University of Western Australia deploys the process mapping capabilities of the Nintex Process Platform to accelerate process improvement and underpin business continuity AUCKLAND, New Zealand, Sept. 14, 2020 — Nintex, the global standard for process management and automation, today announced that The University…

China’s Largest K12 Online Education Platform Zuoyebang Showcased Its AI-Powered Education Solutions at 2020 CIFTIS

BEIJING, Sept. 12, 2020 — On September 4, Zuoyebang, China’s largest online education startup providing K12 tutoring, attended the 2020 China International Fair for Trade in Services (CIFTIS) in Beijing. During CIFITS, Zuoyebang presented its cutting-edge suite of online education solutions including livestreaming courses, the latest Cocos-courseware for primary education, and Paperang P3 series miniature…

MoneyBrain, launched AI Tutor Service “SpeakNow” in China

SEOUL, South Korea, Sept. 11, 2020 — The world’s first artificial intelligence English conversation learning service, "SpeakNow," officially launched in China on September 1.   SpeakNow provides customized learning content to talk about simulations made up of real situations through 1:1 speaking with AI tutors. After the previous…

World’s first graduate-level AI university set to welcome global cohort of students from more than 30 countries

ABU DHABI, UAE, Sept. 10, 2020 — Launched as an open invitation from Abu Dhabi to the world to unleash AI’s full potential, the Mohamed bin Zayed University of Artificial Intelligence (MBZUAI), the world’s first graduate-level, research-based artificial intelligence (AI) university, will welcome an international inaugural cohort of…

China Online Education Group Announces Second Quarter 2020 Results

Second quarter net revenues increased by 40.0% year-over-yearSecond quarter GAAP/non-GAAP net margin were 6.6%/8.0% respectively BEIJING, Sept. 8, 2020 — China Online Education Group ("51Talk" or the "Company") (NYSE:COE), a leading online education platform in China, with core expertise in English education, announced its unaudited financial results for the…

China’s Largest K12 Online Education Platform Zuoyebang Sees 390% Surge in Paid Users This Summer

BEIJING, Sept. 7, 2020 — On August 31, Zuoyebang, China’s largest online education startup providing tutoring to primary and secondary students, released its performance for summer 2020 season. Zuoyebang continues to lead China in paying course students, growth rate and scale of users, while its student acquisition costs are the lowest…

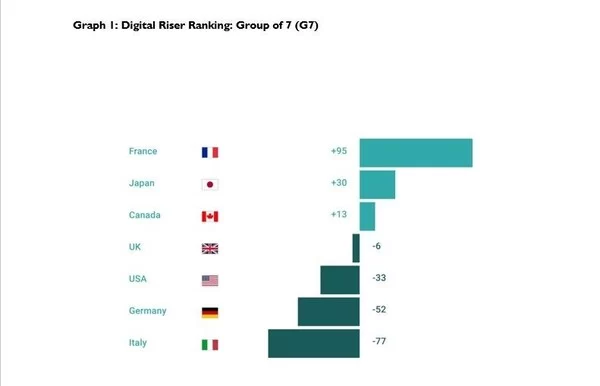

ESCP study reveals: New Digital Risers challenge incumbents

France top Digital Riser, China gains significantly, USA loses BERLIN, Sept. 7, 2020 — Digital incumbents increasingly face new and dynamic competitors from around the world. While countries such as USA, Sweden and Singapore are often perceived as digital champions, a new study indicates that they are not necessarily dynamic Digital…

Adecco Group Announces Jordan Topoleski, 20, from the United States as 2020 “CEO for One Month”

Preparing the Next Generation to Lead in Uncertain Times Program Builds Next Gen Leaders with Focus on a "New Leadership Profile" ZURICH, Sept. 4, 2020 — Jordan Topoleski, 20, from the United States has been named as the Global CEO for…

ASTRI welcomes Graduate Programme 2020 participants, giving talented students a unique opportunity to launch career in an R&D environment

HONG KONG, Sept. 1, 2020 — The Hong Kong Applied Science and Technology Research Institute (ASTRI) welcomes our new recruits for the Graduate Programme 2020, a unique opportunity for university graduates to launch their careers in a research and development environment, in particular one with a mission to deliver impactful solution…

China Distance Education Holdings Limited Announces Results of Annual General Meeting of Shareholders

BEIJING, Aug. 28, 2020 — China Distance Education Holdings Limited (NYSE: DL) ("CDEL", or the "Company"), a leading provider of online education and value-added services for professionals and corporate clients in China, today announced that it held its 2020 Annual General Meeting of Shareholders ("2020 AGM") on August 28, 2020….