ZTE held a Global Industrial Innovation Forum with the theme of "Shaping Digital Innovation" at MWC 2023 The Forum gathered experts to deliver keynote speeches and discuss around…

Mabl Strengthens Commitment to Japanese Quality Engineering Community with New Certification Program

New Japanese learning resources allow more quality professionals to build in-demand quality engineering skills. BOSTON, March 1, 2023 — mabl, the SaaS leader…

H3C Helps Empower the Global Digital Economy with Localized Solutions

NUSA DUA, Bali, Feb. 28, 2023 — H3C NAVIGATE 2023 International Business Summit in Bali, Indonesia, from February 23 to 26, concluded with a focus on further promoting global exchanges…

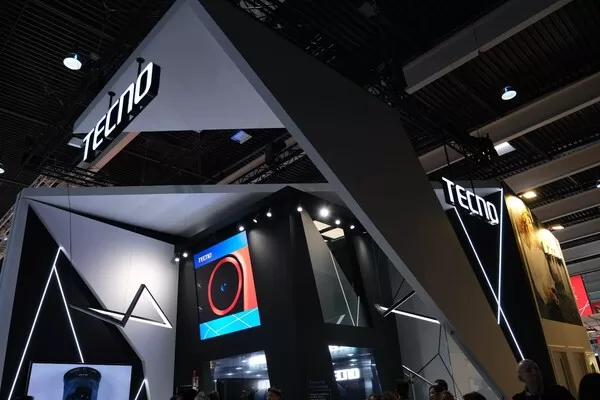

TECNO Marks its MWC Debut Showcasing Two New Smartphones, Upgraded Laptops and Diverse AIoT Offering

TECNO will launch its first foldable smartphone, PHANTOM V Fold, debut its SPARK 10 Pro selfie phone and MEGABOOK S1 2023 laptop with the latest Intel® Core™ processor, and showcase its…

5G 3 years = 4G 5 years, Operators Have Achieved Success after the 1st Round of 5G Deployment

BARCELONA, Spain, Feb. 28, 2023 — Huawei has convened the 5G Business Success Summit at this year’s Mobile World Congress (MWC). Peng Song, President of Huawei’s ICT Strategy &…

Infosys Rolls Out Private 5G-as-a-Service to Accelerate Business Value for Enterprise Clients Worldwide

Delivering simple, flexible, and customizable private 5G services BENGALURU, India, Feb. 27, 2023 — Infosys (NSE: INFY) (BSE: INFY) (NYSE: INFY), a global…

Alibaba Reaffirms Commitment to Driving Digital Economy Education Worldwide at Global Partner Conference

Building on its success since its inception in 2017, Alibaba’s GDT program renewed collaborations with educational institutions in Malaysia and Singapore HANGZHOU,…

TCL Announces Enhanced 40 Series and New Tablets at MWC 2023

BARCELONA, Feb. 27, 2023 — TCL, a pioneer in display technology and affordable, smart connected experiences, announces multiple mobile, tablet and connected devices at MWC 2023. Launching in the…

SequoiaDB is Shortlisted for the IDC Innovator List and Rated as a Distributed Database Innovator

GUANGZHOU, China, Feb. 25, 2023 — In 2022, IDC issued the IDC Innovator Innovative Enterprise Award to non-enterprise customer groups (solution providers) for the first time. SequoiaDB won this…

Hanyun Platform from XCMG Machinery Obtains CMMI Level 5 Certification

XUZHOU ,China, Feb. 25, 2023 — Hanyun Platform from XCMG (SHE:000425; the "XCMG") has recently passed a significant evaluation of international authoritative institutions, and successfully obtained a certificate of Capability…