BEIJING, Aug. 20, 2021 — There probably isn’t a faster and simpler way to add a high-quality vocal track to videos: Just clip on Sennheiser’s new XS Lav mic, connect it to the mobile device or computer and start rolling. Whether users are podcasting, recording a voice-over, interviewing or vlogging – this omni-directional…

Ninja Survey Finds Gen Z and Millennial Parents Are Bored with Their Recipe Rotation and Looking to Spice Things Up

Ninja launches Ninja® Foodi® XL Pressure Cooker Steam Fryer with SmartLid™ to make cooking easier, faster, juicier and crispier results in one Multicooker+ NEEDHAM, Mass., Aug. 18, 2021 — Ninja (HKEX: 1691.HK), the #1 brand in small kitchen appliances*, announced findings from its recent survey…

AiHuiShou International Co. Ltd. Reports Unaudited Second Quarter 2021 Financial Results

SHANGHAI, Aug. 17, 2021 — AiHuiShou International Co. Ltd. ("ATRenew" or the "Company") (NYSE: RERE), a leading technology-driven pre-owned consumer electronics transactions and services platform in China, today announced its unaudited financial results for the second quarter ended June 30, 2021. Second Quarter 2021 Highlights Total net revenues…

TCL Technology Announces Results for First Half of 2021, Net Profit Hits USD1.426 Billion

SHENZHEN, China, Aug. 14, 2021 — TCL Technology Group Corporation ("TCL Technology", Stock Code 000100.SZ), a publicly listed company focusing on the semiconductor display and materials industry, has announced its interim results for the six months ("the reporting period") ended 30 June 2021. During the reporting period, the company achieved operating income…

Dot Inc. Named Winner of the XTC Global Final, a Social Innovation Startup Competition

Dot Inc. Highly recognized for its smart technology for the visually impaired at XTC Global Final, a competition between 3,700 startups from 92 countries SEOUL, South Korea, Aug. 13, 2021 — Dot Inc., a social startup and certified B-corporation, was recently named the winner of TechCrunch’s Extreme Tech Challenge (XTC),…

LG Display Highlights its ESG Management in Sustainability Report for 2021

SEOUL, South Korea, Aug. 13, 2021 — LG Display, the world’s leading innovator of display technologies, highlights its ESG management by outlining the company’s ESG activities and achievements in pursuit of a greener planet in its Sustainability Report for 2021. LG Display publishes a Sustainability Report every year to share the activities…

Delta Advances Towards RE100 by Signing Power Purchase Agreement (PPA) with TCC Green Energy Corporation

TAIPEI, Aug. 13, 2021 — Delta, a global leader in power and thermal management solutions, today announced the signing of its first ever power purchase agreement (PPA) with TCC Green Energy Corporation for the procurement of approximately 19 million kWh of green electricity annually, a step that contributes to its…

MediaTek Announces Dimensity 920 and Dimensity 810 Chips for 5G Smartphones

Bringing brilliant imaging, smarter displays and boosted performance together for incredible mobile experiences HSINCHU, Taiwan, Aug 11, 2021 — MediaTek today announced the new Dimensity 920 and Dimensity 810 chipsets, the latest additions to its Dimensity 5G family. This debut gives smartphone makers the ability to provide boosted performance, brilliant imaging and…

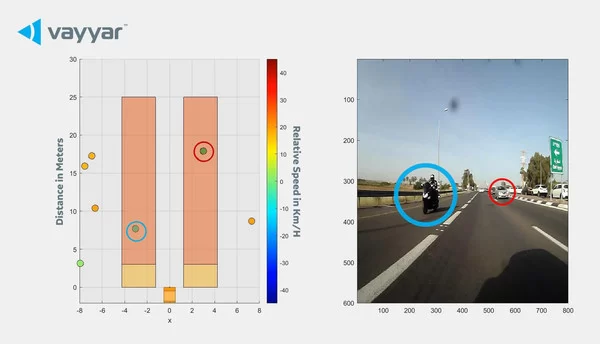

Piaggio Fast Forward Develops New Sensor Technology for Consumer and Enterprise Robots and for Motorcycle and Scooter Safety (ARAS)

TEL AVIV, Israel, Aug. 5, 2021 — Piaggio Fast Forward Develops New Sensor Technology for Consumer and Enterprise Robots and for Motorcycle and Scooter Safety (ARAS) Highlights: Piaggio Fast Forward (PFF) reveals trailblazing sensor technology for consumer and business robots as well as…

Huion Announces Three 23.8inch Pen Displays, Including the Kamvas Pro 24(4K)

SHENZHEN, China, July 30, 2021 — Huion announces three big screen pen displays today, Kamvas 24, Kamvas 24 Plus, and Kamvas Pro 24(4K). Two from its Kamvas series and one from its Kamvas Pro series. Featured with upgraded performances, these pen displays are…