– ARM, Factory Automation Company, Realizes AI-based Smart Factory – KANAZAWA, Japan, Feb. 3, 2021 — ARM Co., Ltd. (ARM) has begun taking pre-orders for "ARMCODE1," which can fully automate NC programming by AI, from Chinese users. Photo1: https://kyodonewsprwire.jp/prwfile/release/M106467/202101280315/_prw_PI1fl_aUh7KJ25.jpg Official site: http://www.armgroup.jp/en/index.html Three biggest benefits of "ARMCODE1": (1) Full automation…

DDPAI x XPeng customized dash camera launched at XPeng Auto Boutique Mall

SHENZHEN, China, Jan. 28, 2021 — Recently, the XPeng customized version of Mini5 and Mini3 Pro dash camera launched at Xpeng Auto Boutique Mall, Xpeng Automobile is smart car brand who more knows China. DDPAI dash camera, focus on the features with high-definition picture quality, good looking design, high playability and other…

Autohome Inc. to Announce Fourth Quarter and Full Year 2020 Financial Results on February 2, 2021

BEIJING, Jan. 26, 2021 — Autohome Inc. (NYSE: ATHM) ("Autohome" or the "Company"), a leading online destination for automobile consumers in China, today announced that it will report its financial results for the fourth quarter and full year ended December 31, 2020, before U.S. markets open on February 2, 2021. Autohome’s…

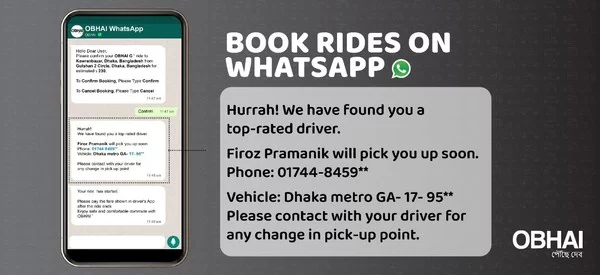

Ridesharing App OBHAI On WhatsApp – A First in Bangladesh

DHAKA, Bangladesh, Jan. 26, 2021 — OBHAI, the home-grown ride-sharing company of Bangladesh is 1st among its peers to recognize the potential benefits of WhatsApp and its ease of access, which would benefit the user base from all walks of life, with the launch of its services on WhatsApp. …

FIC, the CES 2021 Honoree, Intelligent AR HUD for Commercial Vehicle

TAIPEI, Jan. 22, 2021 — In recent years, FIC (First International Computer) group focuses its core business in automotive electronic design, especially for car manufacturers and Tier 1, Tier 2 suppliers. After years of efforts, FIC has successfully developed full color laser beam scanning (FCLBS) technology for AR HUD product;…

Leading Automakers and Technology Companies Advance Blockchain Vehicle Identities that Could Help Buyers Avoid Cars with Incorrect Mileage, Maintenance, or Damage Histories

MOBI Collaborates with BMW, Ford, and Others on Second Installment of a Vehicle Identity Standard for multi-stakeholder, interoperable mobility ecosystems of the future MUNICH, Germany, Jan. 20, 2021 — We’ve all heard about rolled-back odometers and flood-damaged vehicles touted in better condition. BMW, Ford, and other transportation and blockchain leaders…

Autohome Inc. Announces Board Changes

BEIJING, Jan. 12, 2021 — Autohome Inc. ("Autohome" or the "Company") (NYSE: ATHM), the leading online destination for automobile consumers in China, today announced that Mr. Quan Long has been appointed as the successor to Mr. Min Lu to serve as a director and the chairman of the board of directors of…

Luokung Announces EMG Awarded Exclusive 2020 Golden Globe Award for its “HD Map” Functionality

BEIJING, Jan. 11, 2021 — Luokung Technology Corp. (NASDAQ: LKCO) ("Luokung" or the "Company"), a leading interactive location-based services and big data processing technology company in China, today announced that the Company’s previously announced acquisition candidate, eMapgo Technologies (Beijing) Co., Ltd. ("EMG") was recently the sole recipient of the "2020…

Renren Announces Unaudited First Half 2020 Financial Results

BEIJING, Dec. 31, 2020 — Renren Inc. (NYSE: RENN) ("Renren" or the "Company"), which operates a premium used auto business in China through its subsidiary Kaixin Auto Holdings (NASDAQ: KXIN) ("Kaixin") as well as several U.S.-based SaaS businesses, today announced its unaudited financial results for the six months ended June…

Flipclutch Research Report: Hologram AR leads the new trend and new application scenarios of automobile releases

HONG KONG, Dec. 29, 2020 — With the maturity of AR technology, the integration of AR with many industries has become deeper and deeper, and the industry changes brought about by it have also been implemented at an even more alarming speed. The automotive industry is one of the most…