SHANGHAI, Sept. 29, 2020 — The 128th Canton Fair will be held online (https://www.cantonfair.org.cn/) from Oct. 15 to 24, 2020. The promotion of the 128th session of Canton Fair is underway. In organizing exhibitions, this Canton Fair still features 50 sections under 16 categories, and all content will go online at…

Hexindai Launches Elite Influencers Program on Xiaobai Maimai

BEIJING, Sept. 25, 2020 — Hexindai Inc. (NASDAQ: HX) ("Hexindai" or the "Company"), a mobile e-commerce and consumer lending platform in China, today announced that the newly launched Elite Influencers Program on Xiaobai Maimai, a new-form of social e-commerce platform released in May 2020, has made good progress and delivered impressive…

Trip.com Group Reports Unaudited Second Quarter of 2020 Financial Results

Shanghai, Sept. 25, 2020 — Trip.com Group Limited (Nasdaq: TCOM) ("Trip.com Group" or the "Company"), a leading provider of online travel and related services, including accommodation reservation, transportation ticketing, packaged-tour and in-destination services, corporate travel management, and other travel-related services, today announced its unaudited financial results for the second quarter…

Informa Markets in Japan Proves Exhibitions are Returning and Relevant

TOKYO, Sept. 18, 2020 — This week Informa Markets successfully held four exhibitions in Japan, including Call Center/CRM Demo & Conference Osaka, eCommerce Fair Osaka, Diet & Beauty Fair (Tokyo) and PROJECT Tokyo. These events altogether hosted over 500 exhibiting companies and over 20,000 attendees. Eager…

58.com Announces Completion of Merger

BEIJING, Sept. 18, 2020 — 58.com Inc. (NYSE: WUBA) ("58.com" or the "Company"), China’s largest online market place for classifieds, today announced the completion of the merger (the "Merger") with Quantum Bloom Company Ltd ("Merger Sub"), a wholly-owned subsidiary of Quantum Bloom Group Ltd ("Parent"), pursuant to the previously announced agreement…

Report: U.S. Imports Trending Down 5% but China Recovers and Vietnam Climbs

Jungle Scout’s Global Imports Report reveals international trade stats from 2015-2020, explores potential impact from COVID-19 AUSTIN, Texas, Sept. 14, 2020 — Today, Jungle Scout, the leading all-in-one platform for selling on Amazon, released a new report exploring the fast-changing landscape of global trade to the United States, and revealing the…

Manny Pacquiao set to Launch PacPay to Connect Global Influencers, Brands and Fans

SINAGPORE, Sept. 11, 2020 — Technology startup Pac Technologies Pte Ltd and Remsea Pte Ltd, a fintech remittance firm licensed by the Monetary Authority of Singapore, have forged a strategic partnership to further both companies’ initiatives in the fintech space in Asia and beyond. Pac Technologies, co-founded by boxing…

Yiwugo CEO Wang Jianjun Invited to Share Experience at CIFTIS

YIWU, China, Sept. 10, 2020 — On the afternoon of September 7, 2020, Wang Jianjun, CEO of Yiwugo, was invited to deliver a speech entitled "Promoting the Development of New E-Commerce Business Modes for Specialized Small Commodity Market with the Engine of Innovation"…

2020 99 Giving Day Breaks Record for China Internet Charity Platform by Tencent

BEIJING, Sept. 10, 2020 — Tencent today announced the conclusion of 99 Giving Day, the most popular annual charity festival in China jointly initiated by Tencent Charity Foundation and thousands of other charity organizations, enterprises, celebrities and media from Sep. 7 to Sep. 9 (Beijing time). With the theme of…

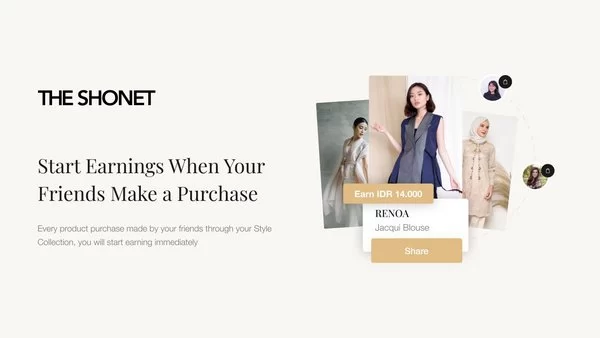

Indonesian Start Up the Shonet, Launches Social Commerce Providing New Stimulus for Fashion and Beauty Players to Survive the Pandemic Period

JAKARTA, Indonesia, Sept. 9, 2020 — The COVID-19 pandemic has an impact on the continuity of the entire industry, including in the realm of fashion and beauty. In the midst of a challenging situation for industry players, the Shonet as a digital company based for social commerce focuses on supporting the…