WARSAW, Poland, Oct. 17, 2020 — Infrastructure investment is a key priority for Countries in Central, Eastern, and Southern Europe (CESEE) to accelerate the convergence of the living standards toward the level of the more advance European countries, the EU15 – says the IMF report published on 28th Sep 2020. IMF…

Second Citizenship from St Kitts and Nevis Opens Doors to British Education in Times of Crisis

LONDON, Oct. 9, 2020 — Despite predictions that the pandemic would cause a decline in international students, the United Kingdom is set for a record increase. Interestingly, enrolments from non-EU international students went up 9 per cent this academic year. According to Jimmy Beale, the founder of The English Education, a…

244% Percent Return on Investment for Peakon Customers, Total Economic Impact Study Reveals

Study conducted by independent consulting firm reveals how Peakon enables organizations to generate strong return on investment (ROI) through improved productivity, reduced staff turnover, and less absenteeism COPENHAGEN, Denmark, LONDON, AUCKLAND, New Zealand, BERLIN and NEW YORK, Oct. 2, 2020 — Peakon – an employee success platform – today released a commissioned Total Economic…

Report: U.S. Imports Trending Down 5% but China Recovers and Vietnam Climbs

Jungle Scout’s Global Imports Report reveals international trade stats from 2015-2020, explores potential impact from COVID-19 AUSTIN, Texas, Sept. 14, 2020 — Today, Jungle Scout, the leading all-in-one platform for selling on Amazon, released a new report exploring the fast-changing landscape of global trade to the United States, and revealing the…

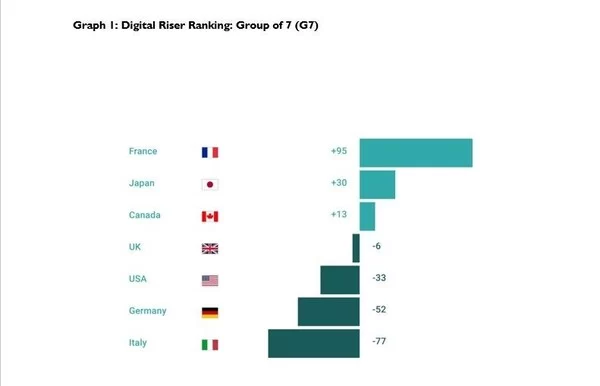

ESCP study reveals: New Digital Risers challenge incumbents

France top Digital Riser, China gains significantly, USA loses BERLIN, Sept. 7, 2020 — Digital incumbents increasingly face new and dynamic competitors from around the world. While countries such as USA, Sweden and Singapore are often perceived as digital champions, a new study indicates that they are not necessarily dynamic Digital…

Xinhua Silk Road: China’s Quanzhou rolls out multiple measures to optimize business environment

BEIJING, Aug. 28, 2020 — Quanzhou City, located in southeast China’s Fujian Province, has rolled out a series of measures to optimize business environment. Self-service machines at the administration service center in Quangang District of Quanzhou City to provide 24-hour government services for the public …

Blis keeps finger on the pulse of consumer behaviour with global sentiment tracker

1 in 3 Singaporeans would save additional funds as sentiment starts to slowly decline SINGAPORE, Aug. 19, 2020 — Blis, a trusted leader in location-powered advertising and analytics has today released the Blis consumer confidence pulse, an interactive tracker that captures a quick snapshot…

Frost & Sullivan: Proliferation of Edge Computing and Testing M2M Solutions to Drive IoT Test and Measurement Market by 2025

Understanding the performance of proprietary applications on connected devices outside the enterprise secure network infrastructure will be a key challenge SANTA CLARA, California, July 30, 2020 — Frost & Sullivan’s recent analysis, Growth Opportunities in Test and Measurement in the IoT Market, Forecast to 2025, finds that because of COVID-19…

Chip Manufacturing Equipment Spending to Hit Record High $70 Billion in 2021 After Strong 2020, SEMI Reports

MILPITAS, California, July 22, 2020 — Global sales of semiconductor manufacturing equipment by original equipment manufacturers are projected to increase six percent to $63.2 billion in 2020 compared to $59.6 billion in 2019 before logging record high revenue of $70 billion in 2021…

Sweeping Workplace Changes Expected in a Post-pandemic World, Says Research From The Adecco Group

Businesses and workers call for greater flexibility, questions raised over the hours-based contract, and a new empathetic leadership profile emerges ZURICH, June 30, 2020 — Workers demand greater flexibility after coronavirus, with a 50/50 split of remote and office time confirmed as…