Agora’s software defined dedicated network sees 60% increase in usage, from 25 billion to more than 40 billion minutes streamed monthly SAN JOSE, California, May 5, 2020 /PRNewswire/ — Agora.io, the leading voice, video and live interactive streaming platform, saw tremendous…

Secoo Entered into Contract with The Zegna Group

BEIJING, May 5, 2020 /PRNewswire/ — Secoo Holding Limited (NASDAQ: SECO) announced today that it had entered into contract with the Zegna Group to offer its products on Secoo’s online Zegna flagship store. View original content:http://www.prnewswire.com/news-releases/secoo-entered-into-contract-with-the-zegna-group-301052964.html

DreamFuelling aims to make a million dreams come true

SYDNEY, May 5, 2020 /PRNewswire/ — Faced with the gloom of COVID 19, business coach Mark Bowness has created a platform to help people escape the negative situation and hopefully fulfil a personal dream. With the current isolation challenges, seeing…

SMBs, get ready to rebound from COVID-19 with Grove HR Free Support Program

HO CHI MINH CITY, Vietnam, May 5, 2020 /PRNewswire/ — Grove HR, an emerging SaaS HR software company focusing on SMBs in APAC, just announced its free program to support companies during the COVID-19 crisis. Small and medium businesses can…

Fastmarkets launches new platform to improve how customers realize value from commodities data

LONDON, May 5, 2020 /PRNewswire/ — Fastmarkets, the industry-leading cross-commodity PRA, announces today that it has launched its new client platform, providing its customers with the ability to use and see price data, price trends, and news. The Fastmarkets platform,…

CyCraft Accelerates Growth in Japan by Allying with SecureBrain (a Hitachi Systems subsidiary) and Launching AI Security Services

TAIPEI, May 5, 2020 /PRNewswire/ — On Cycraft Japan’s first anniversary, it announces SecureBrain (Headquarters: Chiyoda, Tokyo, President and CEO: Kenichi Aoyama) has become an authorized CyCraft Japan partner, and will now offer CyCraft AIR in Japan to achieve a…

HotForex Offers Clients and Partners the Ultimate Performance Reward

Award winning broker of choice HotForex is celebrating its 10 years anniversary by offering all of its loyal clients and Partners generous withdrawable rewards every month from a prize pool of $2,000,000 PORT LOUIS, Mauritius, May 5, 2020 /PRNewswire/ — HotForex,…

Cyient Appoints Felice Gray-Kemp as Global General Counsel

Felice comes with more than two decades of rich experience in global commercial law and will manage all aspects of corporate governance for the company HYDERABAD, India, May 5, 2020 /PRNewswire/ — Cyient, a leading provider of technology services and…

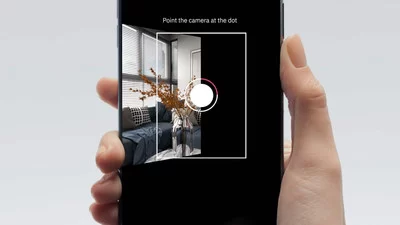

Matterport Brings 3D Capture To The iPhone

Company’s patented 3D technology enables users to capture and share 3D spaces for the first time using their iPhone SUNNYVALE, California, May 4, 2020 /PRNewswire/ — Matterport, the industry leader in 3D capture and spatial data, today released Matterport for iPhone,…

Global Silicon Wafer Area Shipments Edge Up in First Quarter 2020 Despite COVID-19 Headwinds

MILPITAS, Calif., May 4, 2020 /PRNewswire/ — Worldwide silicon wafer area shipments rose 2.7 percent to 2,920 million square inches in the first quarter of 2020, compared with fourth-quarter 2019 shipments of 2,844 million square inches, but dropped 4.3 percent year-over-year,…