STOCKHOLM, Nov. 10, 2020 — Turn-around completed establishing a strong platform to accelerate growth and investments in 5G enterprise applications New long-term EBITA margin target, excluding restructuring, for the Group of 15% – 18% New long-term Free Cash flow (before M&A) target of 9%…

Wealth Dynamix Completes Eighth Year of Growth and Continues Expansion Despite Global Pandemic Challenges

LONDON, Nov. 4, 2020 — Wealth Dynamix, a global leader in Client Lifecycle Management (CLM) solutions, has announced year-end performance results that indicate strong growth during the twelve months to September 30, 2020. Wealth Dynamix has worked with new and existing wealth management clients to deliver the critical capabilities required to…

Financial Report July – September 2020

STOCKHOLM, Oct. 23, 2020 — Financial Summary – Q3’20 Net Sales and Cash flow were better than expected Net Sales of $371 million declined by 20% including an Organic Sales1 decline of 7% Active Safety Net Sales of $170 million declined by 5% including an Organic Sales…

G20 Saudi Secretariat Announces Digital Summit to Discuss Inclusive Growth in Aftermath of Covid-19

RIYADH, Saudi Arabia, Oct. 21, 2020 — The Ministry of Investment of Saudi Arabia and the Saudi Secretariat as part of the international Conference program announces a four-day digital event series to explore how businesses, governments and citizens can drive opportunities for inclusive growth through regulation, new technologies and long-term…

Invitation to Electrolux Q3 presentation

STOCKHOLM, Oct. 9, 2020 — Electrolux results for the third quarter of 2020 will be published on October 23, 2020, at approximately 08.00 CET. A telephone conference will be held following the release of the results, starting at 09.00 CET. Jonas Samuelson, President and CEO and Therese Friberg, CFO will…

Diginex Lists and Begins Trading on Nasdaq

Diginex is the first company with a cryptocurrency exchange to be listed on Nasdaq HONG KONG, Oct. 2, 2020 — Diginex Limited ("Diginex" or the "Company"), a digital assets financial services company, announced today that it has completed its business combination transaction (the "Transaction") with 8i Enterprises Acquisition Corp. (Nasdaq: JFK)…

AB Electrolux to propose reinstated dividend based on recovery in earnings and cash flow

STOCKHOLM, Sept. 25, 2020 — After assessing the company’s financial position and the impact of the coronavirus pandemic, the Board of Directors of AB Electrolux has decided to propose a dividend of SEK 7 per share for the fiscal year 2019. Electrolux has seen a substantial recovery in earnings and…

Arria NLG introduces Microsoft Excel add-in bringing dynamic, on demand natural language summaries and report automation to spreadsheets

New integration turns Excel data into contextual narratives reducing the time it takes to identify and communicate key insights MORRISTOWN, New Jersey, Sept. 2, 2020 — Arria NLG today introduced Arria for Excel, a Microsoft Office add-in that brings natural language generation (NLG) functionality to…

Private Trade Finance Firm, USEC, Issues Limited Private Placement Offering to Expand Trade Operations

GENEVA, Switzerland, Aug. 25, 2020 — Geneva based international investment firm, United Securities Equity Corp (USEC) has recently issued a new limited private placement offering in order to further strengthen its investment portfolio and stimulate trade activity in light of the widespread slowdown…

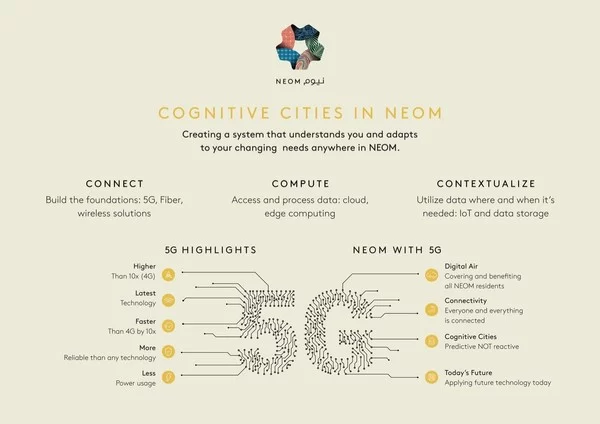

NEOM launches infrastructure work for the world’s leading cognitive cities in an agreement with stc

– NEOM’s next generation cognitive cities will support its cutting-edge urban environments, improving the lives of residents and businesses far beyond the capabilities of today’s smart cities – stc will deliver an advanced 5G and IoT network to support the development of NEOM NEOM, Saudi Arabia, July 28, 2020 — NEOM…