Bayesian optimization engine that already powers dozens of use cases at Merck now open sourced to foster adoption Close partnership to enable the self-driving labs of tomorrow …

ACX and Sylvera partner to broaden access to high-quality carbon credit investment and trading

Carbon data provider and exchange collaborate to launch a standardized contract of highly-rated carbon credits, promoting quality in the market. The…

Foreign Languages Press: China’s active role in promoting human rights within the framework of global governance

BEIJING, Dec. 6, 2023 — The Foreign Languages Press recently invited a panel of scholars to evaluate its multi-language publication titled "Xi Jinping:…

IFS Appoints Max Roberts as Chief Operating Officer and Belinda Finch as Chief Information Officer

LONDON, Dec. 5, 2023 — IFS, the global cloud enterprise software company, today announced that it has made two senior appointments with Max Roberts and Belinda Finch joining the company’s…

The University of Melbourne Collaborates with Cognizant to boost student engagement

Cognizant is helping implement Tealium Customer Data Platform for the University of Melbourne to personalize the student and alumni journey TEANECK, N.J.,…

Ubie’s AI Symptom Checker Used by 2 Million Americans in First Year, Fueling Pharma Partnerships

Ubie, a trailblazing AI-driven healthcare company, has achieved a new milestone with its AI Symptom Checker, surpassing 2 million uses in the U.S. in just over a year. Leveraging…

CGTN: On climate change, we’re running out of time, not options

BEIJING, Dec. 4, 2023 — Beijing, the strong, fast-beating heart of Chinese prosperity, has been known as a safe and stable city free from natural calamities. But not the…

EcoBalance, KazBeef, and rTek Launch Climate Smart Beef Pilot Program at COP28

DUBAI, UAE, Dec. 3, 2023 — EcoBalance Global, a US-based leader in carbon storage projects, Kazbeef, a subsidiary of Yerkin Tatishev’s Kusto Group, and rTek, a Rakurs Consulting Group…

Global Methane Hub Announces the Enteric Fermentation Research & Development Accelerator, a $200M Agricultural Methane Mitigation Funding Initiative

The Largest-Ever Globally Coordinated Funding Investment in Livestock Methane Mitigation Research Announced at the COP28 Business & Philanthropy Climate Forum The public, private…

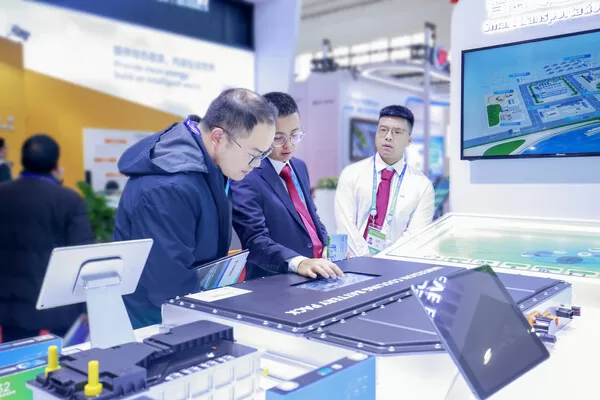

EVE Energy Brings Battery Products Showcase for China International Supply Chain Expo

BEIJING, Dec. 2, 2023 — EVE Energy Co., Ltd., ("EVE Energy") a leading global lithium-ion battery manufacturer, presents its cutting-edge consumer, power, and energy storage battery products in the…