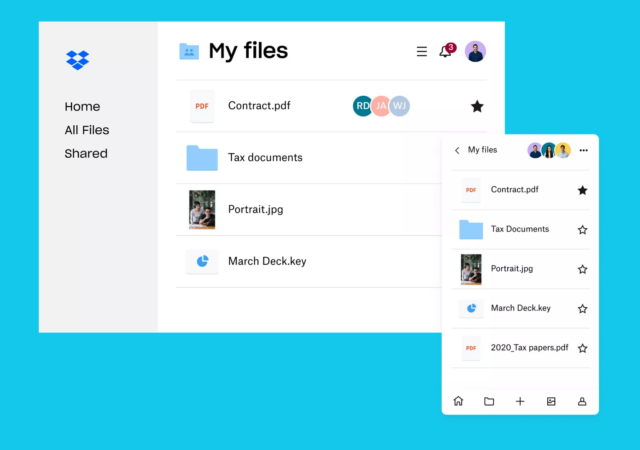

Dropbox drops its unlimited plan in light of abuse and misuse by a small subset of users. A new, more equitable plan is replacing it.

Crypto and NFTs outlawed on GTA Online servers

Cryptocurrencies and NFTs have been banned from the unlikeliest of trading grounds – the role-playing servers of Grand Theft Auto (GTA) Online. New regulations bar trading of crypto, virtual currency and loot boxes An update on developer Rockstar support page…

No FTs in Minecraft – Mojang Studios Takes a Stance on in-game NFTs

Mojang Studios has taken a stance against NFTs and blockchain implentation in Minecraft citing inclusivity and safety as their cause.

Gold vs. Bitcoin: Which is Better to Protect Investors from Financial Crises?

*This article is contributed by By Victor Argonov, Analyst, EXANTE* There is still a great debate about which is the best asset to protect investors in difficult times: cryptocurrencies or gold. Cryptocurrencies are often compared to gold. They have a…