELIN, N.J., Dec. 4, 2020 — Mahomes’ recent signing with adidas to create a personalized shoe in honor of his old high school got us thinking about the young athlete’s meteoric rise. Although it is not one hundred percent known what the twenty-five year old athlete’s net worth is, it is known…

How New Technology Can Help Businesses Adapt to Changing Trends to Bring Convenience to Modern Consumers

SHENZHEN, China, Dec. 4, 2020 — In 2020, consumer habits have changed dramatically; reflected by the adaptation seen throughout businesses and organisations across the globe. With more and more people turning to online services, the reliance on mobile internet has accelerated. This is evident with the growth of online…

CooTek to Participate in December and January Investor Conferences

SHANGHAI, Dec. 4, 2020 — CooTek (Cayman) Inc. (NYSE: CTK) ("CooTek" or the "Company"), a fast-growing global mobile internet company, today announced that the Company will present and meet with institutional investors at the following virtual investor conferences. For more information on CooTek presentations, please visit investor relations website https://ir.cootek.com,…

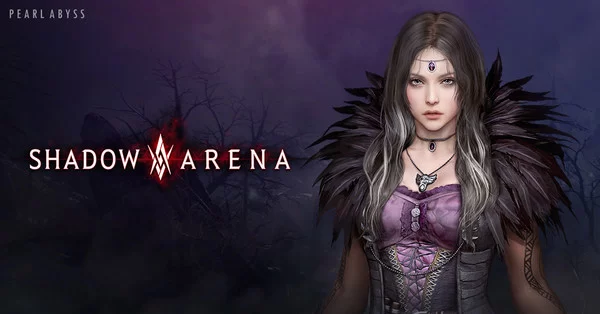

Immortal Witch “Hexe Marie” Arrives in Shadow Arena

SEOUL, South Korea, Dec. 4, 2020 — Pearl Abyss announced today that a new Hero "Hexe Marie" is now available in Shadow Arena. Immortal Witch “Hexe Marie” Arrives in Shadow Arena Shadow Arena’s 19th Hero, Hexe Marie is known as an immortal witch named…

Norwegian Cruise Line Reunites Award-Winning Broadway Stars for “EMBARK NCL Spotlight” Episode, “Live From Broadway”

– Performances by Renowned Musical Theatre Veterans Brenda Braxton, Stephanie Pope, Alan Mingo and More Stream Live 18th December 2020 at www.ncl.com/embark – LONDON, Dec. 4, 2020 — Norwegian Cruise Line, the innovator in global cruise travel with a 53-year history of breaking boundaries, showcases its continued commitment to the performing…

TIDAL Releases ‘My 2020 Rewind’ for Members to Look Back at their Year in Music

NEW YORK, Dec. 2, 2020 — As the year comes to end, global music and entertainment streaming platform, TIDAL, is giving members a recap of their most streamed music in 2020. Beginning today (December 1), TIDAL members can review ‘My 2020 Rewind,’ a personalized year end wrap up highlighting their…