Edifier Wide-Band Multi-Channel ANC – Edifier’s new patented technology – allows the extension of the noise cancellation depth to -50dB, and the…

Pixalate Q2 2023 Ad Fraud Benchmarks for Web Traffic: North America Reports Highest Desktop Invalid Traffic Rate at 13%, Followed by Asia-Pacific

New research shows 12% Global Invalid Traffic (IVT) rates on desktop compared to 8.5% for mobile browsers. LONDON, Sept. 22, 2023 –…

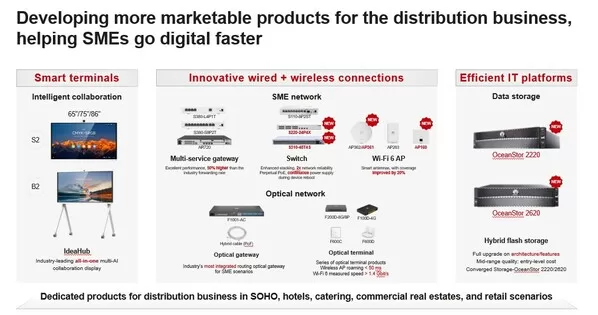

HUAWEI eKit Joins Hands with Distribution Partners to Explore Unlimited Opportunities in the SME Market

SHANGHAI, Sept. 21, 2023 — During HUAWEI CONNECT 2023, Huawei held a distribution business session titled "HUAWEI eKit, Digitalization for Success", outlined its approach to the distribution business: focus on…

PFT unveils Ad Break Automation powered by CLEAR® AI at IBC 2023

Transforming revenue generation across FAST, AVOD, and Linear TV Platforms LOS ANGELES, Sept. 14, 2023 — Prime Focus Technologies (PFT), a leading creator…

Dow Jones and Cision Unveil Exclusive Global Content Partnership for the PR and Corporate Communications Market

New Agreement Empowers Reputation Management and Strategic Communication Agendas Worldwide CHICAGO and NEW YORK, Sept. 7, 2023 — Cision, the leading provider…

Gaabor Launches Spectacular 9.9 Promotion This September in the Philippines

MANILA, Philippines, Sept. 4, 2023 — Leading household appliance brand Gaabor is bringing great deals to shoppers as the year-end shopping season…

Announcing new leadership appointments at HH Global

HH Global is excited to announce three significant, new leadership appointments LONDON, Aug. 14, 2023 — As we continue to grow and…

ENTREPRENEUR UNIVERSE BRIGHT GROUP Announces 2023 Q2 Financial Results

XI’AN, China, Aug. 12, 2023 — ENTREPRENEUR UNIVERSE BRIGHT GROUP ("EUBG" or the "Company") (OTCQB: EUBG), a digital marketing consulting company, announced its unaudited financial results for the second…

Wavemaker Announce Xiaohongshu SEED+ Product Seeding Solution

SHANGHAI, Aug. 8, 2023 — Wavemaker, in partnership with social media platform Xiaohongshu, recently unveiled the Xiaohongshu SEED+ Product Seeding Solution. The initiative includes three key modules: the Precise Insight Methodology…

MediaMint Secures Growth Investment from Everstone Capital and Recognize

Investment Will Further Accelerate Growth and Drive Expansion of Service Offering and Global Delivery Capabilities MUMBAI, India, July 27, 2023…