CITY OF INDUSTRY, Calif., July 7, 2023 — The annual Prime Day is just around the corner. As a company that manufactures and provides high quality portable fridge freezers…

LightInTheBox Announces Share Repurchase Program

SINGAPORE, June 29, 2023 — LightInTheBox Holding Co., Ltd. (NYSE: LITB) ("LightInTheBox" or the "Company"), an apparel e-commerce retailer that ships products to consumers worldwide, today announced that its board…

Visa champions women’s success with new campaign for FIFA Women’s World Cup Australia & New Zealand 2023™

SINGAPORE, June 27, 2023 — To support women’s empowerment in the region, Visa is launching a "Behind Every Number, There’s A Story" campaign timed…

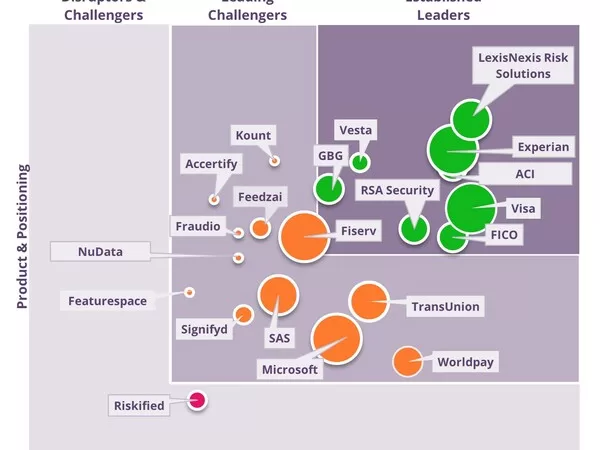

Juniper Research: Losses from Online Payment Fraud to Exceed $362 Billion Globally Over Next 5 Years, as eCommerce Growth in Emerging Markets Accelerates Fraud

HAMPSHIRE, England, June 26, 2023 — A new study from Juniper Research, the foremost experts in payment markets, forecasts that merchant losses from online payment fraud will exceed $362 billion…

Geekbuying – A Recognized and Trusted Global Online Shop

LOS ANGELES, June 8, 2023 — Geekbuying, founded in 2012, is an online retailer selling a vast assortment of products. It is dedicated…

Diane Wang Emphasizes the Significance of Digital Tools in Boosting Women Entrepreneurship at the 2023 BRICS Women’s Leadership Forum

BEIJING, June 7, 2023 — To deepen business cooperation and promote women entrepreneurship among BRICS countries, the China Council for the Promotion of International Trade (CCPIT) and the China Chamber…

Yunji Announces First Quarter 2023 Unaudited Financial Results

HANGZHOU, China, June 2, 2023 — Yunji Inc. ("Yunji" or the "Company") (NASDAQ: YJ), a leading membership-based social e-commerce platform, today announced its unaudited financial results for the first…

Trip.com Group to Hold Annual General Meeting on June 30, 2023

SHANGHAI, May 30, 2023 — Trip.com Group Limited (Nasdaq: TCOM; HKEX: 9961) ("Trip.com Group" or the "Company"), a leading one-stop travel service provider of accommodation reservation, transportation ticketing, packaged tours…

Tuniu to Report First Quarter 2023 Financial Results on June 9, 2023

NANJING, China, May 25, 2023 — Tuniu Corporation (NASDAQ:TOUR) ("Tuniu" or the "Company"), a leading online leisure travel company in China, today announced that it plans to release its…

Meituan Launches Food Delivery Brand KeeTa Amid Hong Kong Debut

KeeTa starts operation in Mong Kok and Tai Kok Tsui areas HONG KONG, May 21, 2023 — Meituan (HKG: 3690) (the "Company"), a leading technology-driven retail company in China, today…