Major payment delays and high costs of cross-border transactions were listed as the main drivers for local companies to seek improved fintech solutions Among those surveyed, 38% have listed…

Personal connections on social media drive more consumer purchases than influencers, Mintel research reveals

MUMBAI, India, Oct. 5, 2023 — Indian consumers are more inclined to be influenced by people they know personally on social media when making purchasing decisions, according to the…

KREAM Announces Business Integration with SODA… To Leap as Asia’s Largest C2C and Fashion E-commerce Platform

SODA, Operator of Japan’s Largest Limited-Edition Goods Trading Platform SNKRDUNK, is Leading the Country’s Consumer Trend and Culture Integration of the two companies is expected…

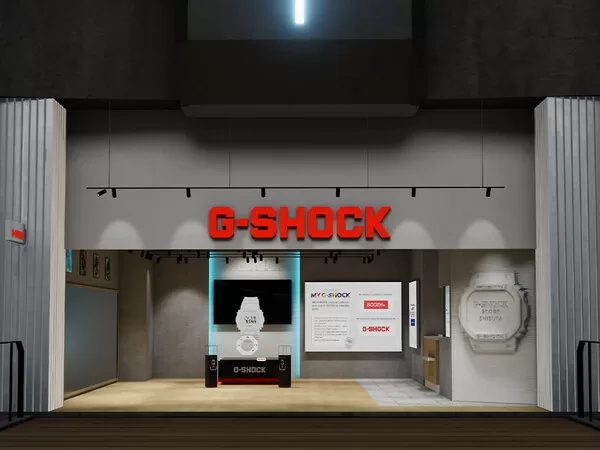

Casio to Open Virtual G-SHOCK STORE in the Metaverse

First to Offer Watch Customization Experiences in VRChat TOKYO, Oct. 3, 2023 — Casio Computer Co., Ltd. announced today the launch of a metaverse-based virtual store for the G-SHOCK…

City Beach Partners with NewStore to Launch Mobile Consumer App

Australia’s leading lifestyle and youth fashion brand will leverage the NewStore Consumer App to extend its digital footprint and enhance customer loyalty…

LightInTheBox Reports Second Quarter 2023 Financial Results

SINGAPORE, Sept. 15, 2023 — LightInTheBox Holding Co., Ltd. (NYSE: LITB) ("LightInTheBox" or the "Company"), an apparel e-commerce retailer that ships products to consumers worldwide, today announced its unaudited financial…

Cross-border eCommerce Enabler Buyandship Secures Initial US$10M in Series B Funding with Strategic Investment from Cool Japan Fund

HONG KONG, Sept. 12, 2023 — Buyandship, a leading global cross-border eCommerce platform headquartered in Hong Kong, announced today first closing of its Series B raise with a US$10…

Trip.com Group Limited Reports Unaudited Second Quarter and First Half of 2023 Financial Results

SHANGHAI, Sept. 5, 2023 — Trip.com Group Limited (Nasdaq: TCOM; HKEX: 9961) ("Trip.com Group" or the "Company"), a leading one-stop travel service provider of accommodation reservation, transportation ticketing, packaged…

Gaabor Launches Spectacular 9.9 Promotion This September in the Philippines

MANILA, Philippines, Sept. 4, 2023 — Leading household appliance brand Gaabor is bringing great deals to shoppers as the year-end shopping season…

Gaabor Launches 9.9 Super Sales on TikTok

JAKARTA, Indonesia, Sept. 3, 2023 — Leading household appliance brand Gaabor is bringing great deals to shoppers as the second half-year shopping…