Recording & analytics for the public and financial sector in Australia and New Zealand HÖSBACH, Germany, March 29, 2022 — ASC Technologies…

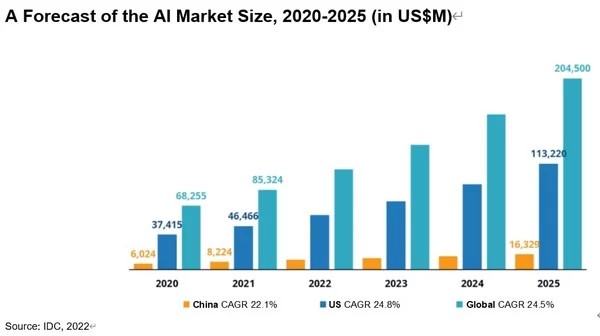

Appen provides data solutions featuring unique advantages for the entire AI lifecycle in the Chinese market

SHANGHAI, March 18, 2022 — IDC recently analyzed the status quo of enterprises in the development and construction of AI applications, and summarized the characteristics of data services required for…

VIVOTEK Unveils Its New VSaaS, VORTEX, at ISC WEST

TAIPEI, March 15, 2022 — VIVOTEK (TWSE: 3454), the leading global IP surveillance provider, is pleased to announce the solution preview of VORTEX, VIVOTEK’s new cloud-based video surveillance as a…

Lacework Ranked #6 on Forbes America’s Best Startup Employers List

Forbes recognizes Lacework for accelerated growth and strong employee engagement as cloud security sector booms SAN JOSE, Calif., March 12, 2022 — Lacework, the data-driven security company for the cloud, today…

Nintex Appoints Ricoh New Zealand as a Reseller Partner to Support Increasing Customer Demand for Intelligent Digital Business Solutions

MELBOURNE, Australia, Feb. 21, 2022 — Nintex, the global standard for process intelligence and automation, today announced Ricoh New Zealand as its newest reseller partner…

Xiaomi Strengthens Data Protection with Independent Audit of Compliance

BEIJING, Feb. 3, 2022 — Xiaomi, a consumer electronics and smart manufacturing company with smartphones and smart hardware connected by an IoT platform at its core, has today announced the…

Retailo Raises $36M million in Landmark Series A Round For Empowering Community Commerce in MENA Region

MENA’s fastest growing B2B start-up focusing on regional expansion and many new initiatives to carry momentum forward RIYADH, Saudi Arabia, Feb. 2, 2022 — Retailo, the fastest growing startup in…

Too early to bottom-fish in China’s property bonds, Greifenberg Digital says

NEW YORK, Jan. 20, 2022 — Greifenberg Digital, a member of the IMTE Group, commented today on the risks to Chinese property bonds…

Luokung Announces Receipt of Nasdaq Notification Regarding Minimum Bid Price Deficiency

BEIJING, Jan. 7, 2022 /PRNewswire/ — Luokung Technology Corp. (NASDAQ: LKCO) ("Luokung" or the "Company"), a leading spatial-temporal intelligent big data services company and provider of interactive location-based services ("LBS") and…

The first 6G AI Competition has been launched by OPPO

BEIJING, Jan. 8, 2022 — OPPO, the world’s leading smart device manufacturers and innovators, officially launched the first 6G AI Competition on December 24, 2021 (Beijing time) on DataFountain (a leading Big Data &…