BEIJING, March 18, 2023 — Pintec Technology Holdings Limited (Nasdaq: PT) ("PINTEC" or the "Company"), a leading independent technology platform enabling financial services in China, today announced that it…

ICZOOM Group Inc. Announces Closing of US$6 Million Initial Public Offering

SHENZHEN, China, March 18, 2023 — ICZOOM Group Inc. (Nasdaq: IZM) (the "Company" or "ICZOOM"), a B2B e-commerce trading platform primarily engaged in sales of electronic component products in Hong…

Secoo Group: Officially Accesses OpenAI and ERNIE Bot, Luxury Goods Intelligent Marketing Scene Will Be More Accurate

BEIJING, March 17, 2023 — Recently, Secoo Group (NASDAQ: SECO), a leading online and offline boutique lifestyle platform in Asia, announced that it has officially accessed the AIGC and…

Modular Furniture Design Company Mojuraa Cuts Costs by Shipping Directly From the Manufacturer

Mojuraa, a direct-from-manufacturer furniture company, offers a wide range of customizable packages made with premium materials. Customers can cut out the middleman and save money because Mojuraa makes the…

Alibaba Reaffirms Commitment to Driving Digital Economy Education Worldwide at Global Partner Conference

Building on its success since its inception in 2017, Alibaba’s GDT program renewed collaborations with educational institutions in Malaysia and Singapore HANGZHOU,…

Vipshop Reports Unaudited Fourth Quarter and Full Year 2022 Financial Results

Conference Call to Be Held at 7:30 A.M. U.S. Eastern Time on February 23, 2023 GUANGZHOU, China, Feb. 23, 2023 — Vipshop Holdings Limited (NYSE: VIPS), a leading online discount…

Which category takes best performance on TikTok? Key Findings From Shoplus 2022 TikTok Trends Report

HONG KONG, Feb. 21, 2023 — Report: "Her Economy" is on the rise, Beauty and Personal Care, Womenswear and Lingerie accounted for 44% in TikTok e-commerce As the most…

Qiming Venture Partners’ portfolio company LanzaTech Lists on Nasdaq

SHANGHAI, Feb. 11, 2023 — LanzaTech NZ, Inc. ("LanzaTech"), an innovative leader in carbon capture and transformation and a Qiming Venture Partners portfolio company, listed on Nasdaq on Feb…

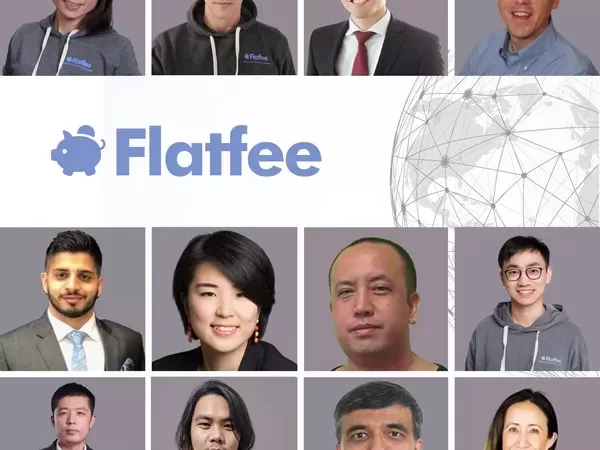

Flatfee Raises $900K

PALO ALTO, Calif., Feb. 4, 2023 — Flatfee (Flateecorp.com), a managed marketplace connecting global small to mid-sized global sellers with legal and…

111SKIN AND USHOPAL SIGN EXCLUSIVE OMNI-CHANNEL PARTNERSHIP IN CHINA

SHANGHAI, Jan. 30, 2023 — USHOPAL ("USHOPAL"), a Shanghai-based market leading luxury beauty group focused on unlocking value for global luxury beauty brands, today announced that it has entered…